Since July 2025, Microchip Technology has been in a holding pattern, posting a small loss of 2.9% while floating around $69.41. The stock also fell short of the S&P 500’s 10.1% gain during that period.

Is now the time to buy Microchip Technology, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Microchip Technology Will Underperform?

We don't have much confidence in Microchip Technology. Here are three reasons you should be careful with MCHP and a stock we'd rather own.

1. Revenue Spiraling Downwards

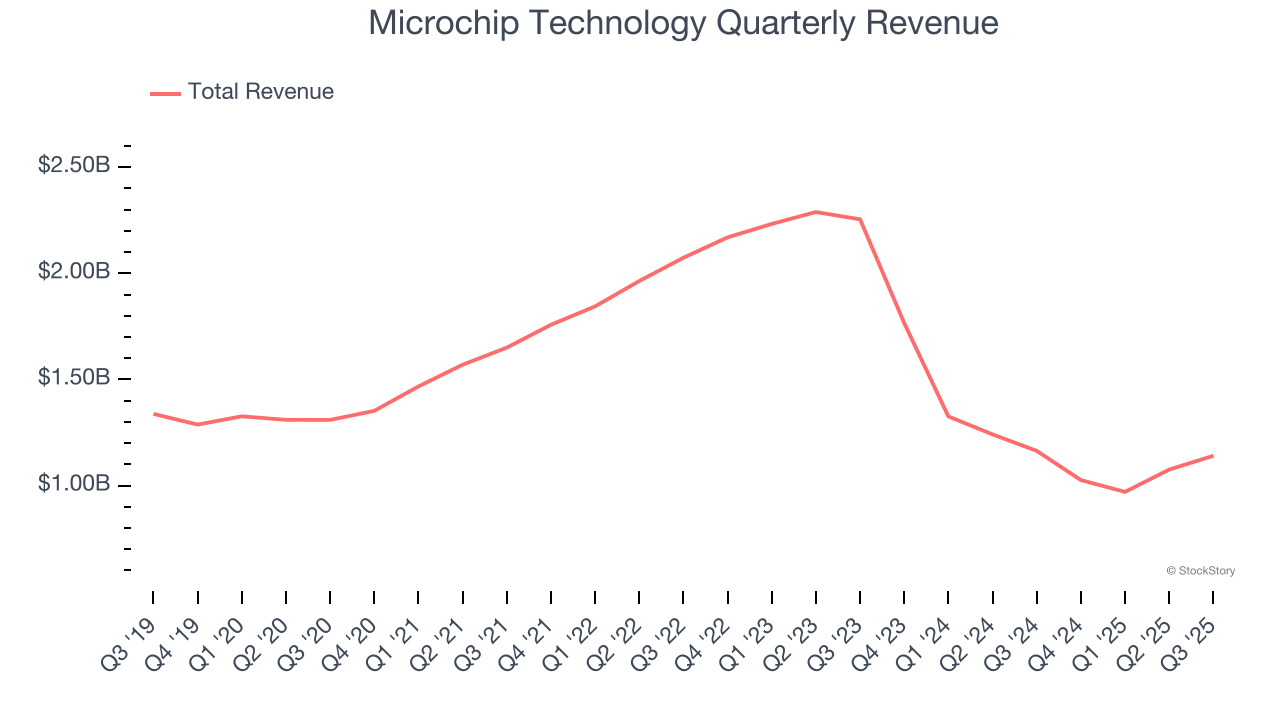

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Microchip Technology’s demand was weak and its revenue declined by 4.2% per year. This wasn’t a great result and is a sign of poor business quality. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. EPS Trending Down

