LegalZoom trades at $10.01 per share and has stayed right on track with the overall market, gaining 16.7% over the last six months. At the same time, the S&P 500 has returned 13.3%.

Is there a buying opportunity in LegalZoom, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is LegalZoom Not Exciting?

We don't have much confidence in LegalZoom. Here are three reasons there are better opportunities than LZ and a stock we'd rather own.

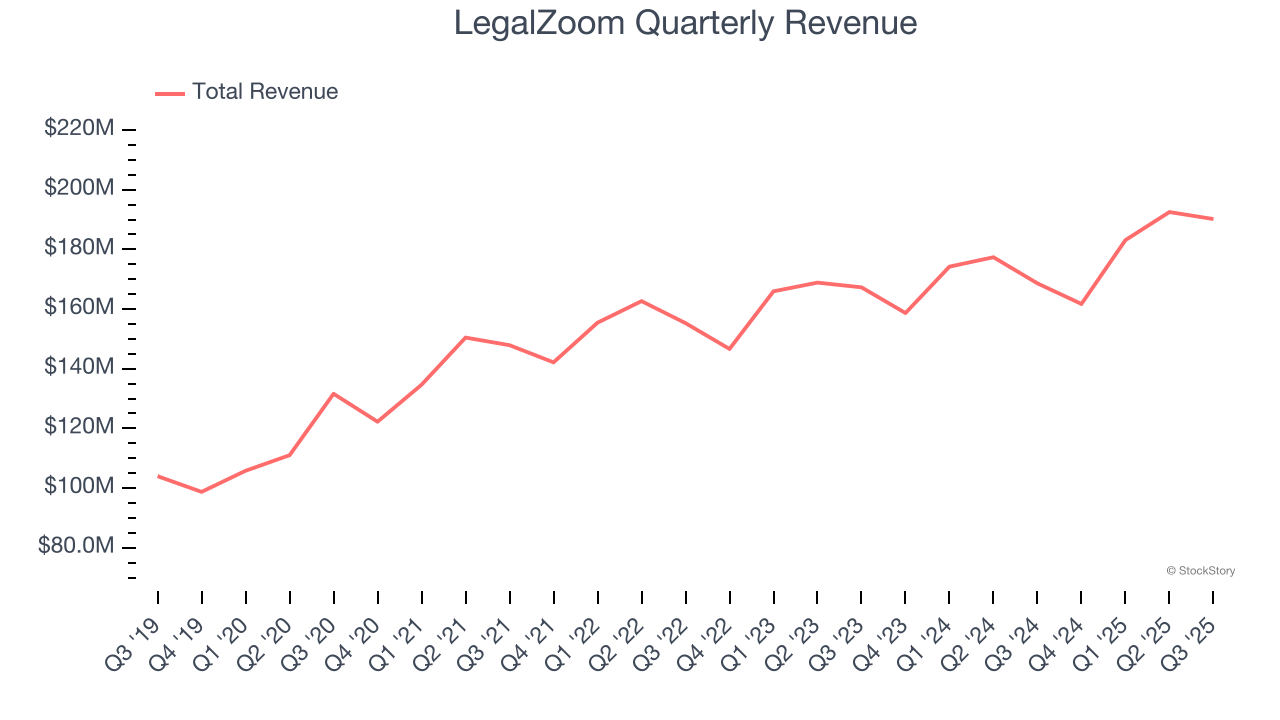

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, LegalZoom’s sales grew at a sluggish 5.7% compounded annual growth rate over the last three years. This fell short of our benchmark for the consumer internet sector.

