The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Kimberly-Clark (NASDAQ:KMB) and the rest of the household products stocks fared in Q4.

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.9% above.

Thankfully, share prices of the companies have been resilient as they are up 7.3% on average since the latest earnings results.

Kimberly-Clark (NASDAQ:KMB)

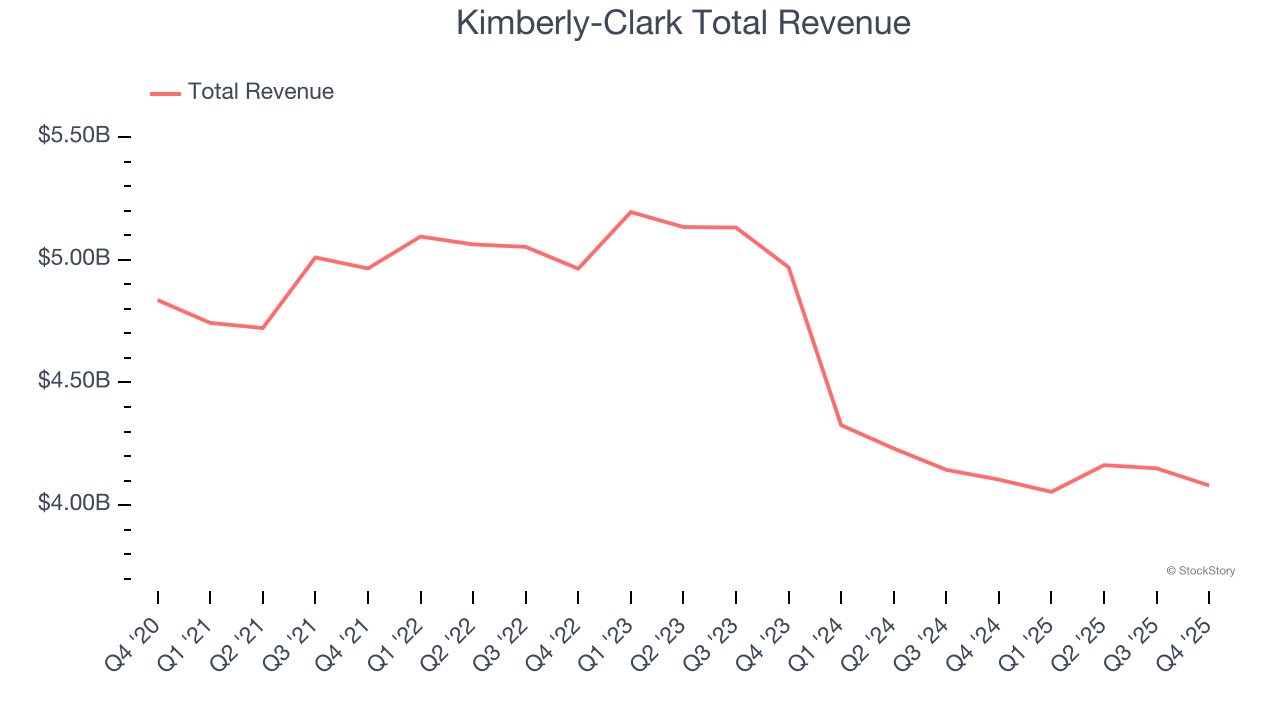

Originally founded as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE:KMB) is now a household products powerhouse known for personal care and tissue products.

Kimberly-Clark reported revenues of $4.08 billion, flat year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a miss of analysts’ EBITDA estimates and a miss of analysts’ adjusted operating income estimates.

"In 2025, we accelerated the largest transformation in Kimberly-Clark's more than 150-year history, delivering results that underscore the strength of our business and serve as a springboard for enhanced growth and continued outperformance in 2026," said Kimberly-Clark Chairman and CEO Mike Hsu.

Interestingly, the stock is up 4.7% since reporting and currently trades at $105.87.

Read our full report on Kimberly-Clark here, it’s free.

