Gilead Sciences trades at $117.95 and has moved in lockstep with the market. Its shares have returned 5.5% over the last six months while the S&P 500 has gained 10.1%.

Is now the time to buy Gilead Sciences, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Gilead Sciences Not Exciting?

We're cautious about Gilead Sciences. Here are three reasons you should be careful with GILD and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

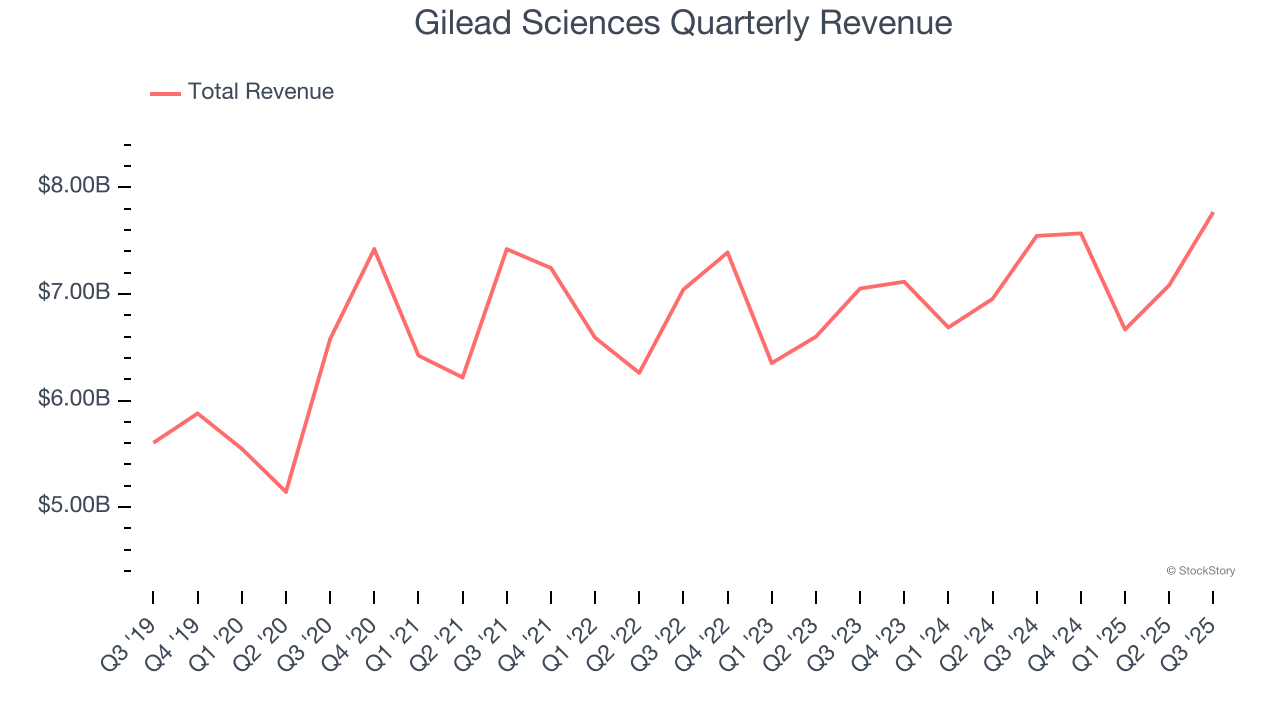

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Gilead Sciences’s sales grew at a mediocre 4.7% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector.

2. Shrinking Adjusted Operating Margin

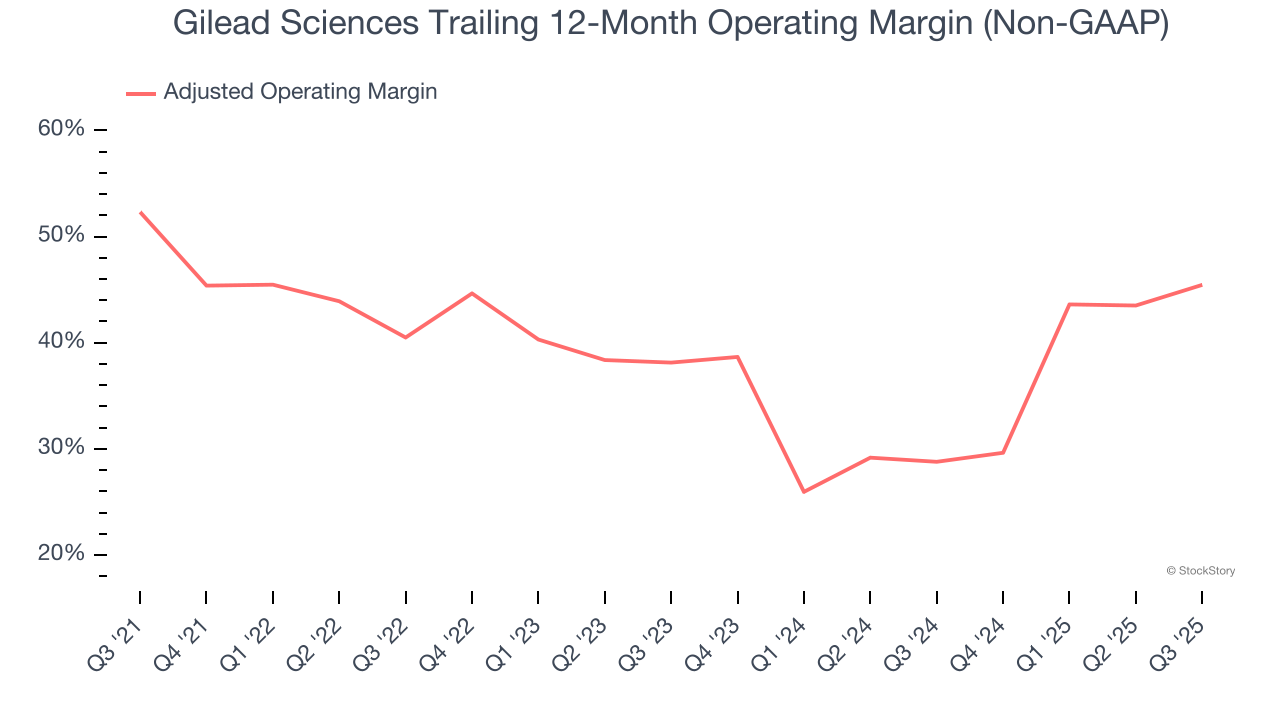

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Looking at the trend in its profitability, Gilead Sciences’s adjusted operating margin decreased by 6.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 45.4%.

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Gilead Sciences’s ROIC has decreased over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Gilead Sciences isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 14.4× forward P/E (or $117.95 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of our top digital advertising picks.

Stocks We Like More Than Gilead Sciences

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.