The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how LifeStance Health Group (NASDAQ:LFST) and the rest of the outpatient & specialty care stocks fared in Q3.

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

The 7 outpatient & specialty care stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.9% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

LifeStance Health Group (NASDAQ:LFST)

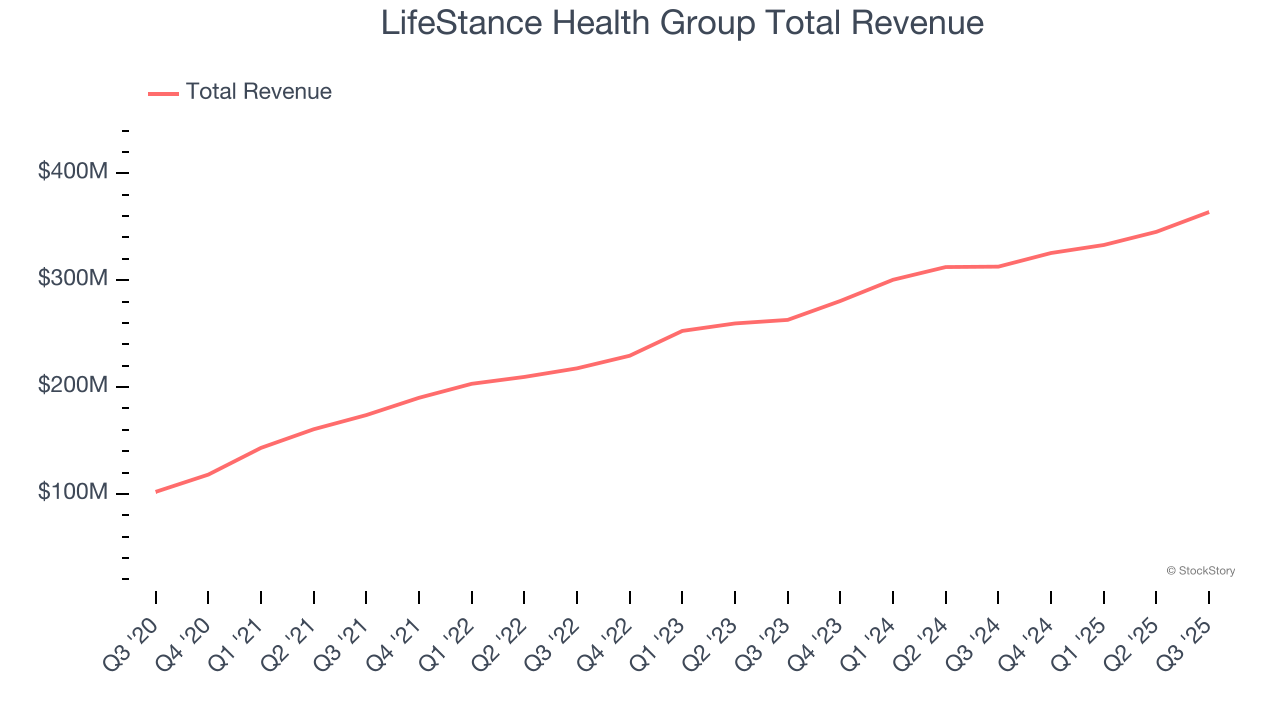

With over 6,600 licensed mental health professionals treating more than 880,000 patients annually, LifeStance Health (NASDAQ:LFST) provides outpatient mental health services through a network of clinicians offering psychiatric evaluations, psychological testing, and therapy across 33 states.

LifeStance Health Group reported revenues of $363.8 million, up 16.3% year on year. This print exceeded analysts’ expectations by 2.3%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ revenue estimates but EPS in line with analysts’ estimates.

“This was a record-breaking quarter for LifeStance,” said Dave Bourdon, CEO of LifeStance.

LifeStance Health Group pulled off the highest full-year guidance raise of the whole group. Unsurprisingly, the stock is up 43.4% since reporting and currently trades at $6.88.

