Looking back on modern fast food stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Portillo's (NASDAQ:PTLO) and its peers.

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

The 6 modern fast food stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 1.4%.

Thankfully, share prices of the companies have been resilient as they are up 9.1% on average since the latest earnings results.

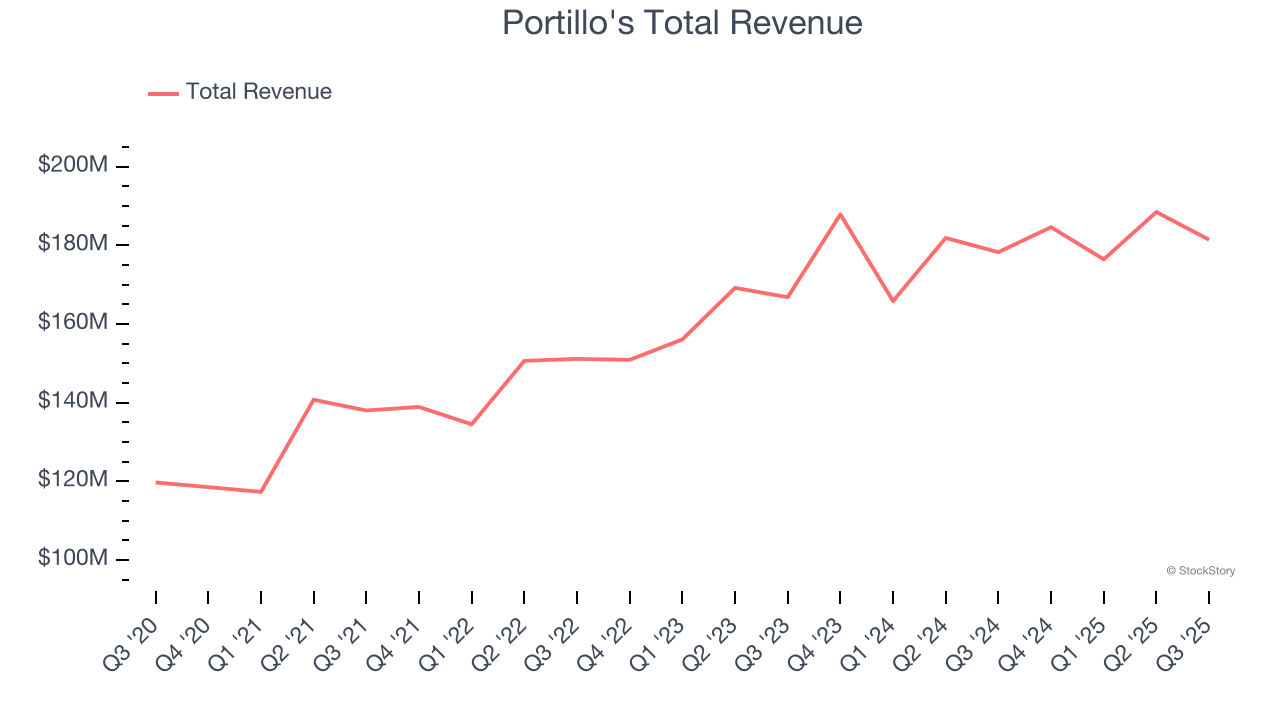

Portillo's (NASDAQ:PTLO)

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ:PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

Portillo's reported revenues of $181.4 million, up 1.8% year on year. This print fell short of analysts’ expectations by 0.7%, but it was still a strong quarter for the company with a beat of analysts’ EPS estimates and an impressive beat of analysts’ same-store sales estimates.

“Portillo’s took a number of steps to reset our growth model in the third quarter, as we proceed at a more measured pace in new markets while pursuing better unit economics,” said Mike Miles, Chairman of the Board and Interim President and Chief Executive Officer of Portillo’s.

The stock is down 13.2% since reporting and currently trades at $4.55.

Is now the time to buy Portillo's? Access our full analysis of the earnings results here, it’s free for active Edge members.

