The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Fluence Energy (NASDAQ:FLNC) and the rest of the renewable energy stocks fared in Q3.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 17 renewable energy stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 5.8% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.8% since the latest earnings results.

Fluence Energy (NASDAQ:FLNC)

Pioneering the use of lithium-ion batteries for grid storage, Fluence (NASDAQ:FLNC) helps store renewable energy sources with battery systems.

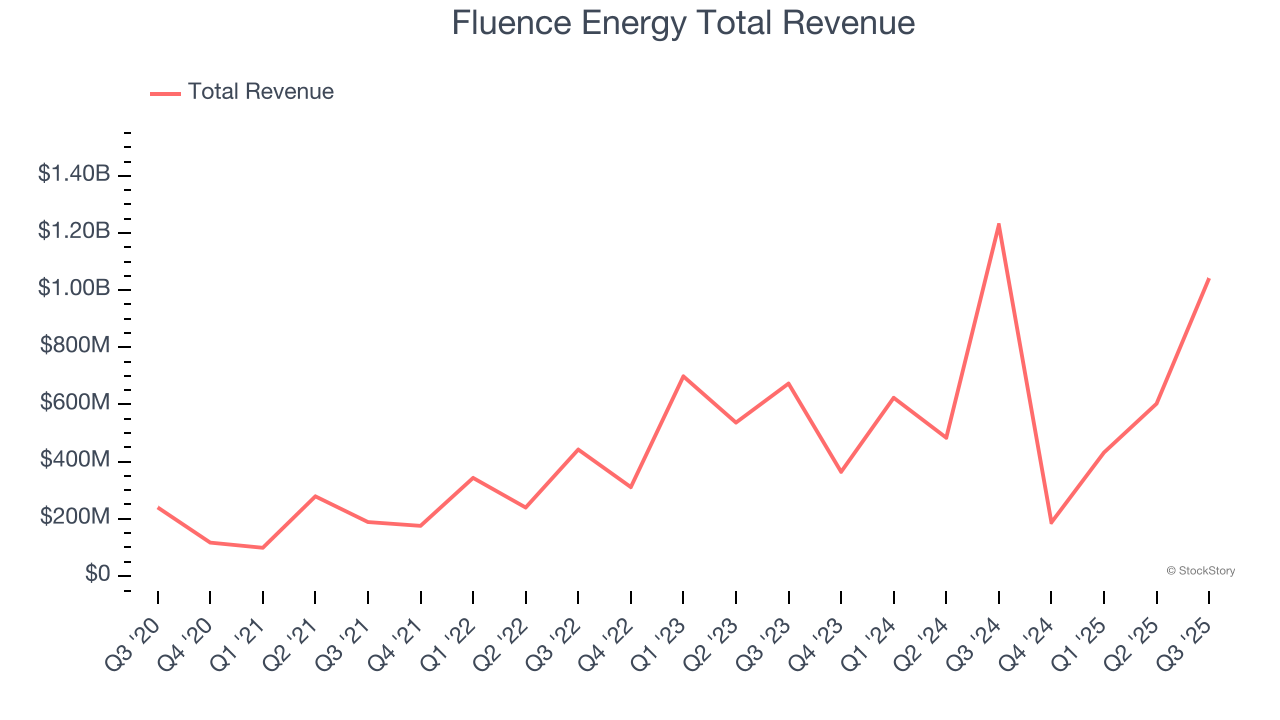

Fluence Energy reported revenues of $1.04 billion, down 15.2% year on year. This print fell short of analysts’ expectations by 24.8%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but full-year EBITDA guidance missing analysts’ expectations significantly.

"We believe we are well positioned to capitalize on the accelerating demand for energy storage. We achieved $1.4 billion of new orders for the quarter and 13.7% adjusted gross profit margin for the year, both record results for the Company," said Julian Nebreda, the Company’s President and Chief Executive Officer.

Fluence Energy delivered the weakest performance against analyst estimates and slowest revenue growth of the whole group. Interestingly, the stock is up 27.2% since reporting and currently trades at $20.09.

Is now the time to buy Fluence Energy? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Bloom Energy (NYSE:BE)

Working in stealth mode for eight years, Bloom Energy (NYSE:BE) designs, manufactures, and markets solid oxide fuel cell systems for on-site power generation.

Bloom Energy reported revenues of $519 million, up 57.1% year on year, outperforming analysts’ expectations by 22.8%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 20.6% since reporting. It currently trades at $89.92.

Is now the time to buy Bloom Energy? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Generac (NYSE:GNRC)

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE:GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $1.11 billion, down 5% year on year, falling short of analysts’ expectations by 6.6%. It was a disappointing quarter as it posted a miss of analysts’ Residential revenue estimates and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 26.9% since the results and currently trades at $139.05.

Read our full analysis of Generac’s results here.

American Superconductor (NASDAQ:AMSC)

Founded in 1987, American Superconductor (NASDAQ:AMSC) has shifted from superconductor research to developing power systems, adapting to changing energy grid needs and naval technology requirements.

American Superconductor reported revenues of $65.86 million, up 20.9% year on year. This number missed analysts’ expectations by 2%. More broadly, it was a satisfactory quarter as it also logged a beat of analysts’ EPS estimates but a significant miss of analysts’ revenue estimates.

The stock is down 48.3% since reporting and currently trades at $30.73.

Read our full, actionable report on American Superconductor here, it’s free for active Edge members.

Enphase (NASDAQ:ENPH)

The first company to successfully commercialize the solar micro-inverter, Enphase (NASDAQ:ENPH) manufactures software-driven home energy products.

Enphase reported revenues of $410.4 million, up 7.8% year on year. This result surpassed analysts’ expectations by 12%. It was a strong quarter as it also put up a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is down 9.4% since reporting and currently trades at $33.35.

Read our full, actionable report on Enphase here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.