As the Q3 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the hr software industry, including Paychex (NASDAQ:PAYX) and its peers.

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

The 5 hr software stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.7% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

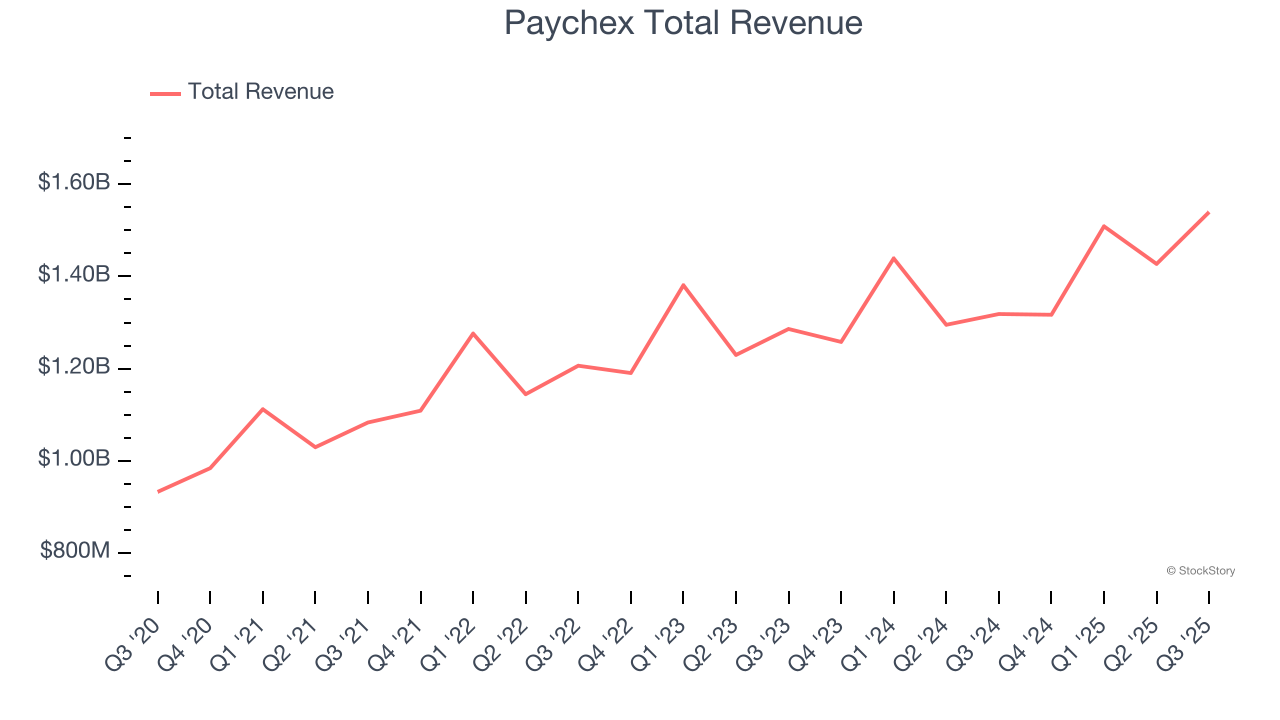

Paychex (NASDAQ:PAYX)

Once known as the go-to service for small business payroll needs, Paychex (NASDAQ:PAYX) provides payroll processing, HR services, employee benefits administration, and insurance solutions to small and medium-sized businesses.

Paychex reported revenues of $1.54 billion, up 16.8% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a slight miss of analysts’ EBITDA estimates.

"We are pleased to report a strong start to fiscal 2026, delivering robust double-digit revenue growth," stated John Gibson, President and Chief Executive Officer.

The stock is down 9.6% since reporting and currently trades at $116.24.

Read our full report on Paychex here, it’s free for active Edge members.