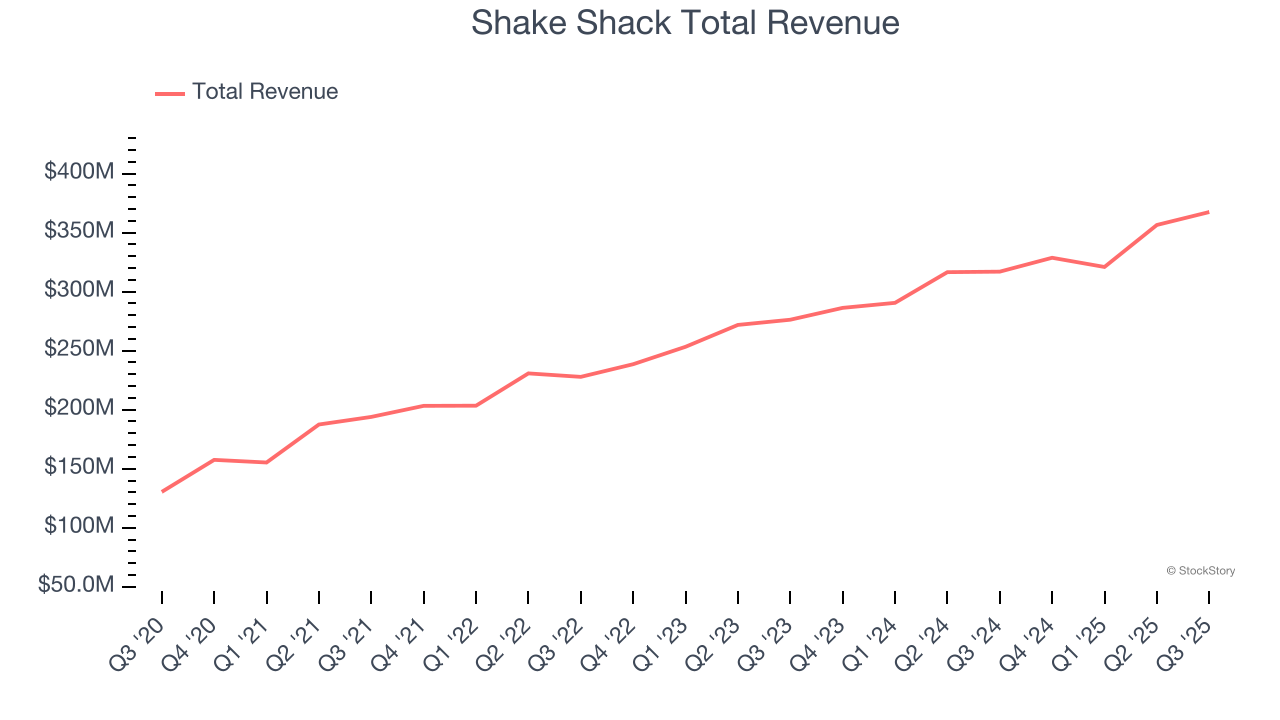

Best Q3: Shake Shack (NYSE:SHAK)

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Shake Shack reported revenues of $367.4 million, up 15.9% year on year, outperforming analysts’ expectations by 1%. The business had a very strong quarter with an impressive beat of analysts’ same-store sales estimates and a solid beat of analysts’ EBITDA estimates.

Shake Shack pulled off the biggest analyst estimates beat among its peers. However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $90.63.

Is now the time to buy Shake Shack? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Sweetgreen (NYSE:SG)

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

Sweetgreen reported revenues of $172.4 million, flat year on year, falling short of analysts’ expectations by 3.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations significantly.

Sweetgreen delivered the slowest revenue growth in the group. Interestingly, the stock is up 16.9% since the results and currently trades at $7.31.

Read our full analysis of Sweetgreen’s results here.

CAVA (NYSE:CAVA)

Starting from a single Washington, D.C. location, CAVA (NYSE:CAVA) operates a fast-casual restaurant chain offering customizable Mediterranean-inspired dishes.

CAVA reported revenues of $292.2 million, up 19.9% year on year. This print was in line with analysts’ expectations. Aside from that, it was a slower quarter as it logged full-year EBITDA guidance missing analysts’ expectations and a slight miss of analysts’ same-store sales estimates.

CAVA pulled off the fastest revenue growth among its peers. The stock is up 31.1% since reporting and currently trades at $67.78.

Read our full, actionable report on CAVA here, it’s free for active Edge members.

Wingstop (NASDAQ:WING)

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Wingstop reported revenues of $175.7 million, up 8.1% year on year. This number came in 5% below analysts' expectations. Overall, it was a softer quarter as it also recorded a significant miss of analysts’ same-store sales estimates and a significant miss of analysts’ revenue estimates.

Wingstop had the weakest performance against analyst estimates among its peers. The stock is up 21.5% since reporting and currently trades at $260.17.

Read our full, actionable report on Wingstop here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.