The past six months have been a windfall for Laureate Education’s shareholders. The company’s stock price has jumped 43.4%, hitting $33.67 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Laureate Education, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Laureate Education Will Underperform?

Despite the momentum, we're swiping left on Laureate Education for now. Here are three reasons there are better opportunities than LAUR and a stock we'd rather own.

1. Weak Growth in Enrolled Students Points to Soft Demand

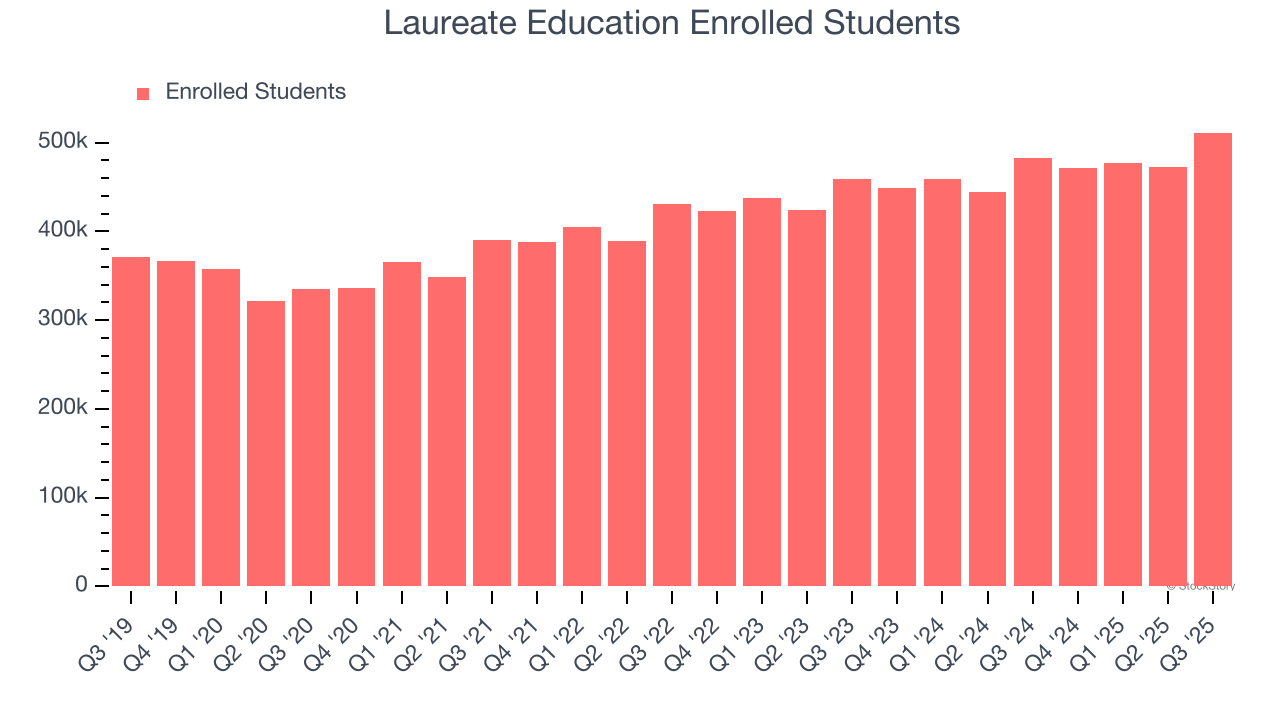

Revenue growth can be broken down into changes in price and volume (for companies like Laureate Education, our preferred volume metric is enrolled students). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Laureate Education’s enrolled students came in at 511,400 in the latest quarter, and over the last two years, averaged 5.3% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. EPS Trending Down