Is now the time to buy LifeStance Health Group? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Select Medical (NYSE:SEM)

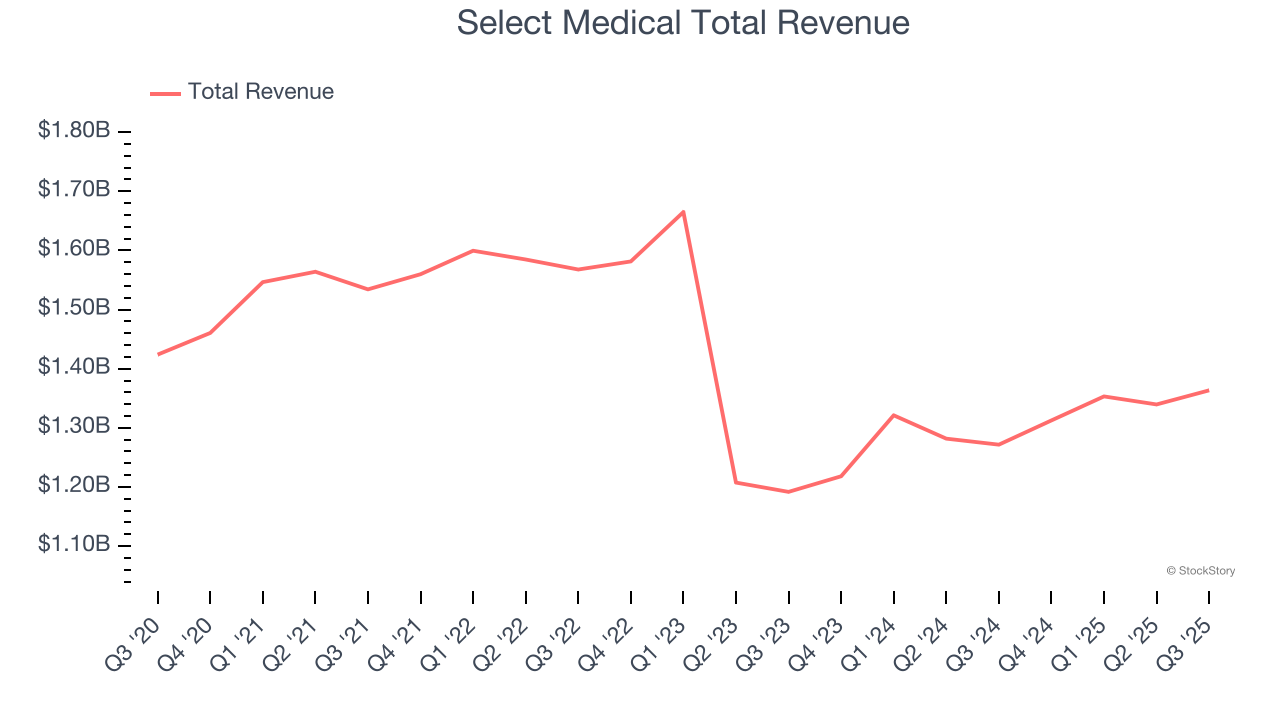

With a nationwide network spanning 46 states and over 2,700 healthcare facilities, Select Medical (NYSE:SEM) operates critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and occupational health centers across the United States.

Select Medical reported revenues of $1.36 billion, up 7.2% year on year, outperforming analysts’ expectations by 2.7%. The business had a strong quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

Select Medical scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 8.7% since reporting. It currently trades at $15.44.

Is now the time to buy Select Medical? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: DaVita (NYSE:DVA)

With over 2,600 dialysis centers across the United States and a presence in 13 countries, DaVita (NYSE:DVA) operates a network of dialysis centers providing treatment and care for patients with chronic kidney disease and end-stage kidney disease.

DaVita reported revenues of $3.42 billion, up 4.8% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ EPS estimates and revenue in line with analysts’ estimates.

DaVita delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.3% since the results and currently trades at $119.85.

Read our full analysis of DaVita’s results here.

U.S. Physical Therapy (NYSE:USPH)

With a nationwide footprint spanning 671 clinics across 42 states, U.S. Physical Therapy (NYSE:USPH) operates a network of outpatient physical therapy clinics and provides industrial injury prevention services to employers across the United States.

U.S. Physical Therapy reported revenues of $197.1 million, up 17.3% year on year. This number beat analysts’ expectations by 1%. Overall, it was a satisfactory quarter as it also put up a narrow beat of analysts’ revenue estimates.

U.S. Physical Therapy delivered the fastest revenue growth among its peers. The stock is down 8.8% since reporting and currently trades at $80.27.

Read our full, actionable report on U.S. Physical Therapy here, it’s free for active Edge members.

agilon health (NYSE:AGL)

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE:AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

agilon health reported revenues of $1.44 billion, down 1.1% year on year. This result surpassed analysts’ expectations by 1%. More broadly, it was a slower quarter as it logged full-year EBITDA guidance missing analysts’ expectations significantly and a significant miss of analysts’ EPS estimates.

agilon health had the slowest revenue growth among its peers. The company added 5,000 customers to reach a total of 503,000. The stock is flat since reporting and currently trades at $0.72.

Read our full, actionable report on agilon health here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.