Palo Alto Networks has been treading water for the past six months, recording a small loss of 1.2% while holding steady at $188.47. The stock also fell short of the S&P 500’s 11.1% gain during that period.

Does this present a buying opportunity for PANW? Or is its underperformance reflective of its story and business quality? Find out in our full research report, it’s free.

Why Does Palo Alto Networks Spark Debate?

Founded in 2005 by security visionary Nir Zuk who sought to reimagine firewall technology, Palo Alto Networks (NASDAQ:PANW) provides AI-powered cybersecurity platforms that protect organizations' networks, clouds, and endpoints from sophisticated threats.

Two Things to Like:

1. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Palo Alto Networks is extremely efficient at acquiring new customers, and its CAC payback period checked in at 20.7 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

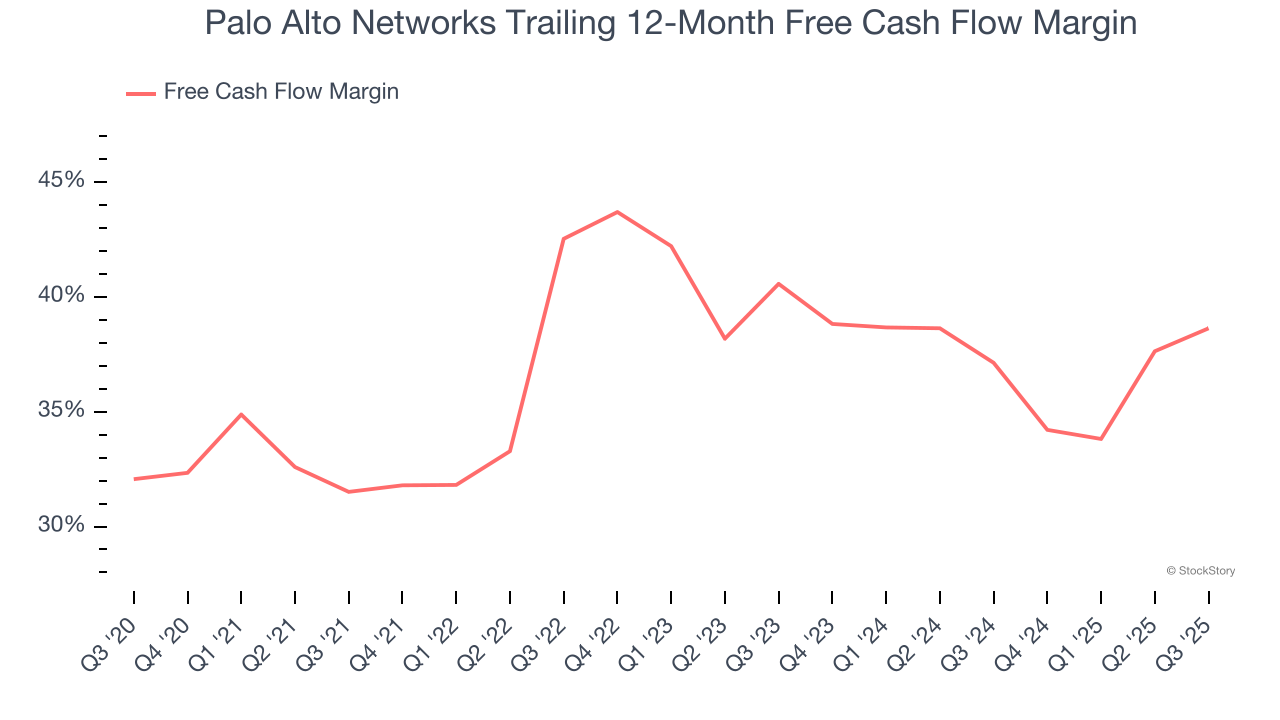

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Palo Alto Networks has shown terrific cash profitability, driven by its cost-effective customer acquisition strategy that enables it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 38.6% over the last year.

One Reason to be Careful:

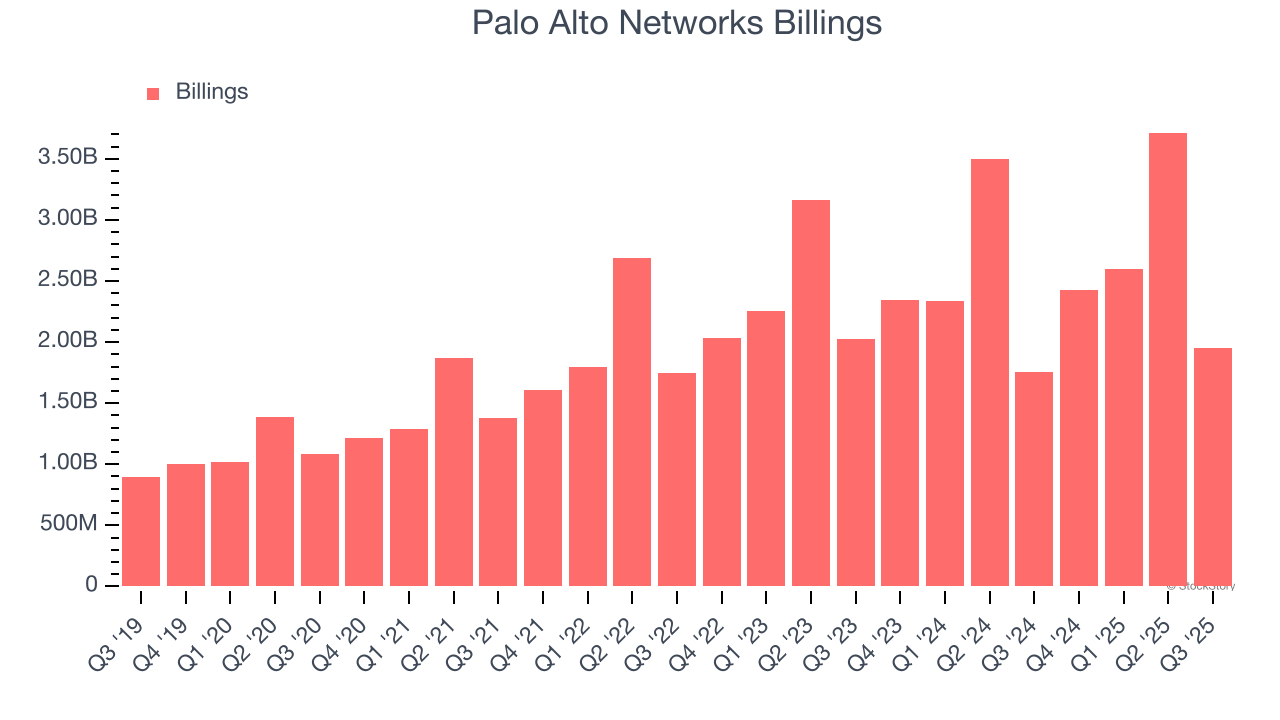

Weak Billings Point to Soft Demand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Palo Alto Networks’s billings came in at $1.95 billion in Q3, and over the last four quarters, its year-on-year growth averaged 8.1%. This performance was underwhelming and suggests that increasing competition is causing challenges in acquiring/retaining customers.

Final Judgment

Palo Alto Networks has huge potential even though it has some open questions. With its shares lagging the market recently, the stock trades at 12.4× forward price-to-sales (or $188.47 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Palo Alto Networks

Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.