The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how specialized consumer services stocks fared in Q3, starting with Matthews (NASDAQ:MATW).

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

The 11 specialized consumer services stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 19.3% while next quarter’s revenue guidance was in line.

While some specialized consumer services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.4% since the latest earnings results.

Best Q3: Matthews (NASDAQ:MATW)

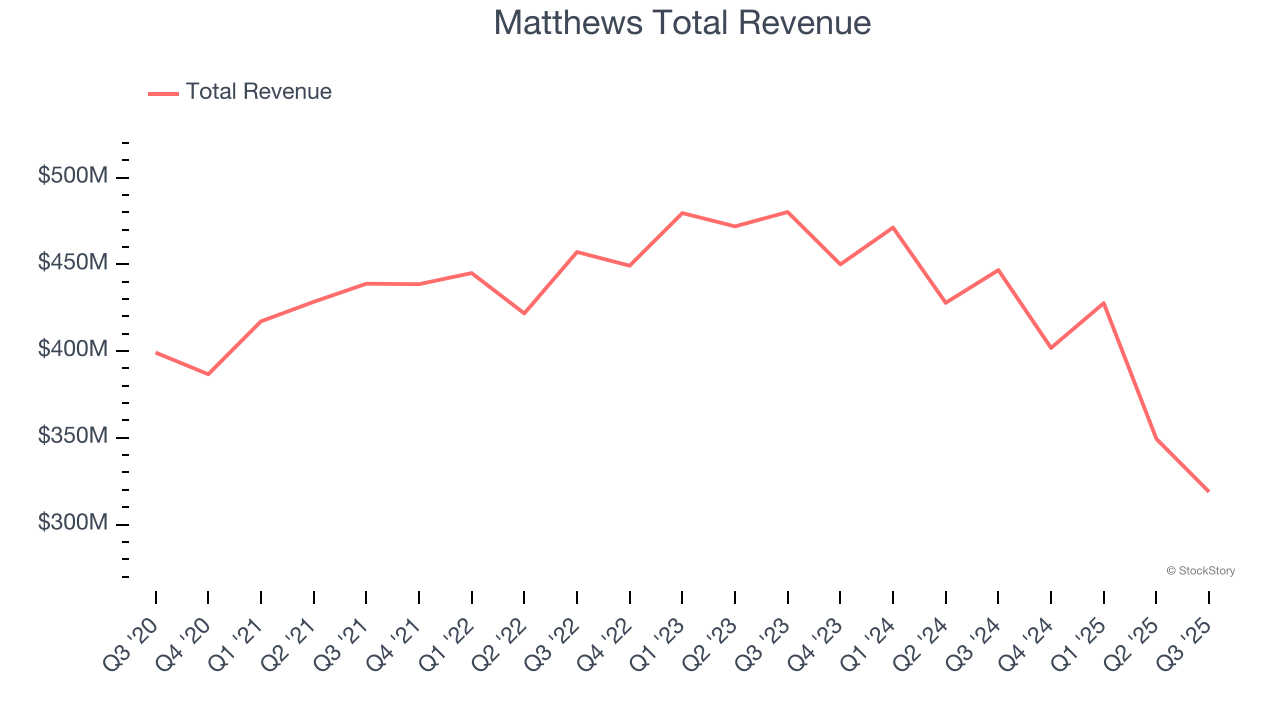

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews reported revenues of $318.8 million, down 28.6% year on year. This print exceeded analysts’ expectations by 9.6%. Overall, it was a very strong quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

Matthews pulled off the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 9.5% since reporting and currently trades at $27.00.

Is now the time to buy Matthews? Access our full analysis of the earnings results here, it’s free for active Edge members.

H&R Block (NYSE:HRB)

