Impinj has been on fire lately. In the past six months alone, the company’s stock price has rocketed 72.2%, reaching $194.03 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy PI? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does Impinj Spark Debate?

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

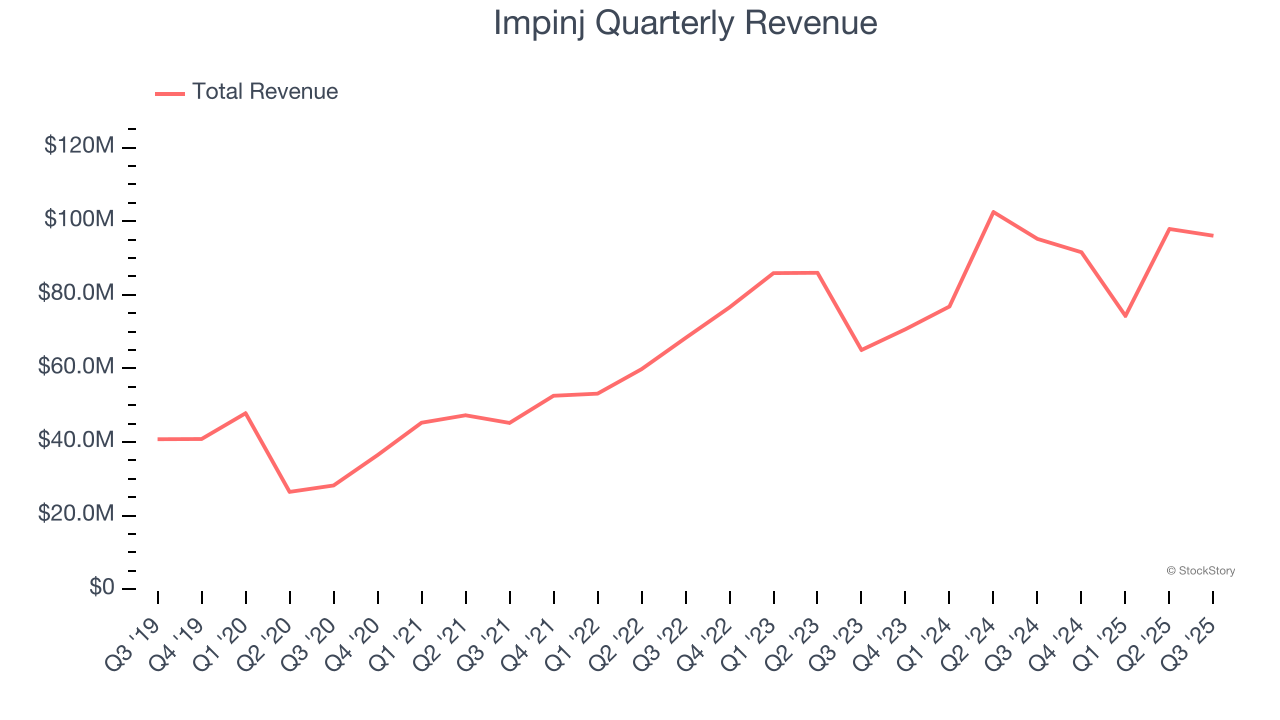

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Impinj’s 20.2% annualized revenue growth over the last five years was exceptional. Its growth beat the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

2. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

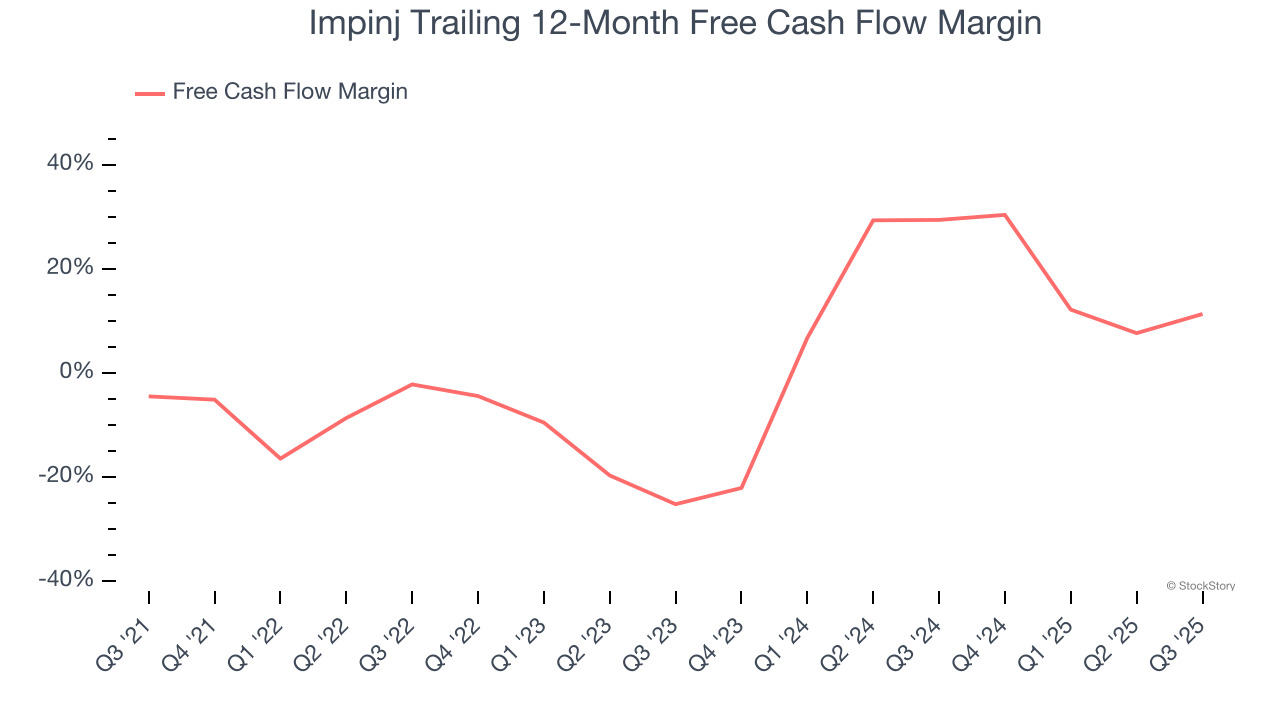

As you can see below, Impinj’s margin expanded by 15.8 percentage points over the last five years. This is encouraging because it gives the company more optionality. Impinj’s free cash flow margin for the trailing 12 months was 11.3%.

One Reason to be Careful:

Previous Growth Initiatives Have Lost Money

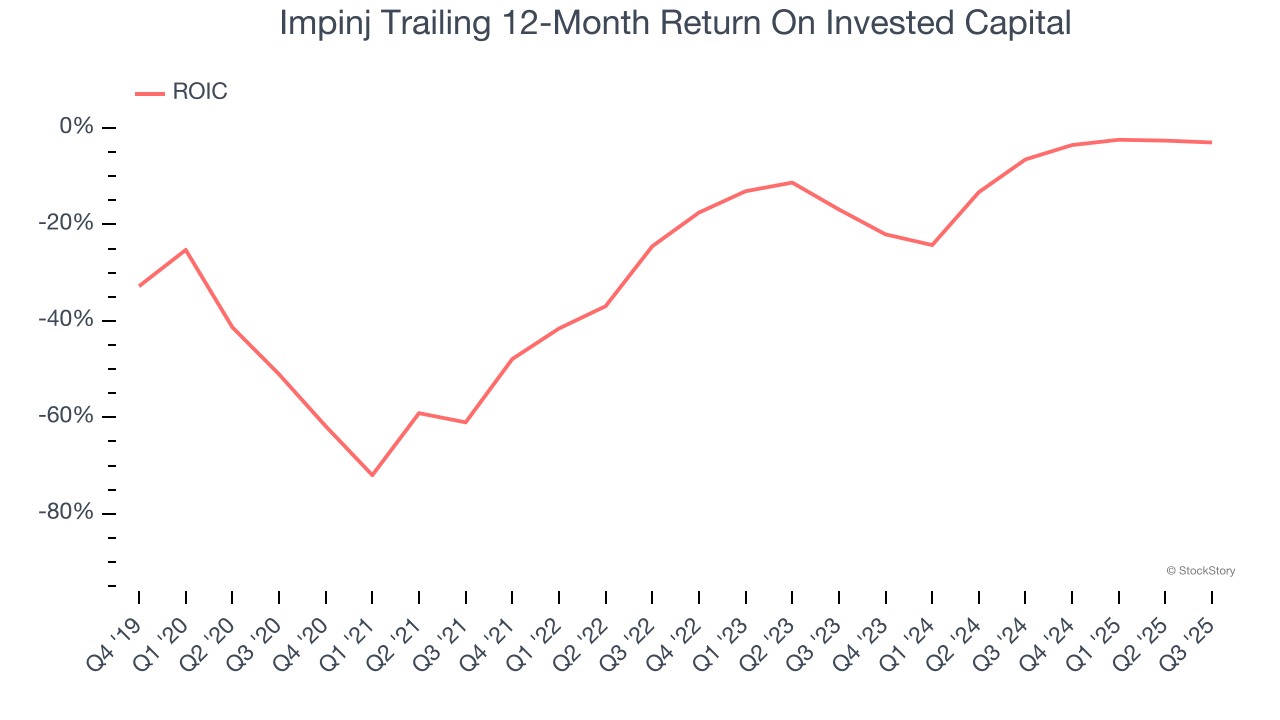

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Impinj has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 22.4%, meaning management lost money while trying to expand the business.

Final Judgment

Impinj’s positive characteristics outweigh the negatives, and after the recent surge, the stock trades at 77.7× forward P/E (or $194.03 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Impinj

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.