Over the past six months, Pilgrim's Pride’s stock price fell to $38.52. Shareholders have lost 16% of their capital, which is disappointing considering the S&P 500 has climbed by 14.3%. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Pilgrim's Pride, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Pilgrim's Pride Will Underperform?

Despite the more favorable entry price, we're sitting this one out for now. Here are three reasons there are better opportunities than PPC and a stock we'd rather own.

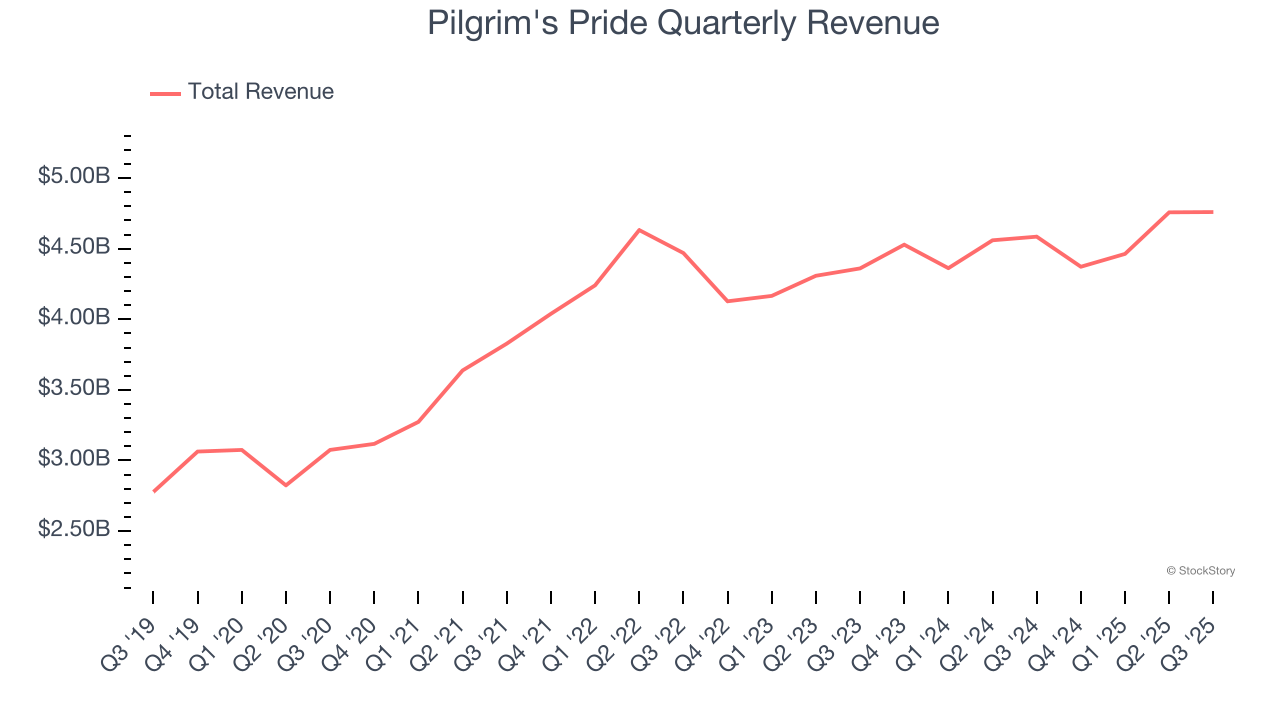

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Pilgrim's Pride’s sales grew at a sluggish 1.8% compounded annual growth rate over the last three years. This was below our standards.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Pilgrim's Pride’s revenue to drop by 1.3%, a decrease from This projection doesn't excite us and indicates its products will face some demand challenges.

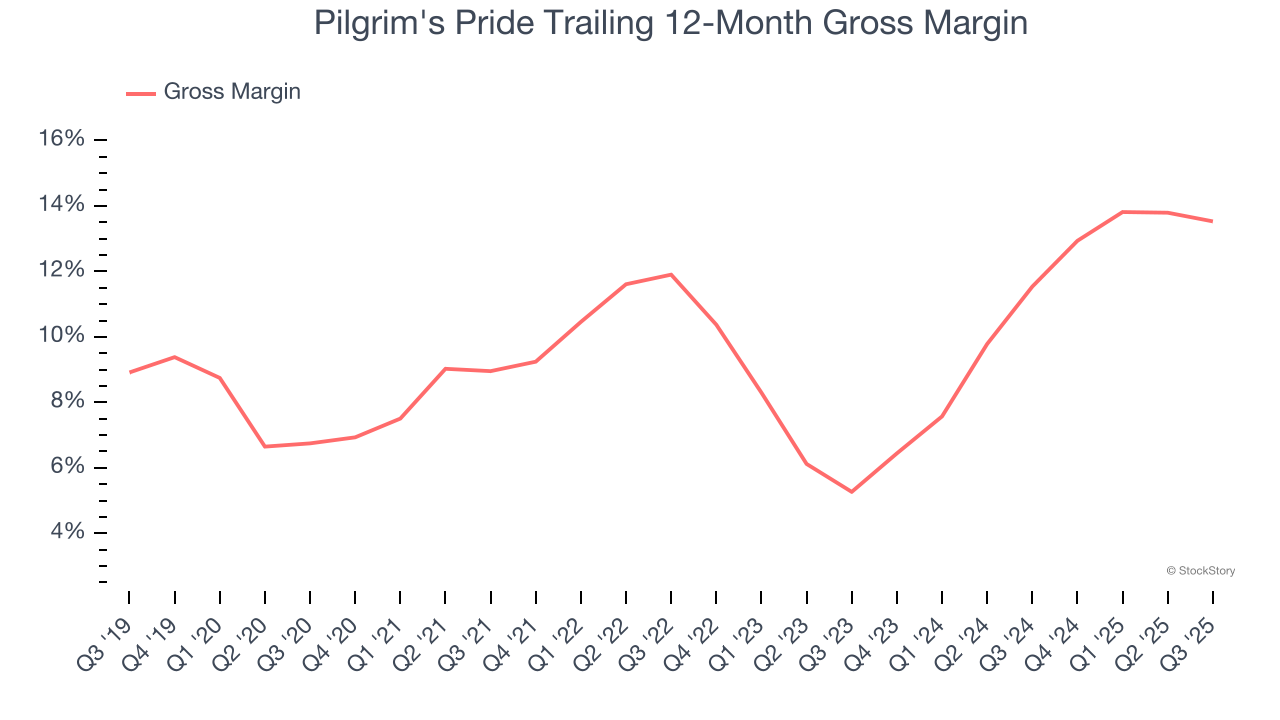

3. Low Gross Margin Reveals Weak Structural Profitability

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

Pilgrim's Pride has bad unit economics for a consumer staples company, signaling it operates in a competitive market and lacks pricing power because its products can be substituted. As you can see below, it averaged a 12.5% gross margin over the last two years. Said differently, for every $100 in revenue, a chunky $87.46 went towards paying for raw materials, production of goods, transportation, and distribution.

Final Judgment

Pilgrim's Pride doesn’t pass our quality test. Following the recent decline, the stock trades at 9.5× forward P/E (or $38.52 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. Let us point you toward the most entrenched endpoint security platform on the market.

Stocks We Would Buy Instead of Pilgrim's Pride

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.