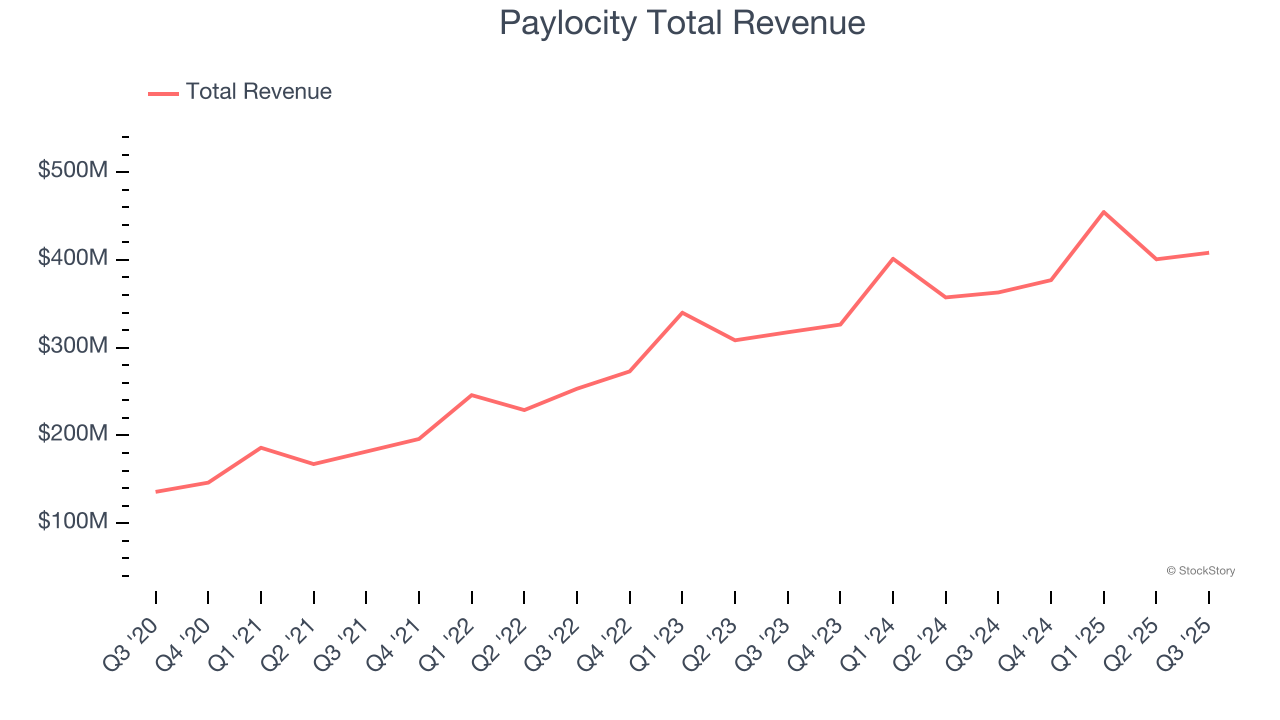

Best Q3: Paylocity (NASDAQ:PCTY)

Operating in a field where companies traditionally juggled multiple disconnected systems, Paylocity (NASDAQ:PCTY) provides cloud-based human capital management and payroll software solutions that help businesses manage their workforce and HR processes.

Paylocity reported revenues of $408.2 million, up 12.5% year on year, outperforming analysts’ expectations by 1.9%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

Paylocity achieved the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 8.3% since reporting. It currently trades at $150.87.

Is now the time to buy Paylocity? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Dayforce (NYSE:DAY)

Rebranded from Ceridian in January 2024 to highlight its flagship product, Dayforce (NYSE:DAY) provides cloud-based software that helps organizations manage their entire employee lifecycle, including HR, payroll, workforce management, benefits, and talent development.

Dayforce reported revenues of $481.6 million, up 9.5% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a miss of analysts’ billings estimates.

Dayforce delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 1.3% since the results and currently trades at $69.27.

Read our full analysis of Dayforce’s results here.

Asure Software (NASDAQ:ASUR)

Operating in the often-overlooked smaller metropolitan markets where HR expertise can be scarce, Asure Software (NASDAQ:ASUR) provides cloud-based human capital management software and services that help small and medium-sized businesses manage payroll, taxes, time tracking, and HR compliance.

Asure Software reported revenues of $36.25 million, up 23.7% year on year. This number topped analysts’ expectations by 1.6%. More broadly, it was a satisfactory quarter as it also produced a solid beat of analysts’ billings estimates but full-year revenue guidance missing analysts’ expectations significantly.

Asure Software achieved the fastest revenue growth but had the weakest full-year guidance update among its peers. The stock is up 9.4% since reporting and currently trades at $8.92.

Read our full, actionable report on Asure Software here, it’s free for active Edge members.

Paycom (NYSE:PAYC)

Pioneering the concept of employees doing their own payroll with its "Beti" technology, Paycom (NYSE:PAYC) provides cloud-based human capital management software that helps businesses manage the entire employment lifecycle from recruitment to retirement.

Paycom reported revenues of $493.3 million, up 9.2% year on year. This print was in line with analysts’ expectations. Zooming out, it was a mixed quarter as it also logged a narrow beat of analysts’ EBITDA estimates but billings in line with analysts’ estimates.

Paycom pulled off the highest full-year guidance raise but had the slowest revenue growth among its peers. The stock is down 8.6% since reporting and currently trades at $168.01.

Read our full, actionable report on Paycom here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.