Over the past six months, Enphase’s shares (currently trading at $36.64) have posted a disappointing 12.7% loss, well below the S&P 500’s 11.1% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Enphase, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Enphase Will Underperform?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons there are better opportunities than ENPH and a stock we'd rather own.

1. Demand Slips as Sales Volumes Slide

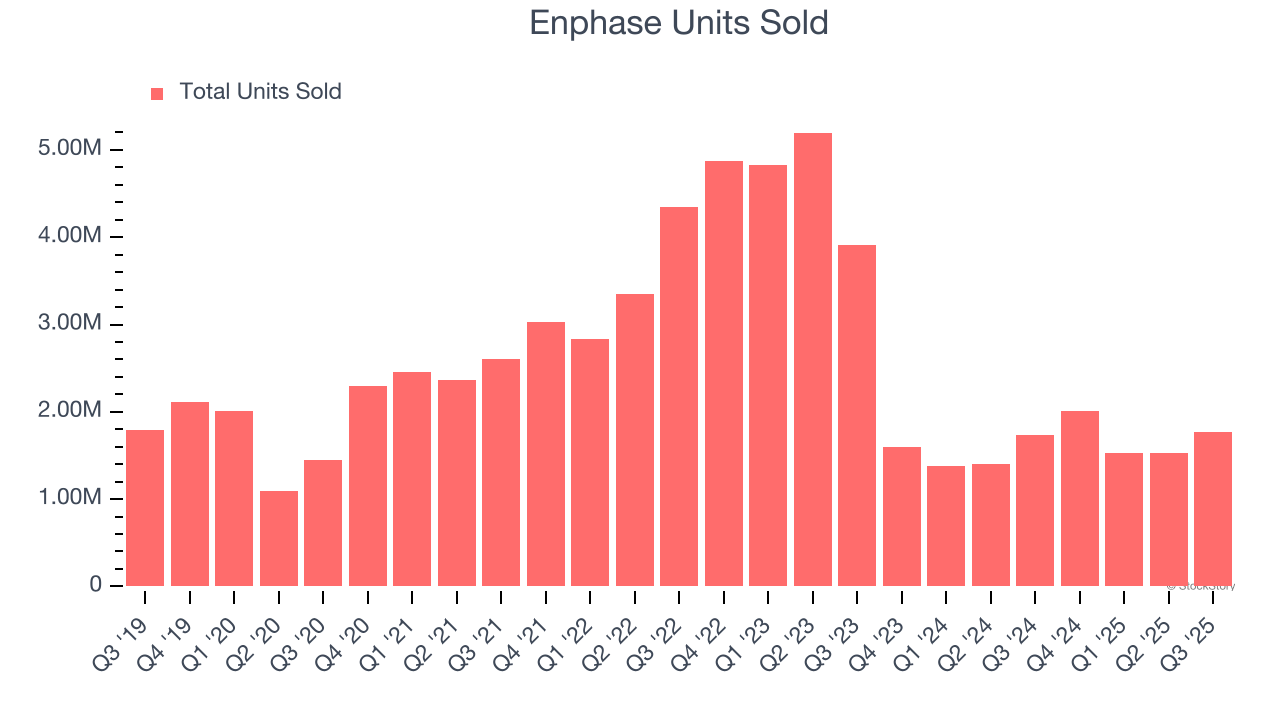

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Renewable Energy company because there’s a ceiling to what customers will pay.

Enphase’s units sold came in at 1.77 million in the latest quarter, and they averaged 27.4% year-on-year declines over the last two years. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Enphase might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

