Energy Recovery trades at $15.63 per share and has stayed right on track with the overall market, gaining 12.5% over the last six months. At the same time, the S&P 500 has returned 9.1%.

Is now a good time to buy ERII? Find out in our full research report, it’s free.

Why Does Energy Recovery Spark Debate?

Having saved far more than a trillion gallons of water, Energy Recovery (NASDAQ:ERII) provides energy recovery devices to the water treatment, oil and gas, and chemical processing sectors.

Two Things to Like:

1. EPS Surges Higher Over the Last Two Years

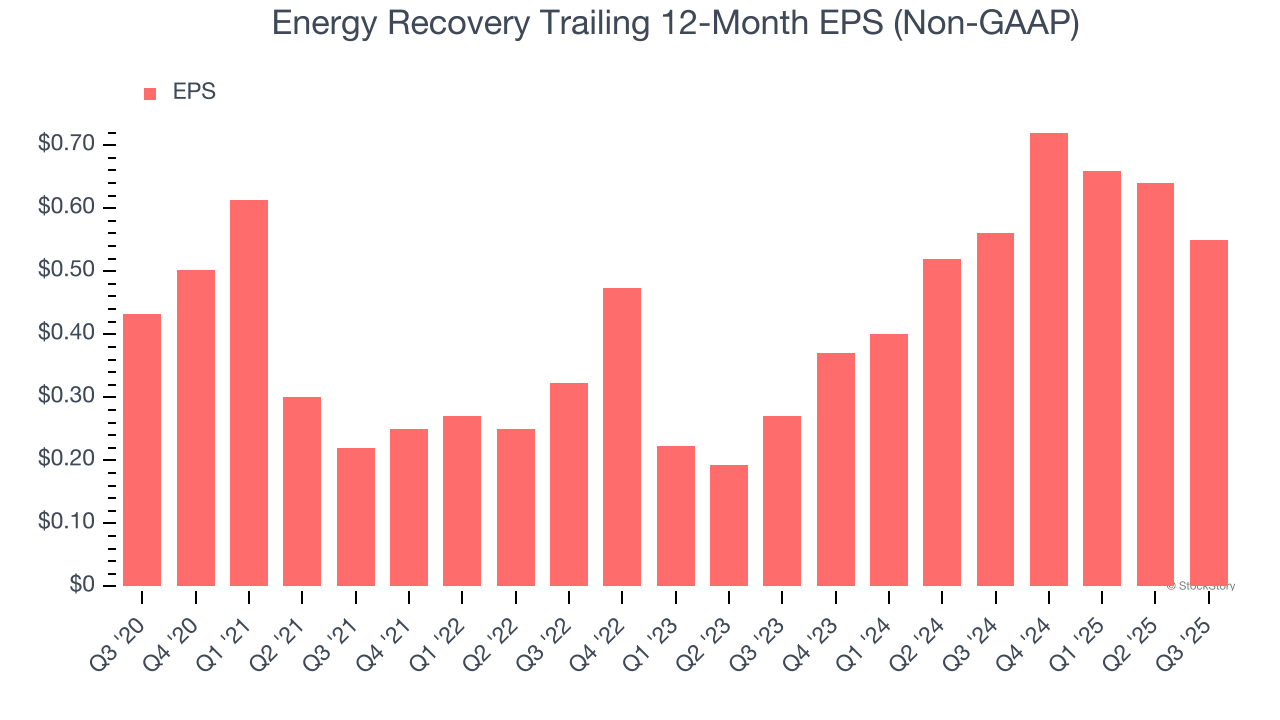

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Energy Recovery’s EPS grew at an astounding 42.6% compounded annual growth rate over the last two years, higher than its 9.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