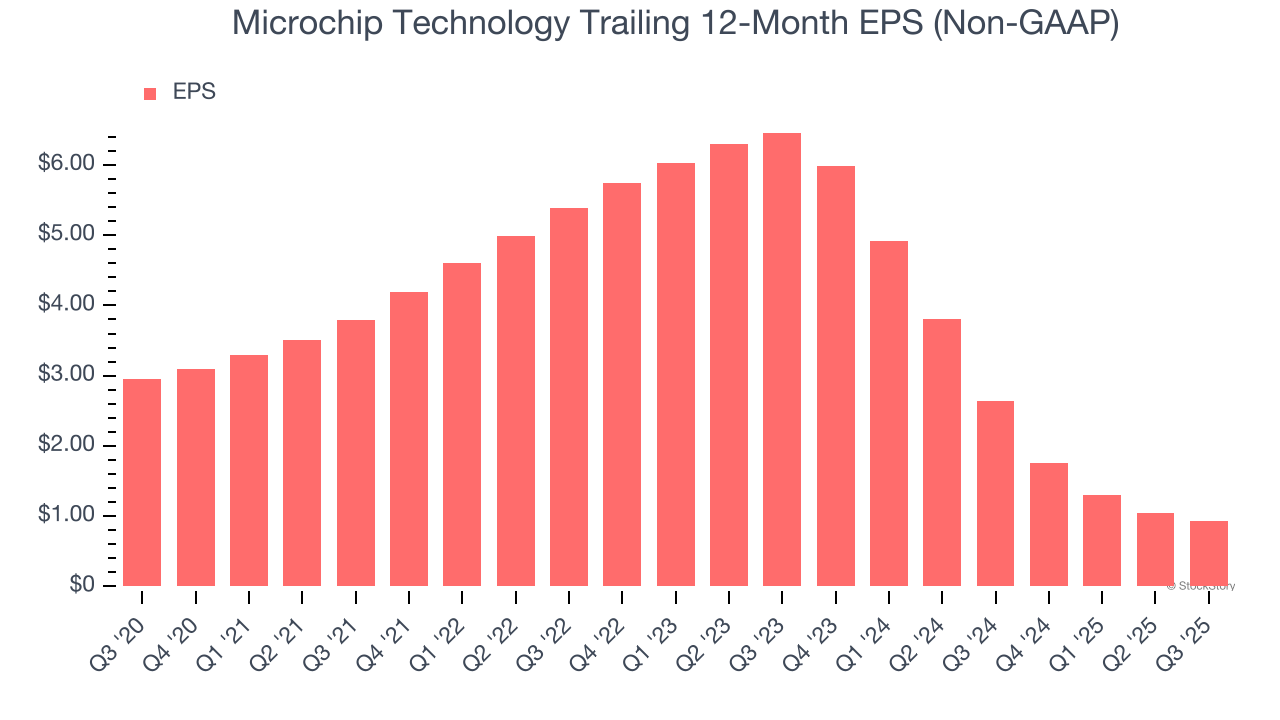

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Microchip Technology, its EPS declined by 20.6% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

3. Free Cash Flow Margin Dropping

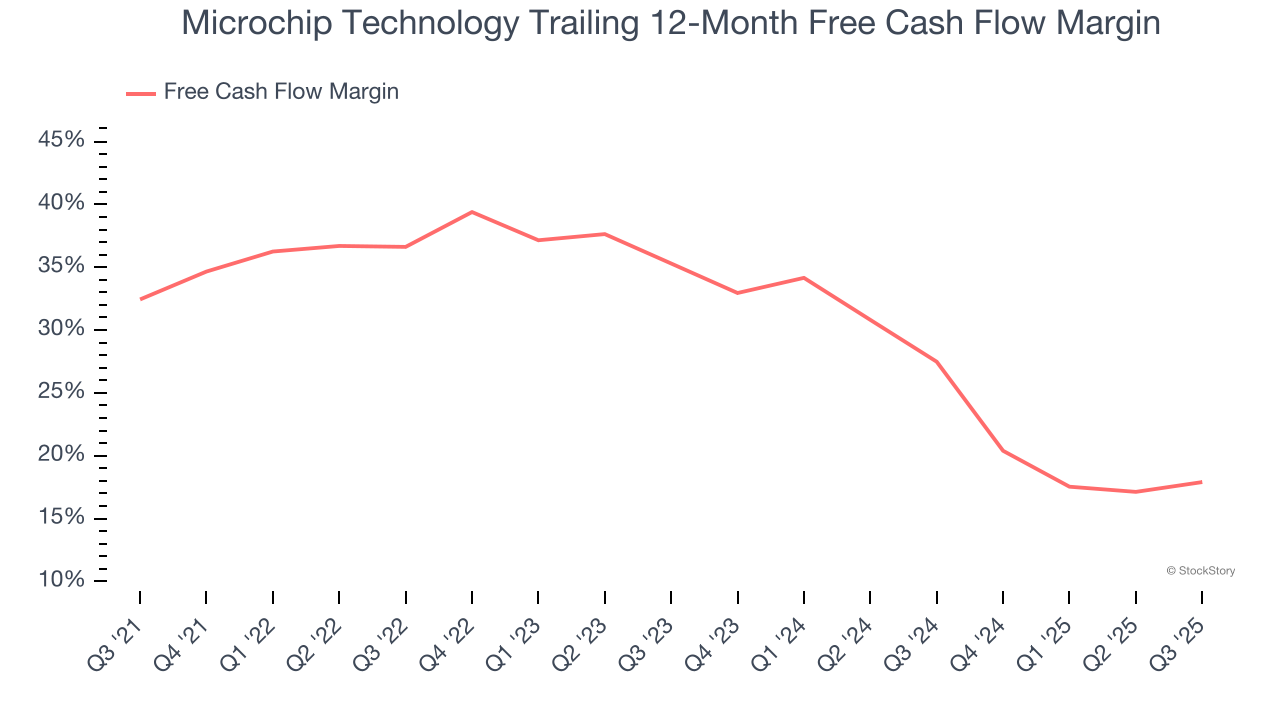

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Microchip Technology’s margin dropped by 14.5 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle. Microchip Technology’s free cash flow margin for the trailing 12 months was 17.9%.

Final Judgment

We cheer for all companies solving complex technology issues, but in the case of Microchip Technology, we’ll be cheering from the sidelines. With its shares lagging the market recently, the stock trades at 32.4× forward P/E (or $69.41 per share). This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere. We’d recommend looking at the most dominant software business in the world.

Stocks We Like More Than Microchip Technology

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.