Eastern Bank has been on fire lately. In the past six months alone, the company’s stock price has rocketed 43.9%, reaching $21.97 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Eastern Bank, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Eastern Bank Not Exciting?

Despite the momentum, we're sitting this one out for now. Here are three reasons we avoid EBC and a stock we'd rather own.

1. Low Net Interest Margin Reveals Weak Loan Book Profitability

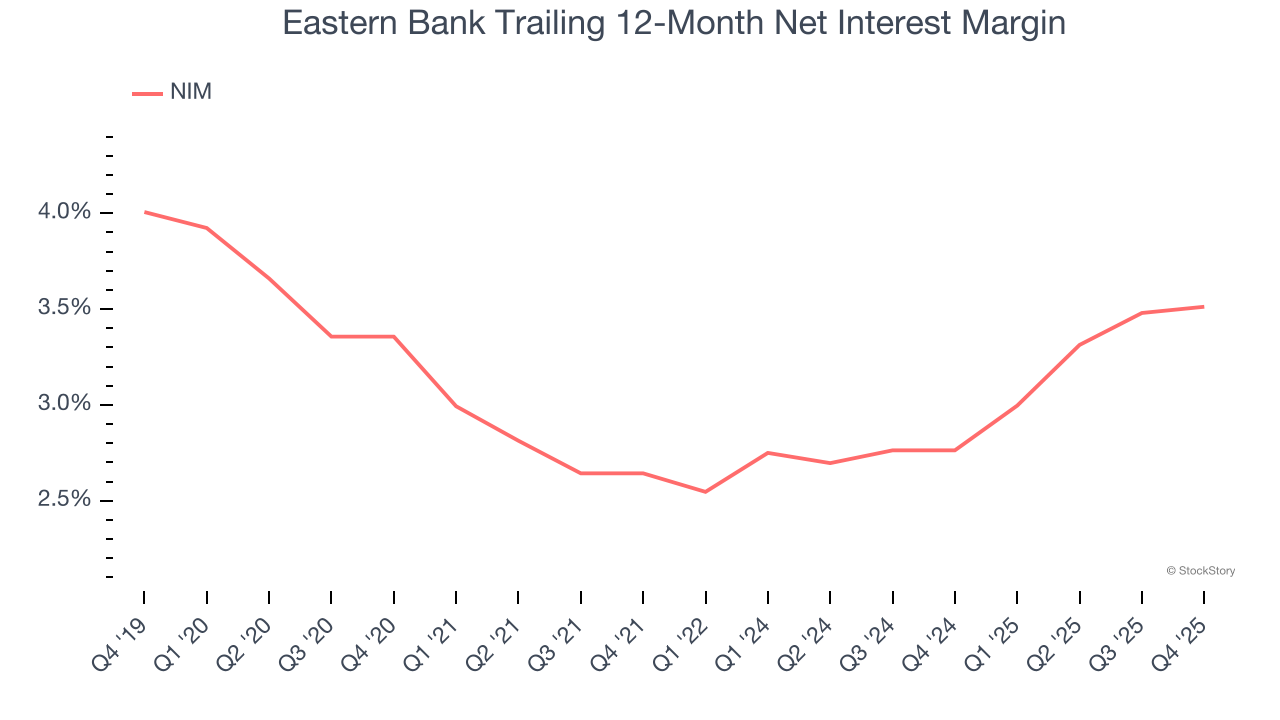

Net interest margin (NIM) serves as a critical gauge of a bank's fundamental profitability by showing the spread between interest income and interest expenses. It's essential for understanding whether a firm can sustainably generate returns from its lending operations.

Over the past two years, we can see that Eastern Bank’s net interest margin averaged a subpar 3.2%. This metric is well below other banks, signaling its loans aren’t very profitable.

2. Declining TBVPS Reflects Erosion of Asset Value

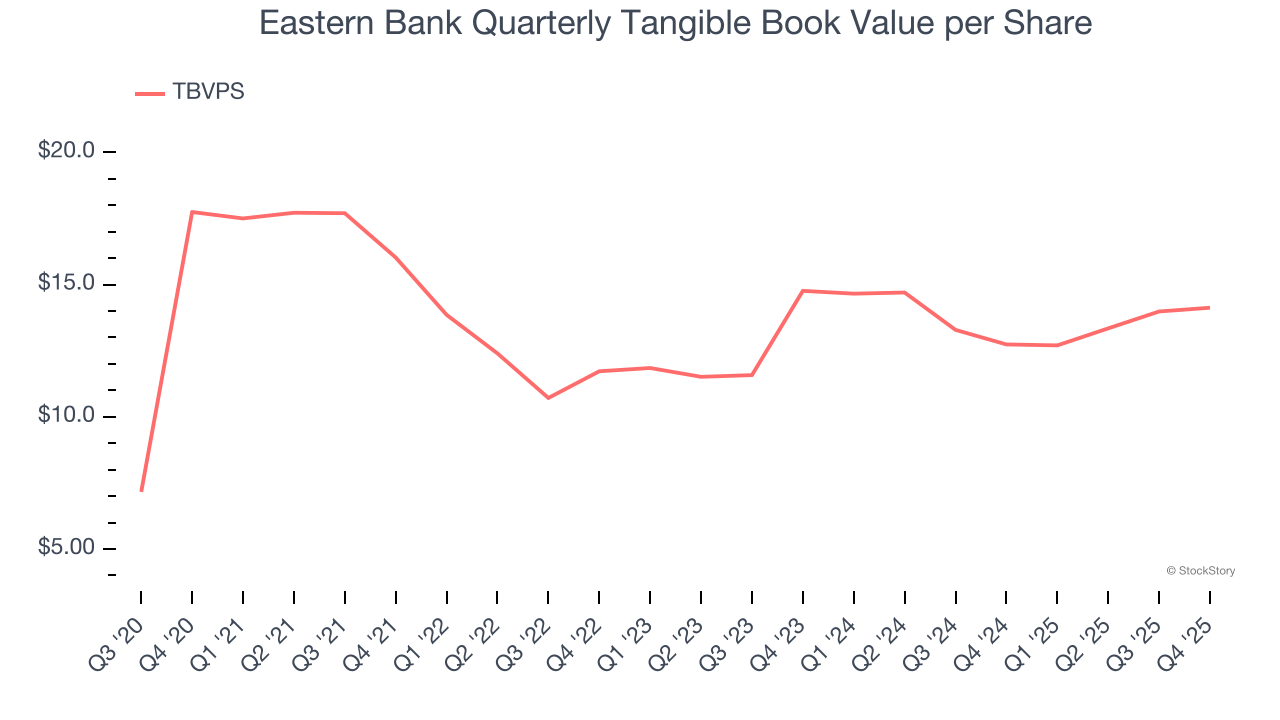

For banks, tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

Disappointingly for investors, Eastern Bank’s TBVPS declined at a 2.2% annual clip over the last two years.

3. Projected TBVPS Growth Shows Limited Upside

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for Eastern Bank’s TBVPS to remain flat at roughly $14.03, a disappointing projection.

Final Judgment

Eastern Bank isn’t a terrible business, but it isn’t one of our picks. Following the recent surge, the stock trades at 1.1× forward P/B (or $21.97 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at one of Charlie Munger’s all-time favorite businesses.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.