Let’s dig into the relative performance of Northwest Bancshares (NASDAQ:NWBI) and its peers as we unravel the now-completed Q3 thrifts & mortgage finance earnings season.

Thrifts & Mortgage Finance institutions operate by accepting deposits and extending loans primarily for residential mortgages, earning revenue through interest rate spreads (difference between lending rates and borrowing costs) and origination fees. The industry benefits from demographic tailwinds as millennials enter prime homebuying age, technological advancements streamlining the loan approval process, and potential interest rate stabilization improving affordability. However, significant headwinds include net interest margin compression during rate volatility, increased competition from fintech disruptors offering digital-first experiences, mounting regulatory compliance costs, and potential housing market corrections that could impact loan portfolios and default rates.

The 15 thrifts & mortgage finance stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 4.7% while next quarter’s revenue guidance was 2.3% above.

In light of this news, share prices of the companies have held steady as they are up 3.3% on average since the latest earnings results.

Northwest Bancshares (NASDAQ:NWBI)

Founded in 1896 and operating across Pennsylvania, New York, Ohio, and Indiana, Northwest Bancshares (NASDAQ:NWBI) is a bank holding company that operates Northwest Bank, providing personal and business banking, investment management, and trust services.

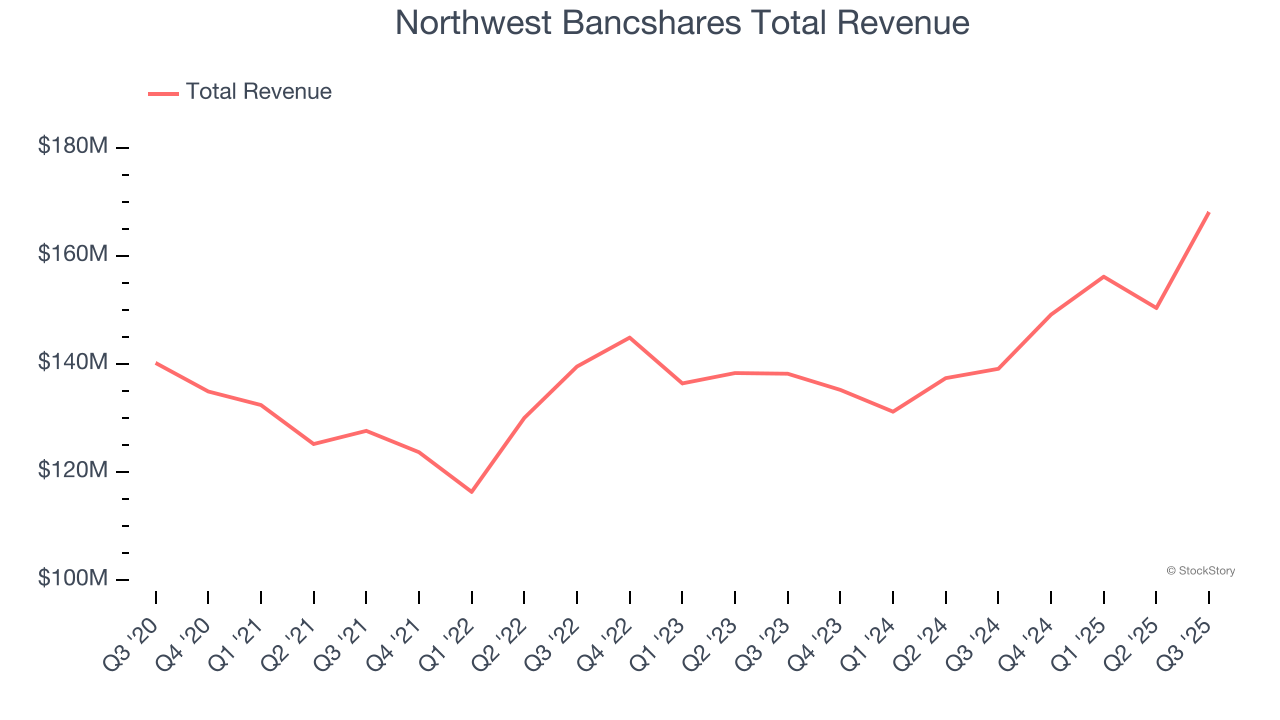

Northwest Bancshares reported revenues of $168.1 million, up 20.8% year on year. This print exceeded analysts’ expectations by 2%. Despite the top-line beat, it was still a mixed quarter for the company with a solid beat of analysts’ net interest income estimates but a significant miss of analysts’ EPS estimates.

Louis J. Torchio, President and CEO, Northwest Bancshares commented, "I am pleased with our first quarter of performance as a combined company. The team completed merger integration activities on time, while staying focused on executing our strategy, and delivering on our commitment to sustainable, responsible, and profitable growth. The benefits of the additional scale from the merger are already evident. We delivered a record $168 million in revenue for the quarter, more than 25% year over year average commercial C&I loan growth continuing our strategic re-balancing, and drove a strong 3Q net interest margin of 3.65% as we maintained our loan yield and low-cost, high-quality, stable funding base. "

Unsurprisingly, the stock is down 1.7% since reporting and currently trades at $12.30.

Read our full report on Northwest Bancshares here, it’s free for active Edge members.

