FirstSun Capital Bancorp currently trades at $38.31 per share and has shown little upside over the past six months, posting a middling return of 3.9%.

Is there a buying opportunity in FirstSun Capital Bancorp, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is FirstSun Capital Bancorp Not Exciting?

We're cautious about FirstSun Capital Bancorp. Here are three reasons you should be careful with FSUN and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

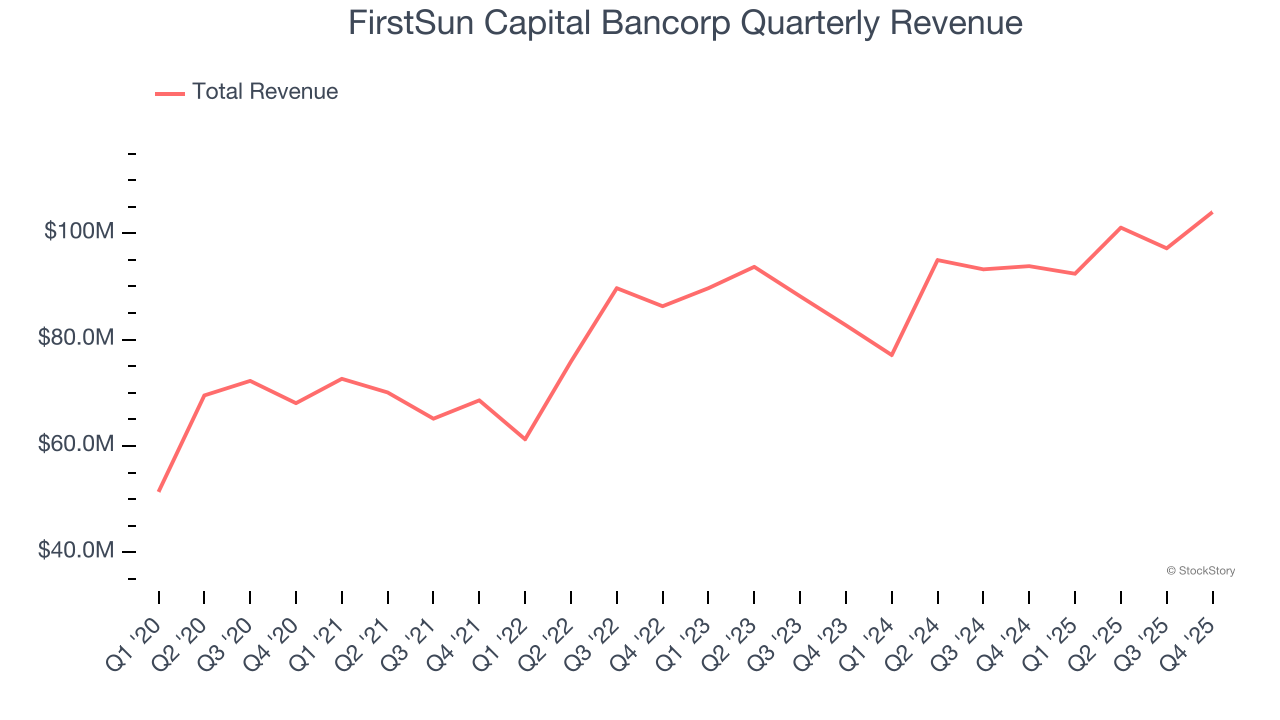

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income.

Regrettably, FirstSun Capital Bancorp’s revenue grew at a mediocre 8.6% compounded annual growth rate over the last five years. This was below our standard for the banking sector.

