The Marzetti Company currently trades at $163.68 per share and has shown little upside over the past six months, posting a small loss of 4.9%. The stock also fell short of the S&P 500’s 12.9% gain during that period.

Is now the time to buy The Marzetti Company, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Is The Marzetti Company Not Exciting?

We're cautious about The Marzetti Company. Here are three reasons we avoid MZTI and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

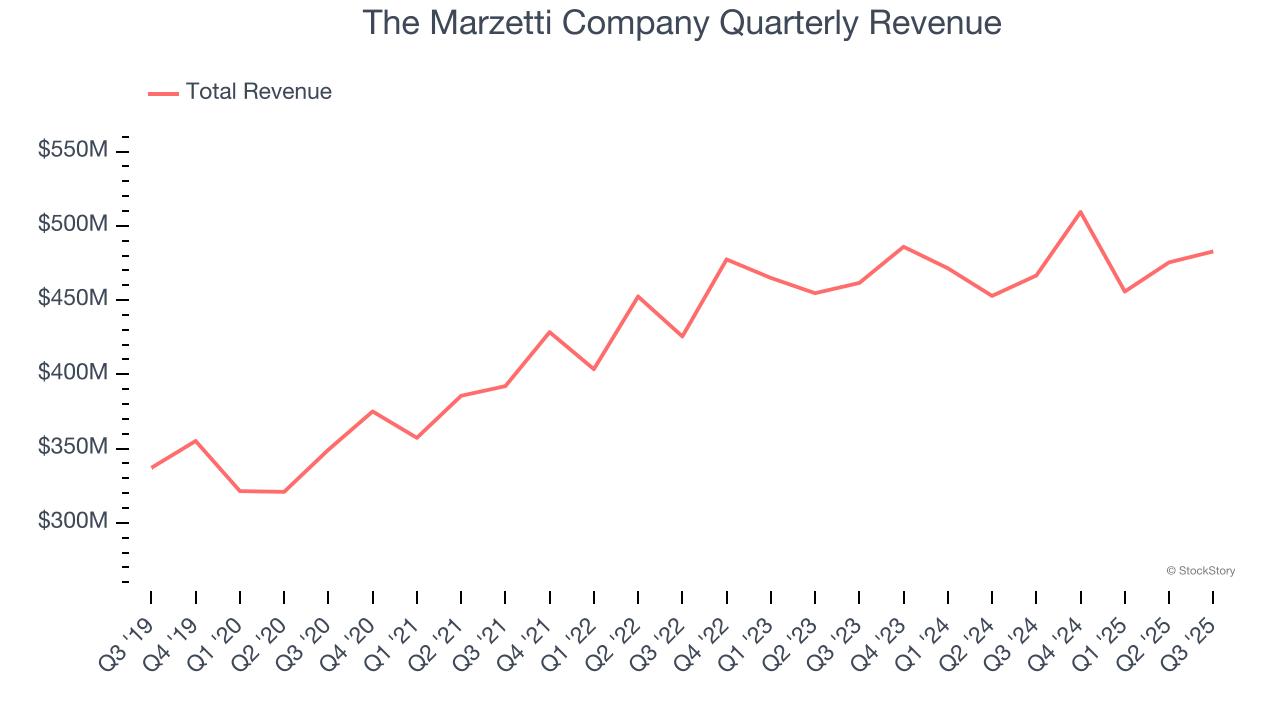

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, The Marzetti Company grew its sales at a sluggish 4% compounded annual growth rate. This fell short of our benchmark for the consumer staples sector.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect The Marzetti Company’s revenue to rise by 1.8%, a slight deceleration versus This projection is underwhelming and indicates its products will see some demand headwinds.

3. Low Gross Margin Reveals Weak Structural Profitability

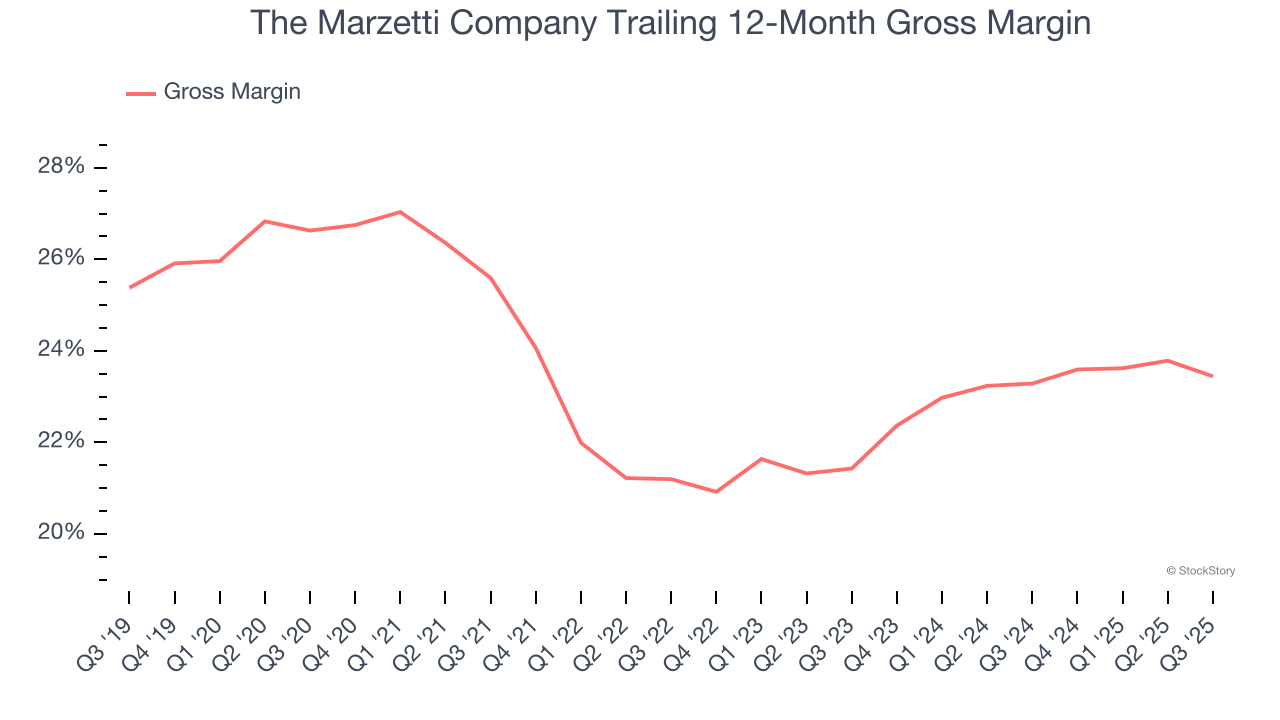

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

The Marzetti Company has bad unit economics for a consumer staples company, giving it less room to reinvest and develop new products. As you can see below, it averaged a 23.4% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $76.63 went towards paying for raw materials, production of goods, transportation, and distribution.

Final Judgment

The Marzetti Company’s business quality ultimately falls short of our standards. With its shares underperforming the market lately, the stock trades at 23.4× forward P/E (or $163.68 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better stocks to buy right now. Let us point you toward one of Charlie Munger’s all-time favorite businesses.

Stocks We Would Buy Instead of The Marzetti Company

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.