Best Q4: Spectrum Brands (NYSE:SPB)

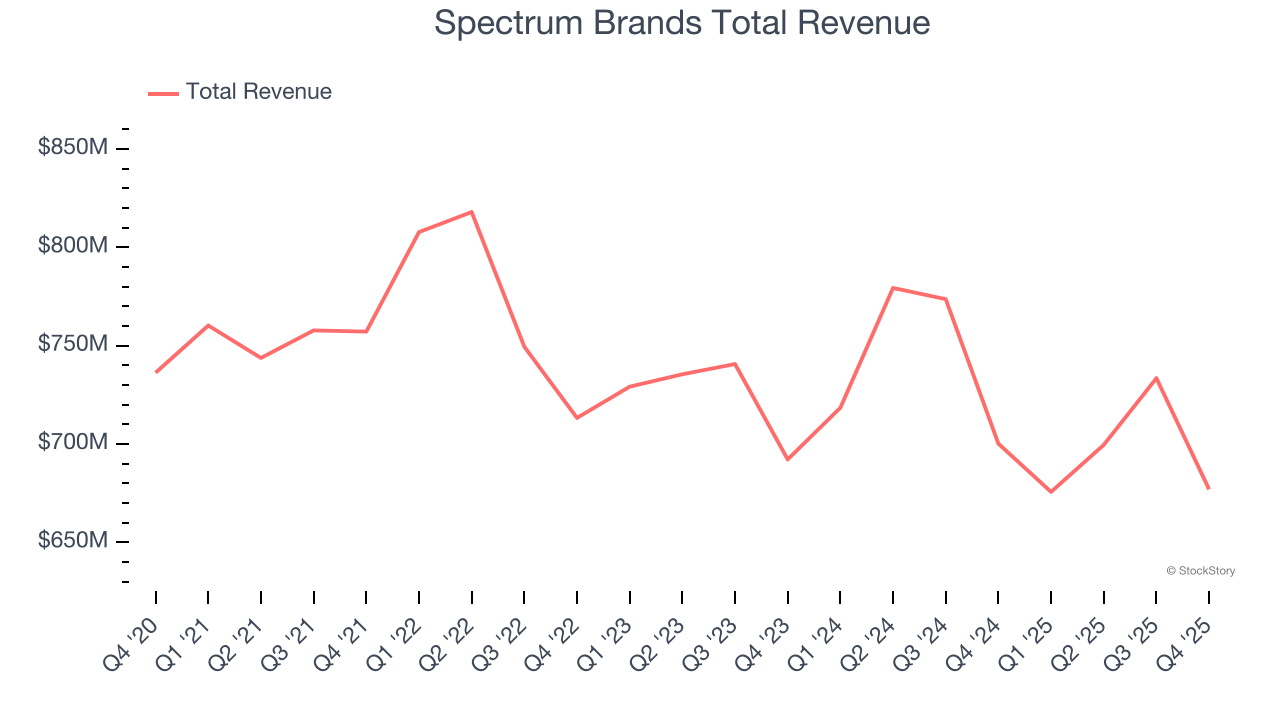

A leader in multiple consumer product categories, Spectrum Brands (NYSE:SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Spectrum Brands reported revenues of $677 million, down 3.3% year on year, outperforming analysts’ expectations by 1.2%. The business had a very strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 8.9% since reporting. It currently trades at $74.51.

Is now the time to buy Spectrum Brands? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: WD-40 (NASDAQ:WDFC)

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

WD-40 reported revenues of $154.4 million, flat year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 17.4% since the results and currently trades at $238.90.

Read our full analysis of WD-40’s results here.

Energizer (NYSE:ENR)

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

Energizer reported revenues of $778.9 million, up 6.5% year on year. This number beat analysts’ expectations by 10%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Energizer pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 3.9% since reporting and currently trades at $22.47.

Read our full, actionable report on Energizer here, it’s free.

Colgate-Palmolive (NYSE:CL)

Formed after the 1928 combination between toothpaste maker Colgate and soap maker Palmolive-Peet, Colgate-Palmolive (NYSE:CL) is a consumer products company that focuses on personal, household, and pet products.

Colgate-Palmolive reported revenues of $5.23 billion, up 5.8% year on year. This print surpassed analysts’ expectations by 1.7%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

The stock is up 10.2% since reporting and currently trades at $93.91.

Read our full, actionable report on Colgate-Palmolive here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.