Since August 2025, European Wax Center has been in a holding pattern, posting a small loss of 4.6% while floating around $4.01. The stock also fell short of the S&P 500’s 8.6% gain during that period.

Is now the time to buy European Wax Center, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Do We Think European Wax Center Will Underperform?

We don't have much confidence in European Wax Center. Here are three reasons we avoid EWCZ and a stock we'd rather own.

1. Flat Same-Store Sales Indicate Weak Demand

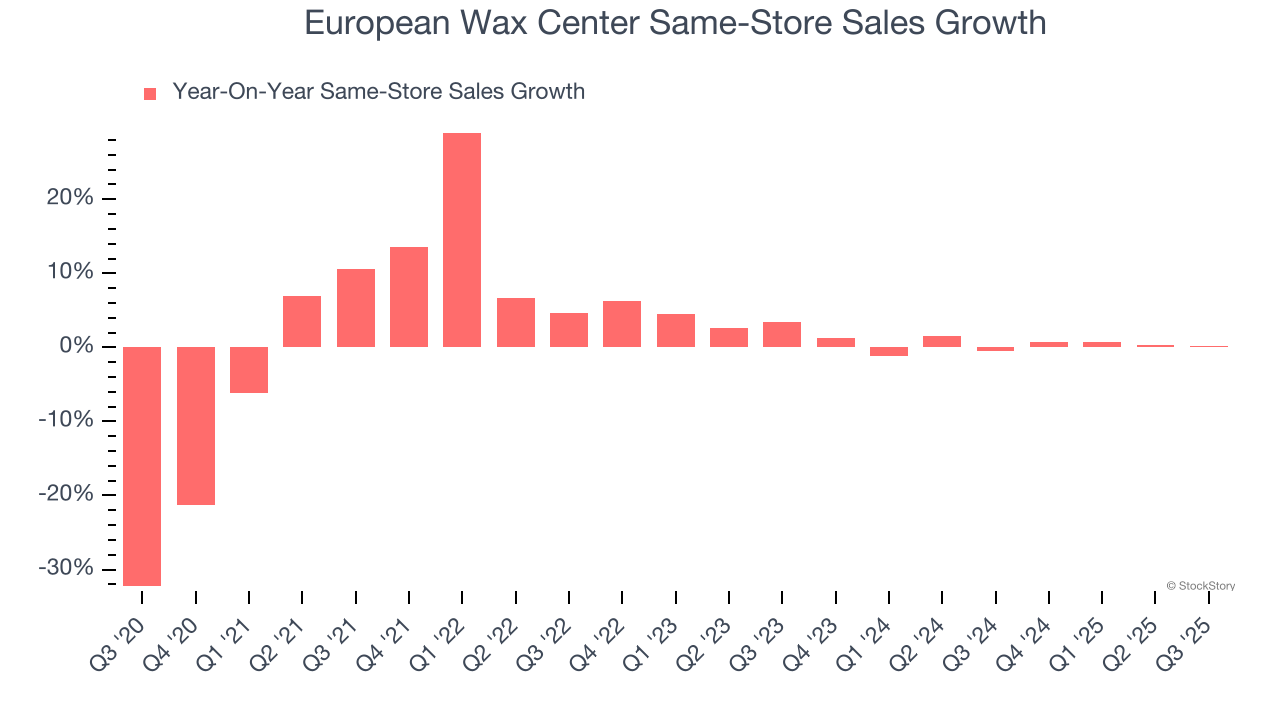

We can better understand Leisure Facilities companies by analyzing their same-store sales. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into European Wax Center’s underlying demand characteristics.

Over the last two years, European Wax Center failed to grow its same-store sales. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests European Wax Center might have to change its strategy and pricing, which can disrupt operations.

2. EPS Barely Growing

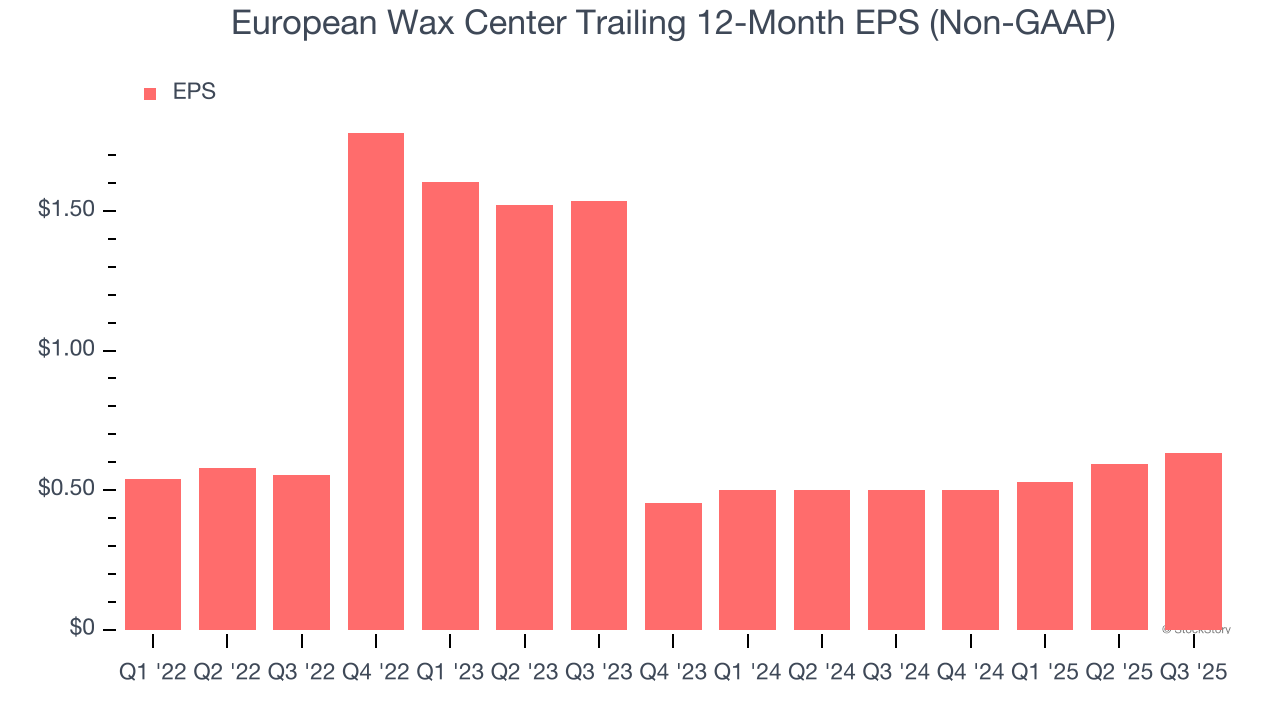

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

European Wax Center’s full-year EPS grew at a weak 4% compounded annual growth rate over the last four years, worse than the broader consumer discretionary sector.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

European Wax Center historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

We see the value of companies helping consumers, but in the case of European Wax Center, we’re out. With its shares underperforming the market lately, the stock trades at 7.6× forward P/E (or $4.01 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. We’d suggest looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than European Wax Center

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.