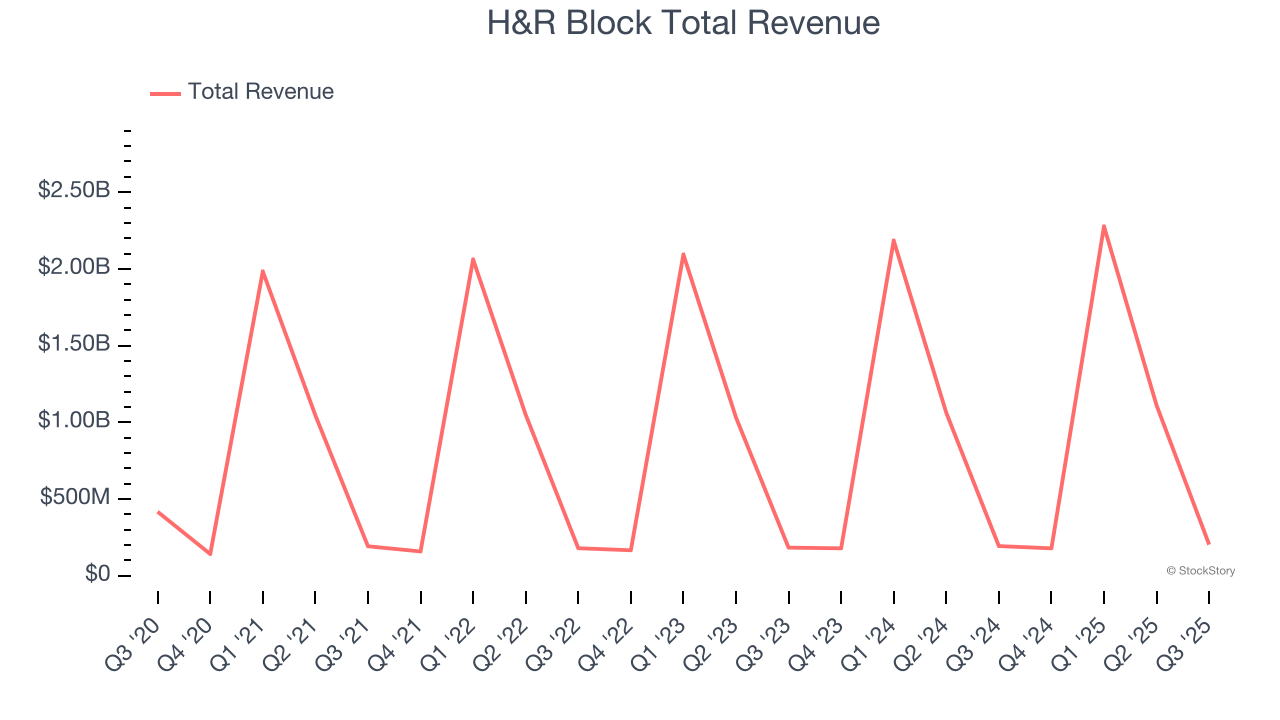

Founded in 1955 by brothers Henry W. Bloch and Richard A. Bloch, H&R Block (NYSE:HRB) is a tax preparation company offering professional tax assistance and financial solutions to individuals and small businesses.

H&R Block reported revenues of $203.6 million, up 5% year on year, outperforming analysts’ expectations by 1.5%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

H&R Block pulled off the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 15.4% since reporting. It currently trades at $43.53.

Is now the time to buy H&R Block? Access our full analysis of the earnings results here, it’s free for active Edge members.

1-800-FLOWERS (NASDAQ:FLWS)

Founded in 1976, 1-800-FLOWERS (NASDAQ:FLWS) is an online retailer of flowers, gifts, and gourmet foods, serving customers globally.

1-800-FLOWERS reported revenues of $215.2 million, down 11.1% year on year, falling short of analysts’ expectations by 1.2%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and a slight miss of analysts’ revenue estimates.

Interestingly, the stock is up 33.3% since the results and currently trades at $4.66.

Read our full analysis of 1-800-FLOWERS’s results here.

Pool (NASDAQ:POOL)

Founded in 1993 and headquartered in Louisiana, Pool (NASDAQ:POOL) is one of the largest wholesale distributors of swimming pool supplies, equipment, and related leisure products.

Pool reported revenues of $1.45 billion, up 1.3% year on year. This result was in line with analysts’ expectations. Aside from that, it was a mixed quarter as it also produced full-year EPS guidance slightly topping analysts’ expectations but organic revenue in line with analysts’ estimates.

The stock is down 20.5% since reporting and currently trades at $236.57.

Read our full, actionable report on Pool here, it’s free for active Edge members.

Mister Car Wash (NASDAQ:MCW)

Formerly known as Hotshine Holdings, Mister Car Wash (NYSE:MCW) offers car washes across the United States through its conveyorized service.

Mister Car Wash reported revenues of $263.4 million, up 5.7% year on year. This number beat analysts’ expectations by 0.9%. Overall, it was a satisfactory quarter as it also recorded a solid beat of analysts’ same-store sales estimates.

The stock is up 8% since reporting and currently trades at $5.62.

Read our full, actionable report on Mister Car Wash here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.