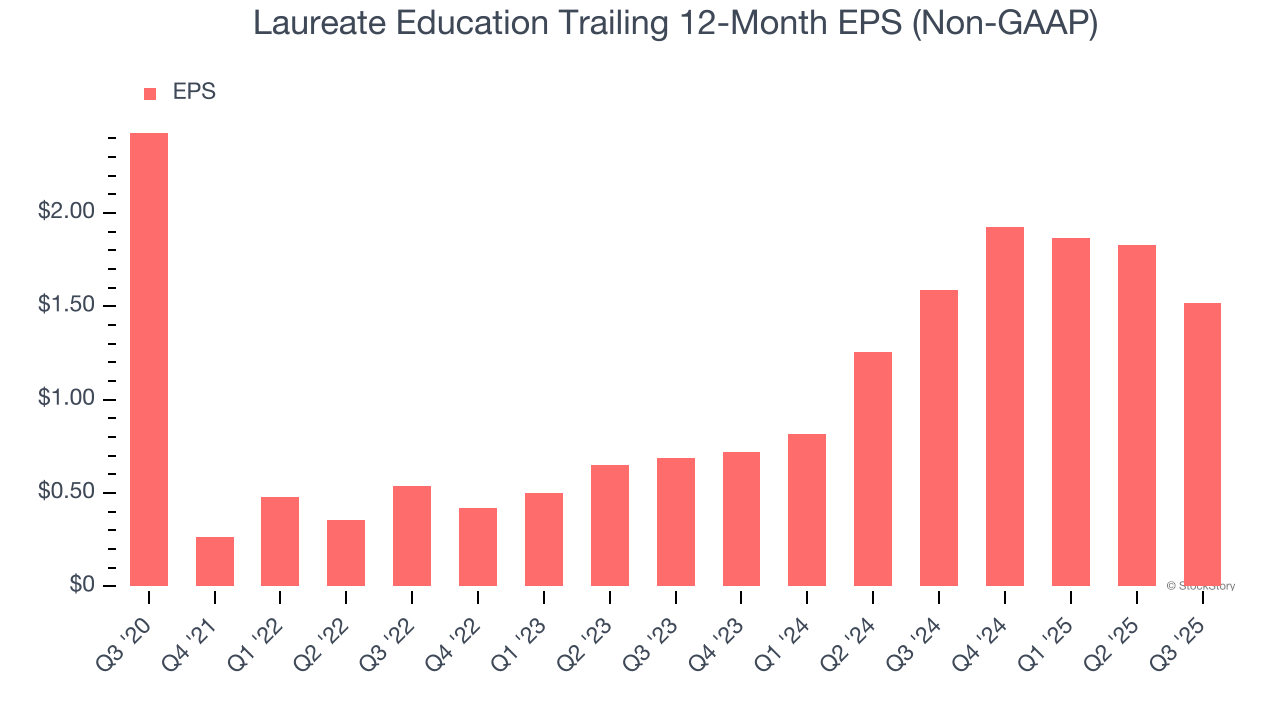

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Laureate Education, its EPS declined by 9% annually over the last five years while its revenue grew by 7.7%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

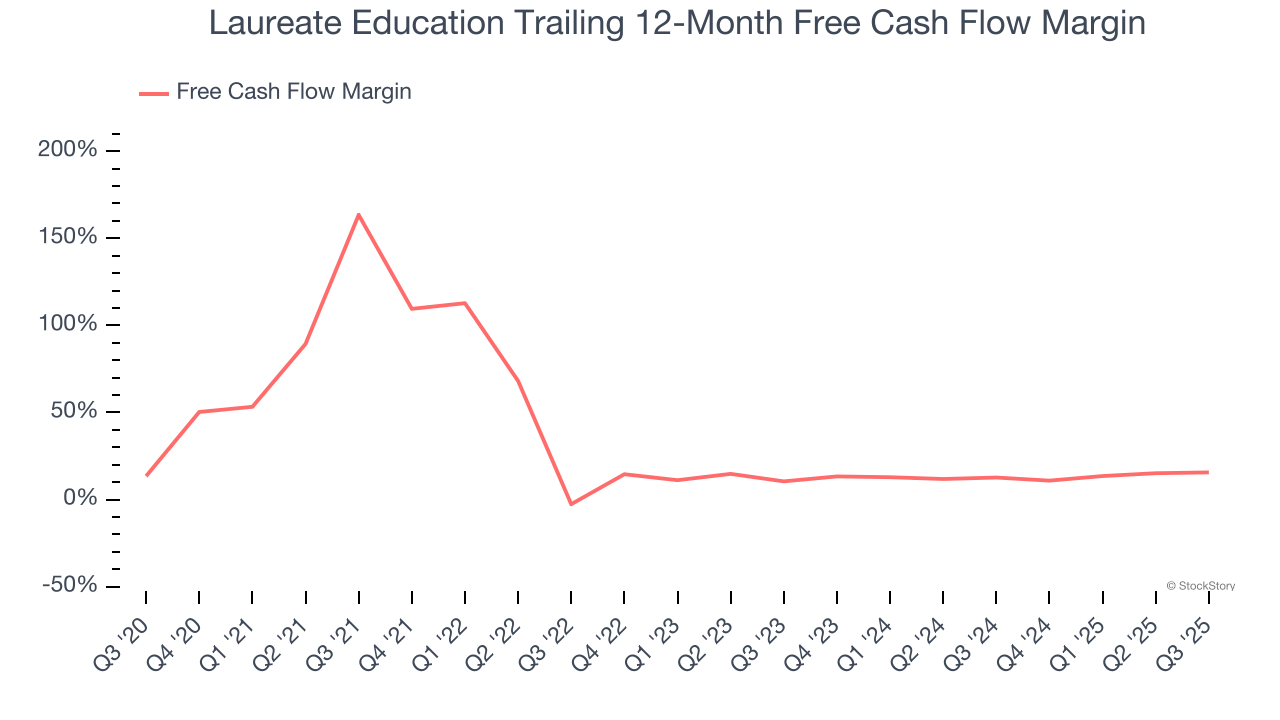

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Laureate Education has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 14.1%, lousy for a consumer discretionary business.

Final Judgment

Laureate Education falls short of our quality standards. After the recent rally, the stock trades at 17.2× forward P/E (or $33.67 per share). While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better investments elsewhere. We’d suggest looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Like More Than Laureate Education

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.