2. Net Interest Margin Dropping

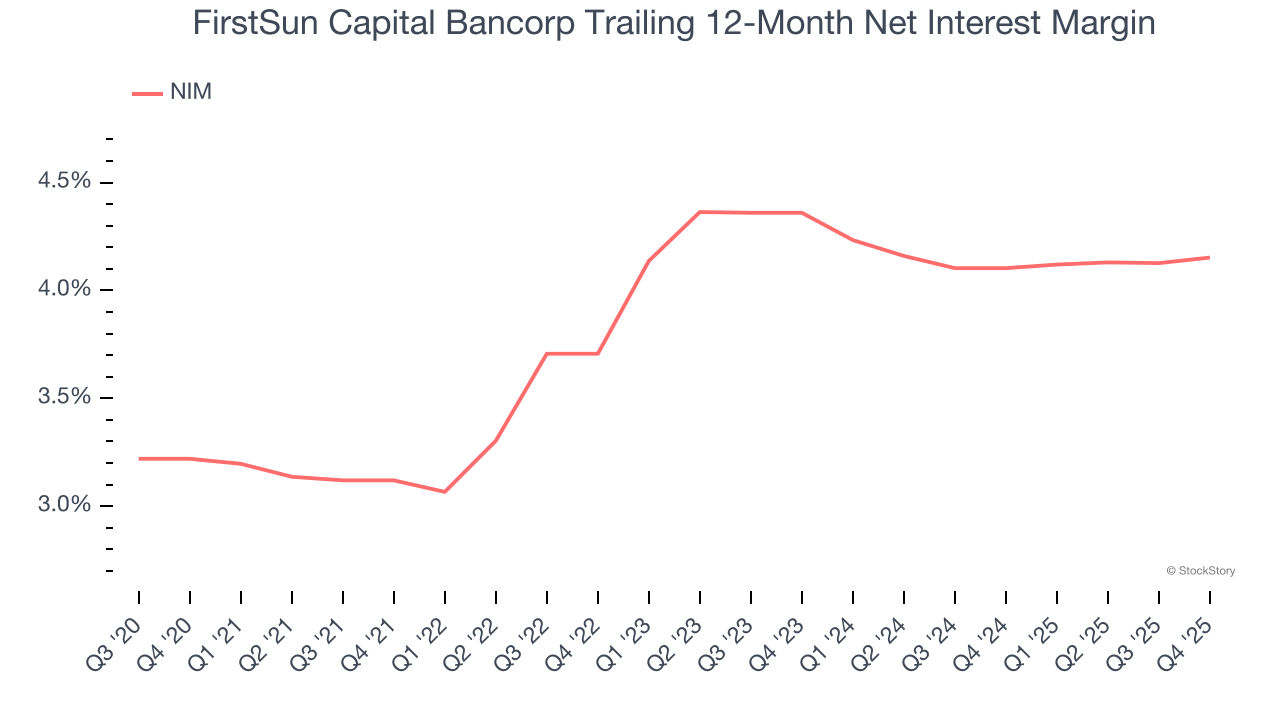

Net interest margin (NIM) represents the unit economics of a bank by measuring the profitability of its interest-bearing assets relative to its interest-bearing liabilities. It's a fundamental metric that investors use to assess lending premiums and returns.

Over the past two years, FirstSun Capital Bancorp’s net interest margin averaged 4.1%. However, its margin contracted by 20.8 basis points (100 basis points = 1 percentage point) over that period.

This decline was a headwind for its net interest income. While prevailing rates are a major determinant of net interest margin changes over time, the decline could mean FirstSun Capital Bancorp either faced competition for loans and deposits or experienced a negative mix shift in its balance sheet composition.

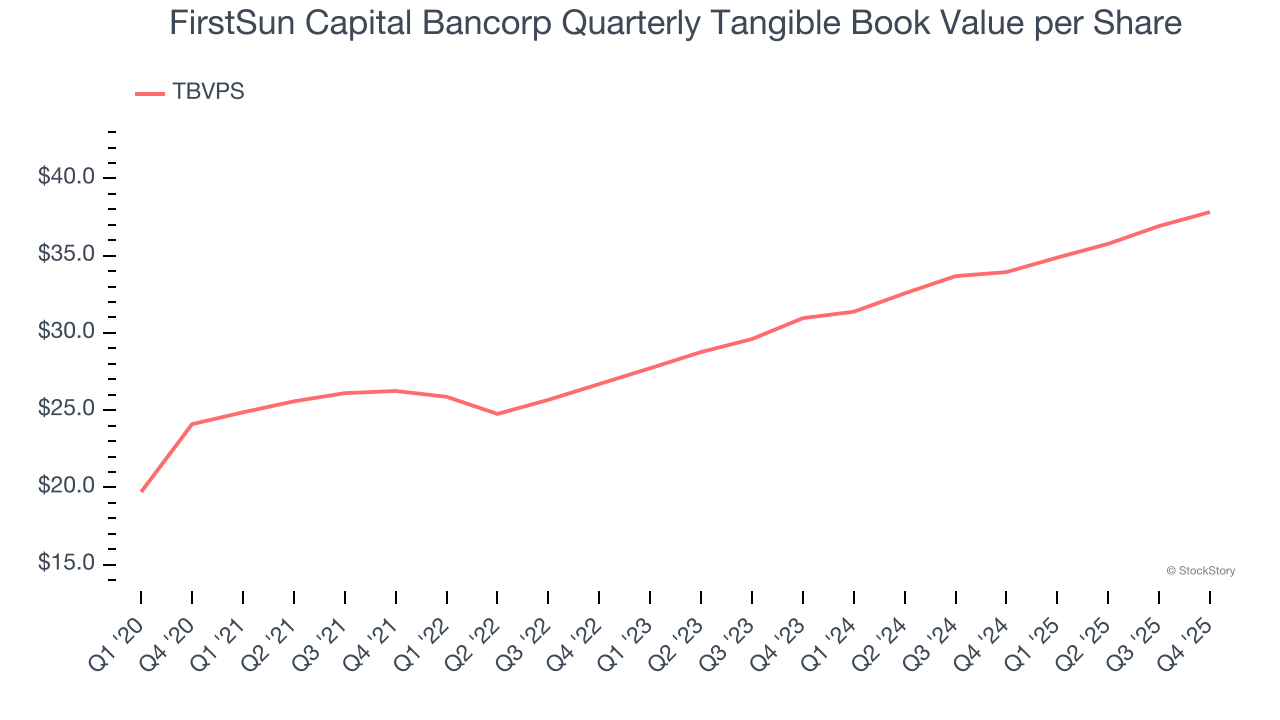

3. TBVPS Projections Show Stormy Skies Ahead

The key to tangible book value per share (TBVPS) growth is a bank’s ability to earn consistent returns on its assets that exceed its funding costs and credit losses.

Over the next 12 months, Consensus estimates call for FirstSun Capital Bancorp’s TBVPS to shrink by 3.3% to $36.59, a sour projection.

Final Judgment

FirstSun Capital Bancorp isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 0.9× forward P/B (or $38.31 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.