What a time it’s been for Exact Sciences. In the past six months alone, the company’s stock price has increased by a massive 152%, reaching $103.18 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Exact Sciences, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Exact Sciences Not Exciting?

Despite the momentum, we're swiping left on Exact Sciences for now. Here are two reasons we avoid EXAS and a stock we'd rather own.

1. Cash Burn Ignites Concerns

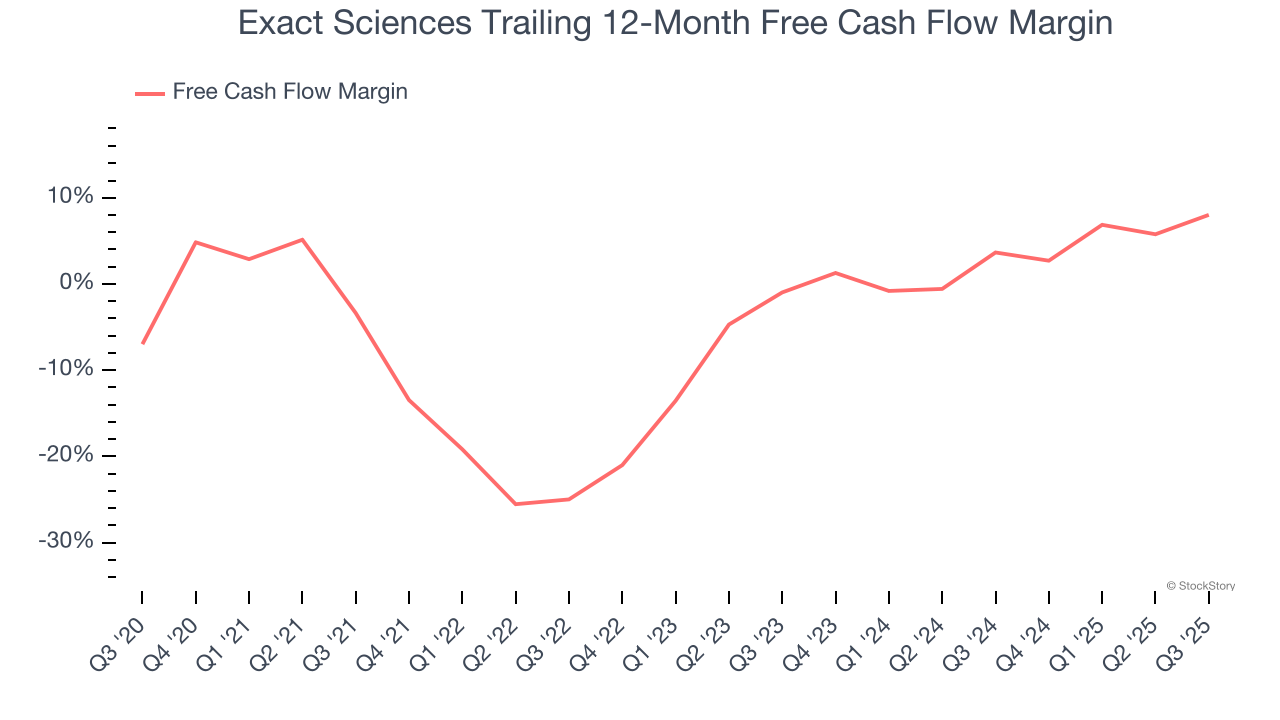

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Exact Sciences posted positive free cash flow this quarter, the broader story hasn’t been so clean. Exact Sciences’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 2%. This means it lit $2.00 of cash on fire for every $100 in revenue.

2. Previous Growth Initiatives Have Lost Money

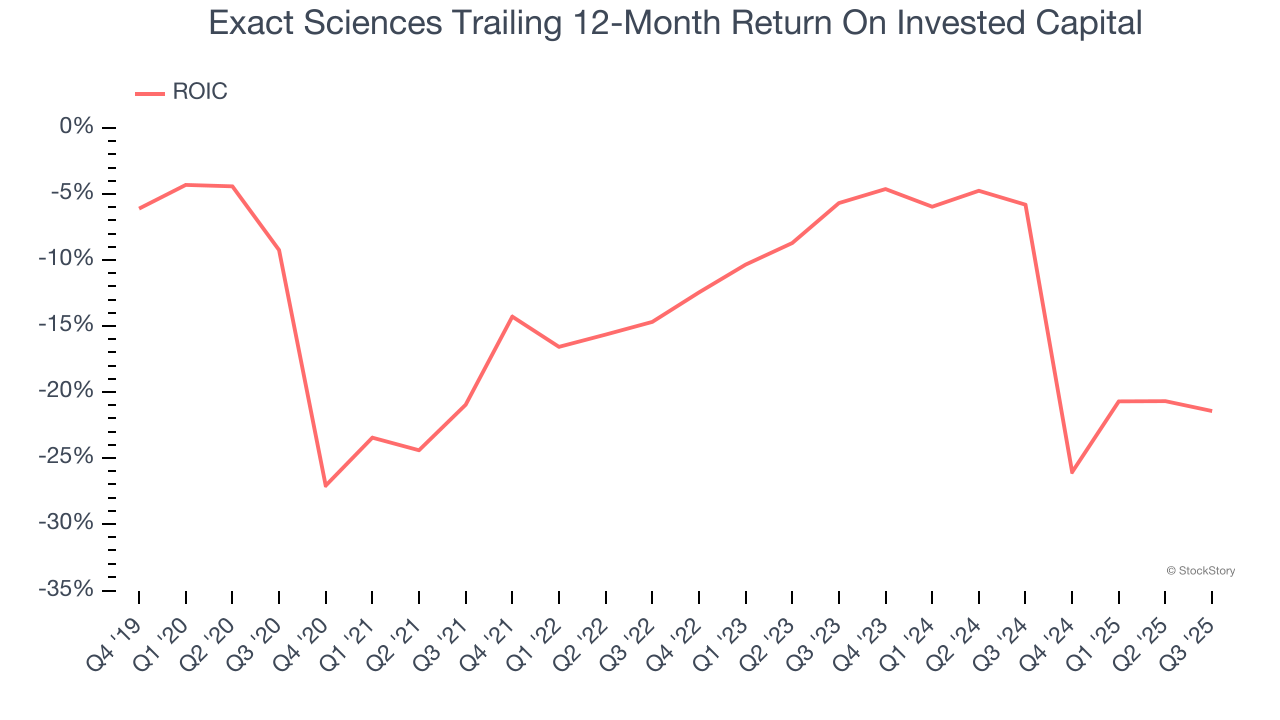

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Exact Sciences’s five-year average ROIC was negative 13.7%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

Final Judgment

Exact Sciences isn’t a terrible business, but it doesn’t pass our bar. After the recent surge, the stock trades at 121.8× forward P/E (or $103.18 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our top digital advertising picks.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.