2. Increasing Free Cash Flow Margin Juices Financials

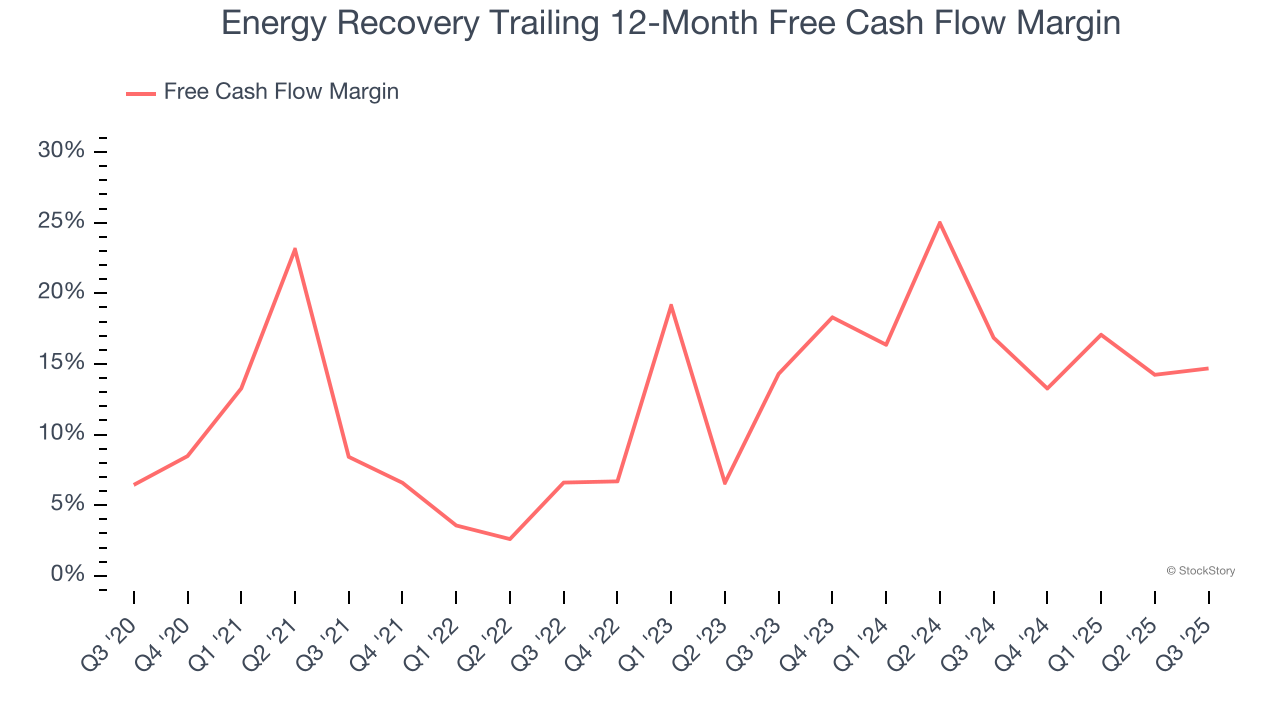

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Energy Recovery’s margin expanded by 6.3 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Energy Recovery’s free cash flow margin for the trailing 12 months was 14.7%.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

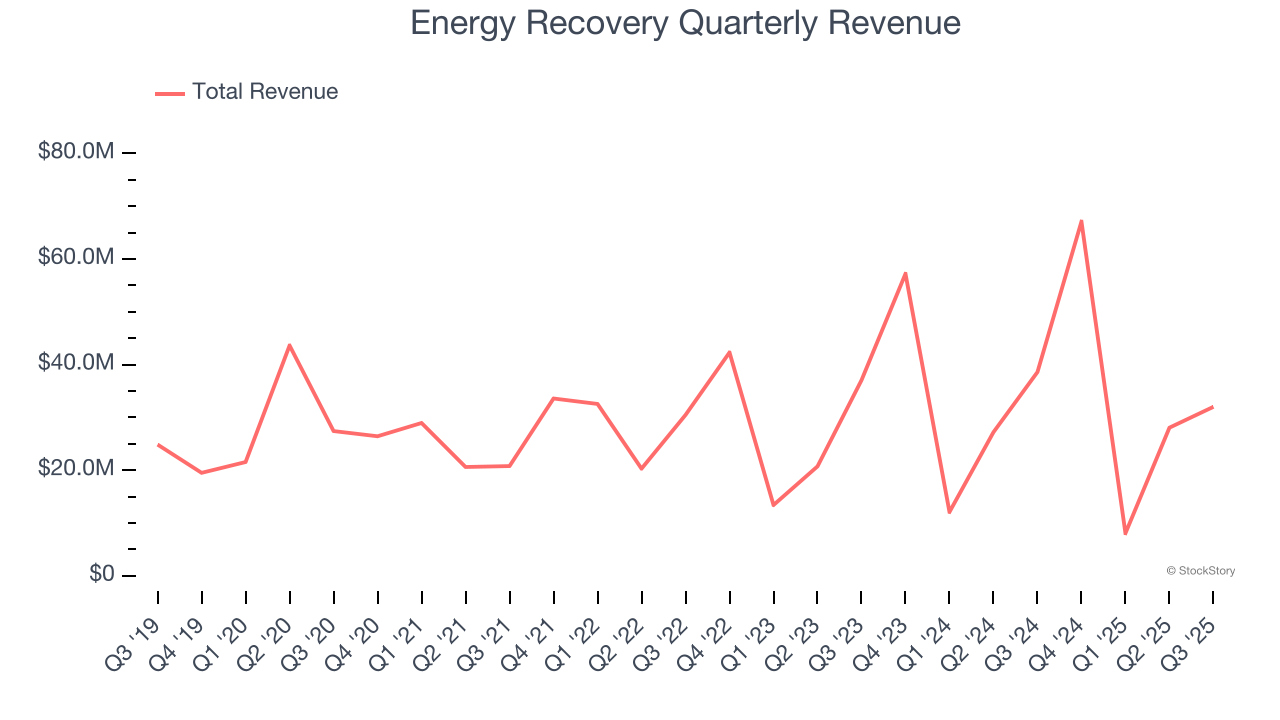

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Energy Recovery’s sales grew at a sluggish 3.8% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Energy Recovery.

Final Judgment

Energy Recovery’s merits more than compensate for its flaws, but at $15.63 per share (or 18.4× forward P/E), is now the time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.