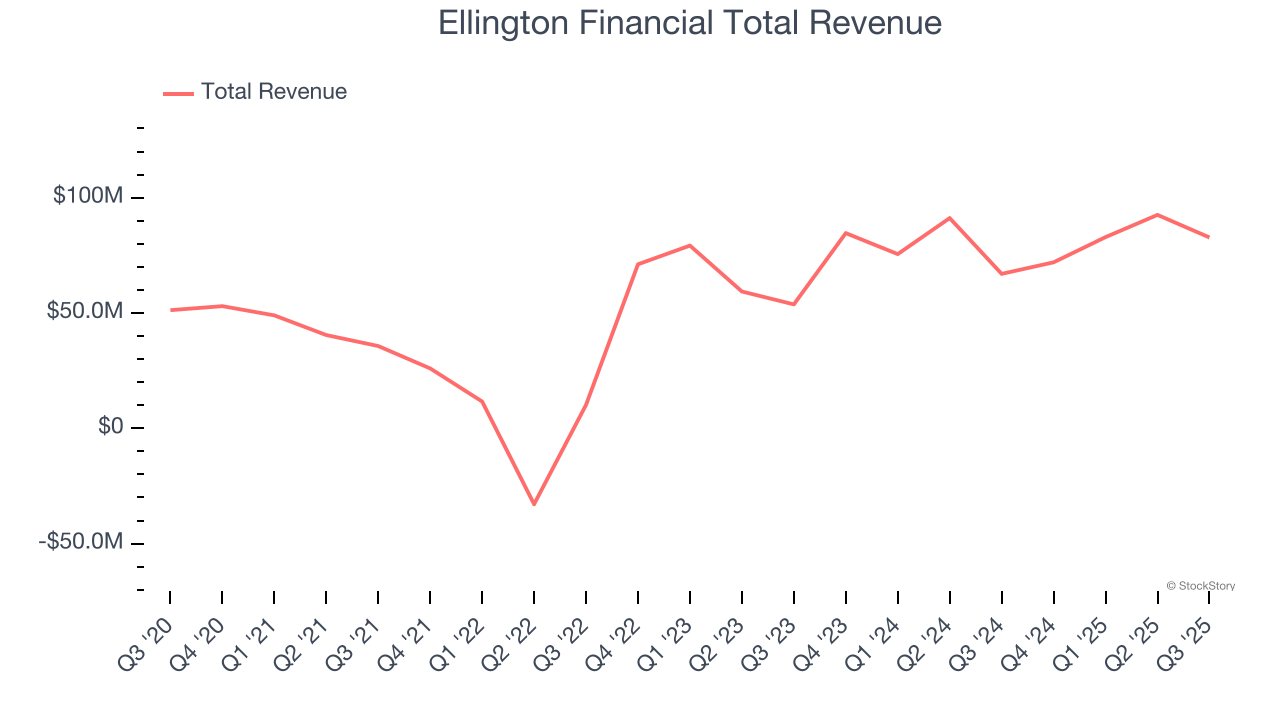

Best Q3: Ellington Financial (NYSE:EFC)

Operating under the guidance of Ellington Management Group, a respected name in structured credit markets, Ellington Financial (NYSE:EFC) acquires and manages a diverse portfolio of mortgage-related, consumer-related, and other financial assets to generate returns for investors.

Ellington Financial reported revenues of $82.76 million, up 23.6% year on year, outperforming analysts’ expectations by 4.9%. The business had an exceptional quarter with a beat of analysts’ EPS and revenue estimates.

The market seems content with the results as the stock is up 1.5% since reporting. It currently trades at $13.88.

Is now the time to buy Ellington Financial? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: WaFd Bank (NASDAQ:WAFD)

Founded in 1917 and rebranded from Washington Federal in 2023, WaFd (NASDAQ:WAFD) is a bank holding company that provides lending, deposit services, and insurance through its Washington Federal Bank subsidiary across eight western states.

WaFd Bank reported revenues of $187.2 million, flat year on year, falling short of analysts’ expectations by 1.7%. It was a disappointing quarter as it posted a significant miss of analysts’ net interest income estimates and a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 19% since the results and currently trades at $33.11.

Read our full analysis of WaFd Bank’s results here.

TFS Financial (NASDAQ:TFSL)

Tracing its roots back to 1938 during the Great Depression era when savings and loans were vital to homeownership, TFS Financial (NASDAQ:TFSL) is a savings and loan holding company that provides mortgage lending, deposit services, and other retail banking products primarily in Ohio and Florida.

TFS Financial reported revenues of $84.48 million, up 14% year on year. This print met analysts’ expectations. It was a strong quarter as it also logged EPS in line with analysts’ estimates and a narrow beat of analysts’ tangible book value per share estimates.

The stock is flat since reporting and currently trades at $14.11.

Read our full, actionable report on TFS Financial here, it’s free for active Edge members.

Arbor Realty Trust (NYSE:ABR)

With roots dating back to 2003 and a focus on the stability of multifamily housing, Arbor Realty Trust (NYSE:ABR) is a specialized lender that provides financing solutions for multifamily and commercial real estate while also originating and servicing government-backed mortgage loans.

Arbor Realty Trust reported revenues of $112.4 million, down 28.2% year on year. This number missed analysts’ expectations by 25.8%. More broadly, it was a mixed quarter as it also recorded a beat of analysts’ EPS estimates but a significant miss of analysts’ revenue estimates.

Arbor Realty Trust had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 31.7% since reporting and currently trades at $7.89.

Read our full, actionable report on Arbor Realty Trust here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.