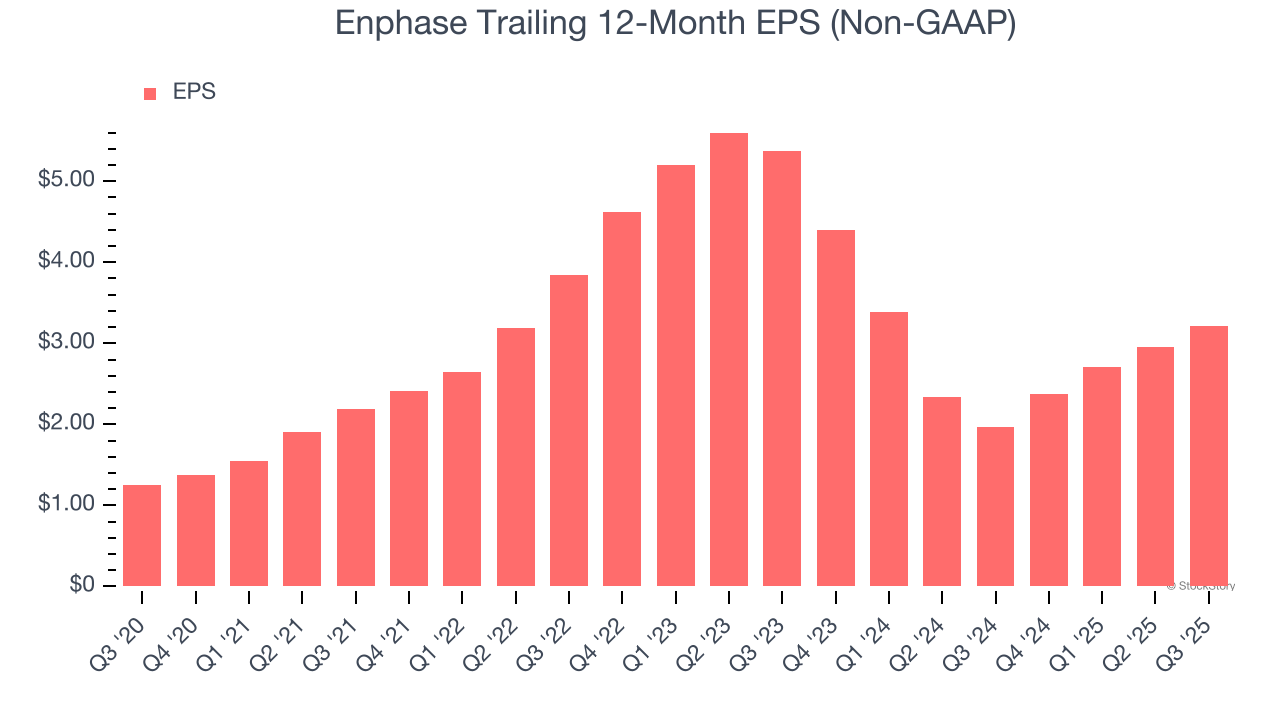

2. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Enphase, its EPS and revenue declined by 22.7% and 25.3% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Enphase’s low margin of safety could leave its stock price susceptible to large downswings.

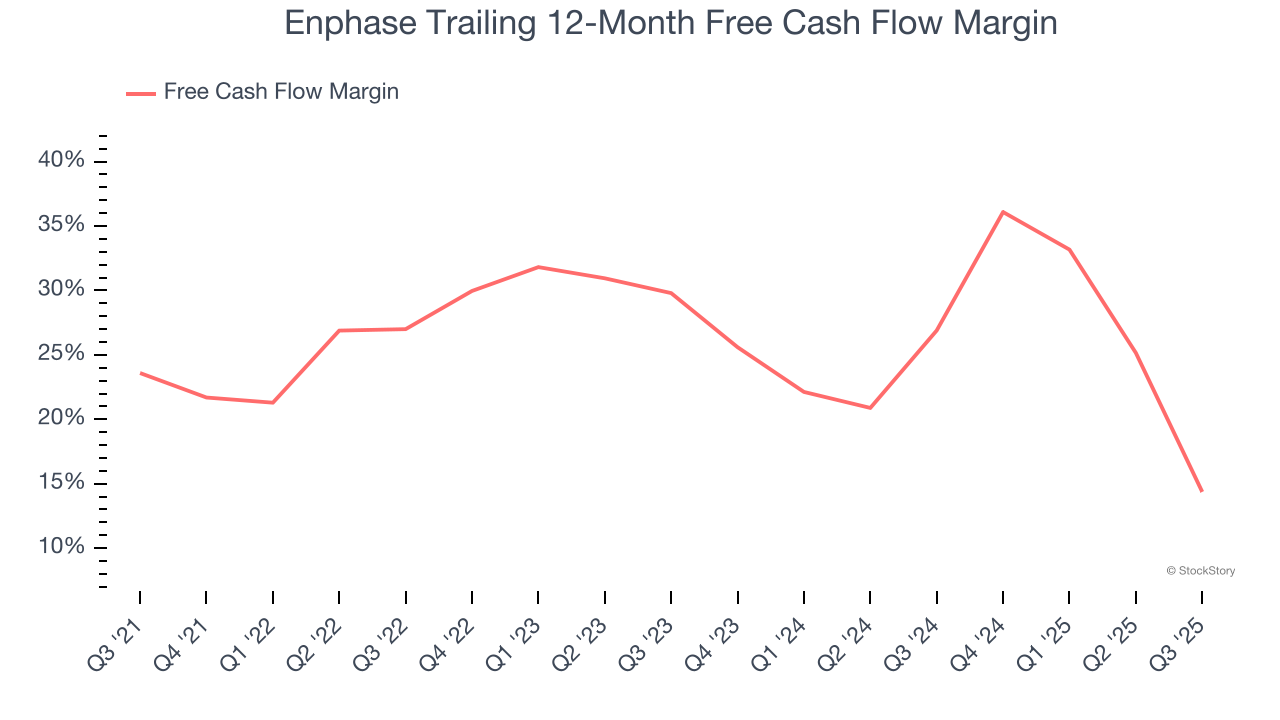

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Enphase’s margin dropped by 9.2 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Enphase’s free cash flow margin for the trailing 12 months was 14.4%.

Final Judgment

Enphase falls short of our quality standards. After the recent drawdown, the stock trades at 17.1× forward P/E (or $36.64 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are better investments elsewhere. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Enphase

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.