Over the past six months, PTC’s stock price fell to $164.41. Shareholders have lost 19.4% of their capital, which is disappointing considering the S&P 500 has climbed by 8.8%. This may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy PTC? Find out in our full research report, it’s free.

Why Does PTC Stock Spark Debate?

Originally known as Parametric Technology Corporation until its 2013 rebranding, PTC (NASDAQ:PTC) provides software that helps manufacturers design, develop, and service physical products through digital solutions for CAD, PLM, ALM, and SLM.

Two Positive Attributes:

1. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

PTC is extremely efficient at acquiring new customers, and its CAC payback period checked in at 15.2 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

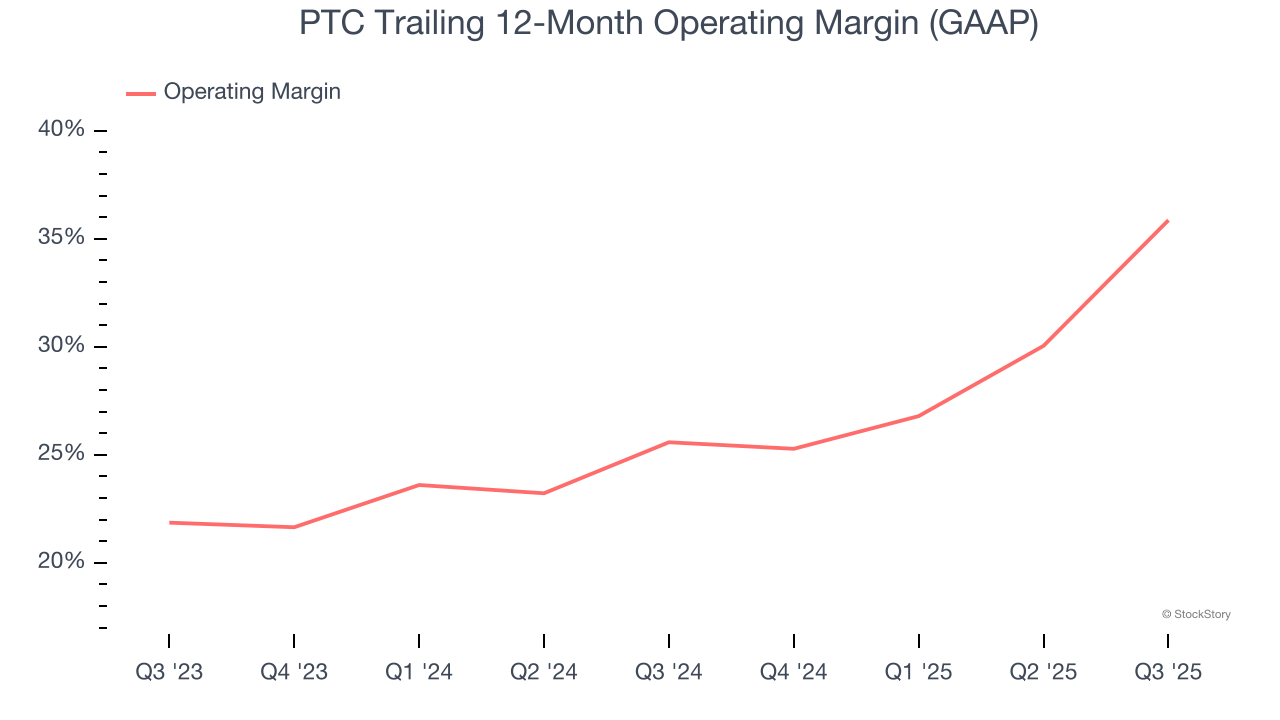

2. Operating Margin Reveals a Well-Run Organization

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

PTC has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 35.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

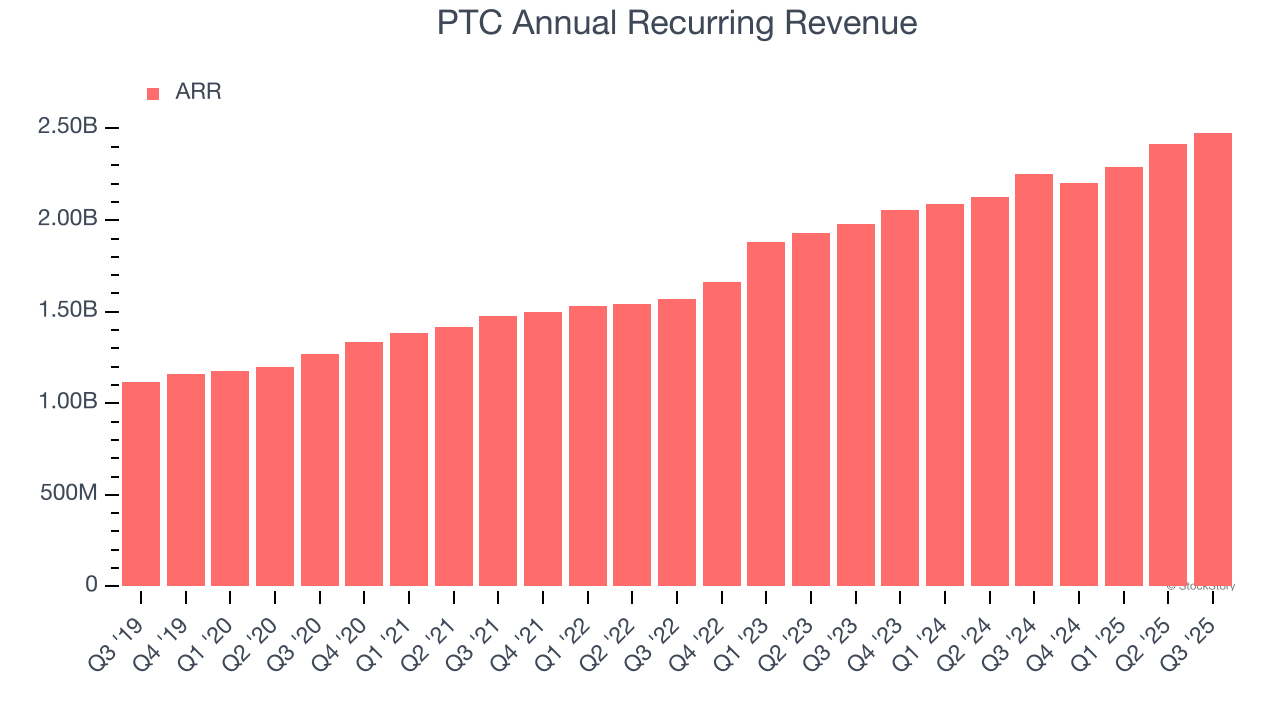

Weak ARR Points to Soft Demand

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

PTC’s ARR came in at $2.48 billion in Q3, and over the last four quarters, its year-on-year growth averaged 10.1%. This performance was underwhelming and suggests that increasing competition is causing challenges in securing longer-term commitments.

Final Judgment

PTC has huge potential even though it has some open questions. With the recent decline, the stock trades at 7.2× forward price-to-sales (or $164.41 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than PTC

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.