2. Customer Spending Stalls, Engagement Falling?

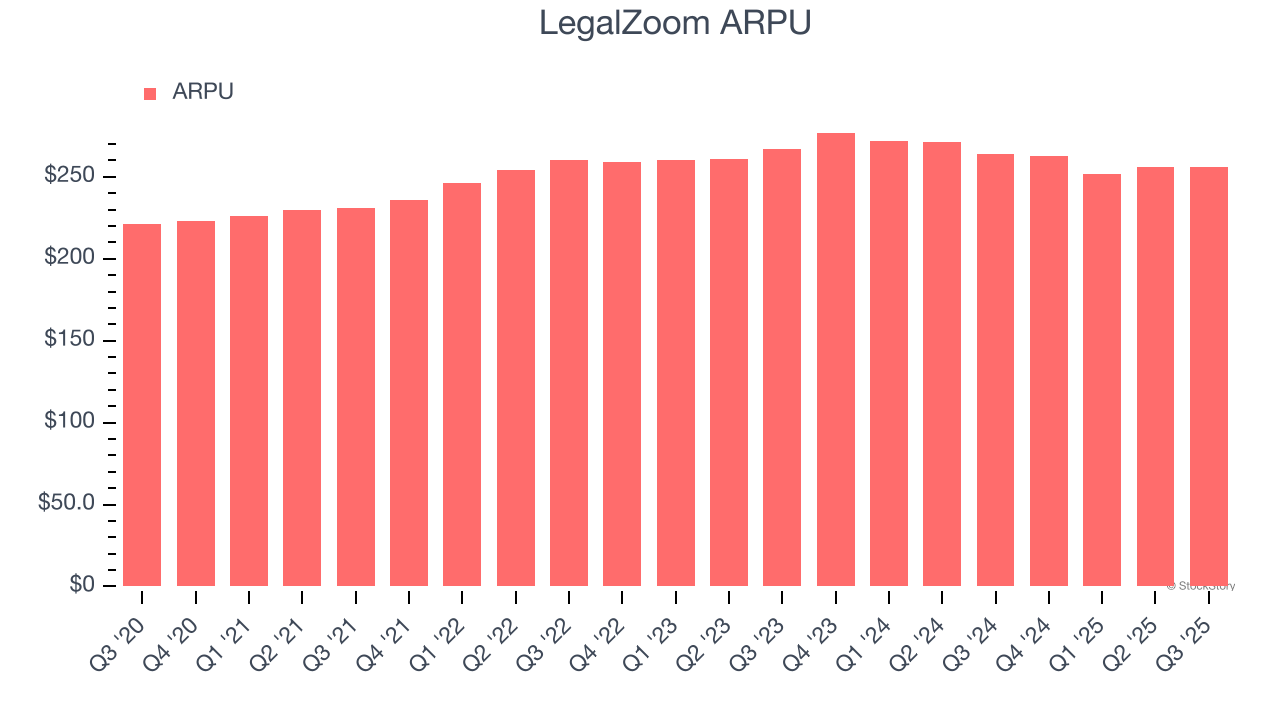

Average revenue per user (ARPU) is a critical metric to track because it measures how much the company earns in transaction fees from each user. ARPU also gives us unique insights into a user’s average order size and LegalZoom’s take rate, or "cut", on each order.

LegalZoom’s ARPU has been roughly flat over the last two years. This isn’t great, but the increase in subscription units is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if LegalZoom tries boosting ARPU by taking a more aggressive approach to monetization, it’s unclear whether users can continue growing at the current pace.

3. Poor Marketing Efficiency Drains Profits

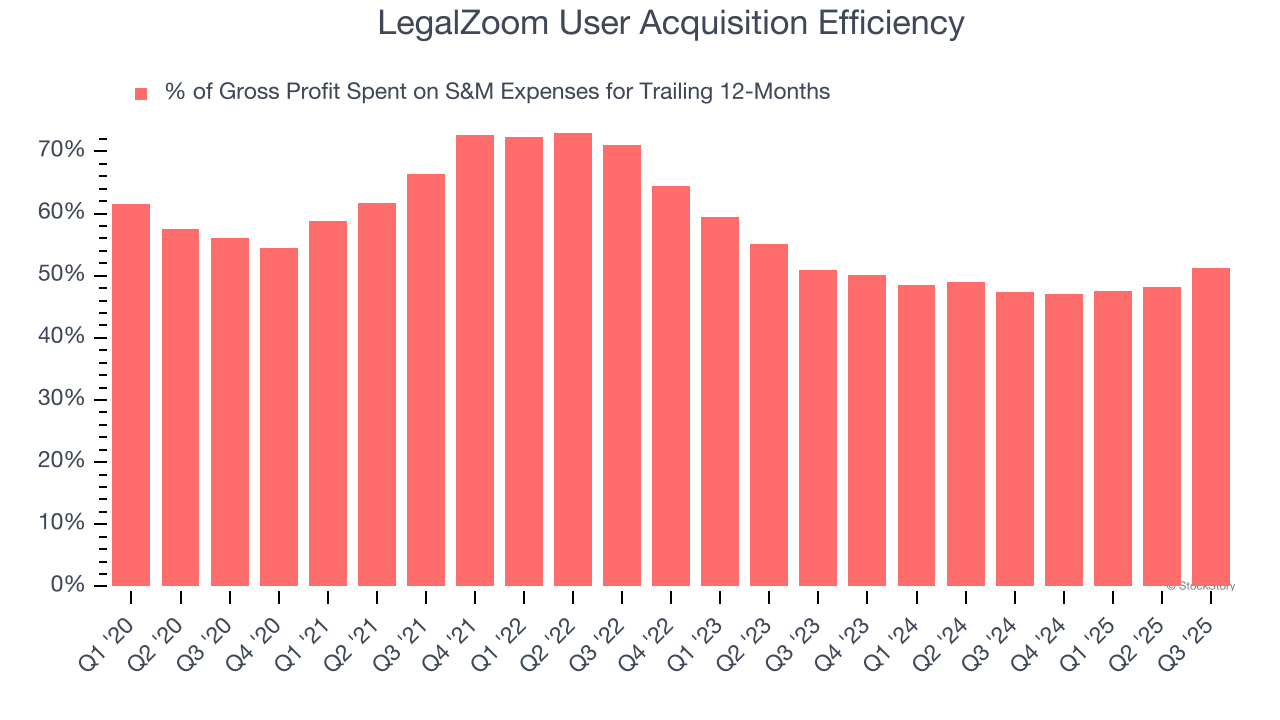

Consumer internet businesses like LegalZoom grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s expensive for LegalZoom to acquire new users as the company has spent 51.3% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that LegalZoom’s product offering can be easily replicated and that it must continue investing to maintain an acceptable growth trajectory.

Final Judgment

LegalZoom’s business quality ultimately falls short of our standards. That said, the stock currently trades at 8.8× forward EV/EBITDA (or $10.01 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of LegalZoom

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.