Rivian’s 14.3% return over the past six months has outpaced the S&P 500 by 6.1%, and its stock price has climbed to $15.75 per share. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now still a good time to buy RIVN? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Does Rivian Spark Debate?

The manufacturer of Amazon’s delivery trucks, Rivian (NASDAQ:RIVN) designs, manufactures, and sells electric vehicles and commercial delivery vans.

Two Positive Attributes:

1. Skyrocketing Revenue Shows Strong Momentum

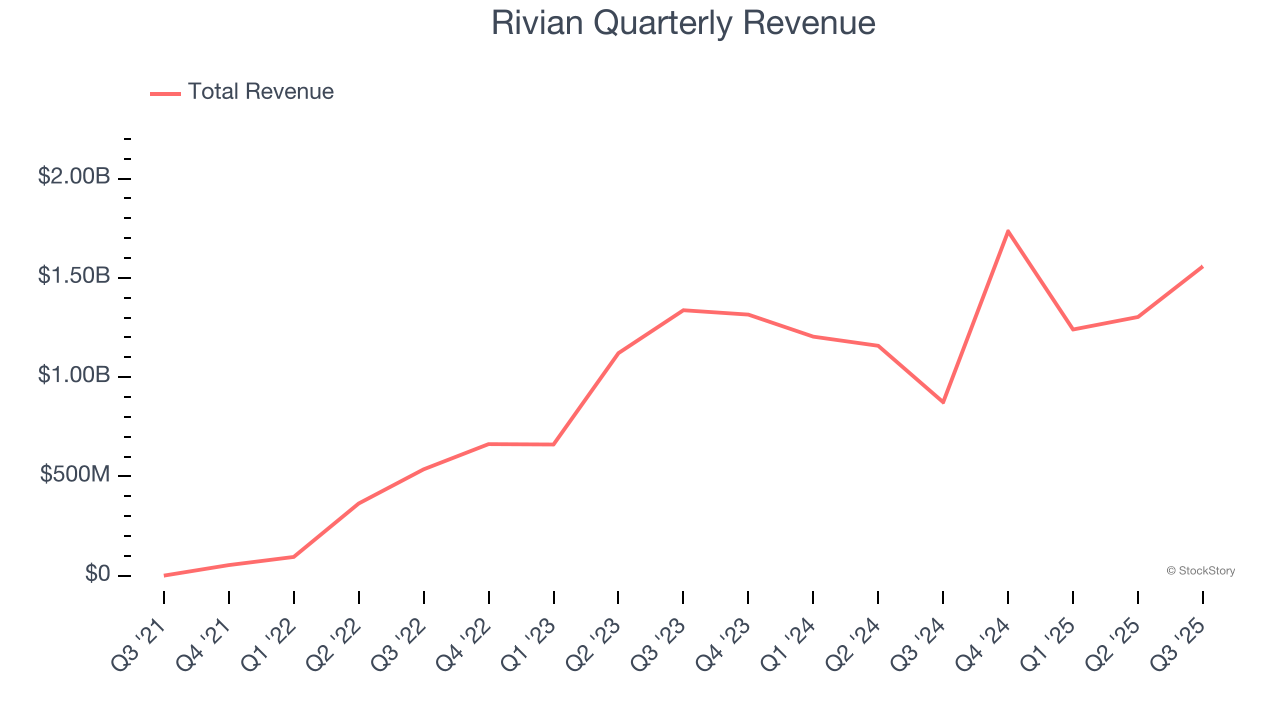

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Rivian’s 171% annualized revenue growth over the last three years was incredible. Its growth surpassed the average industrials company and shows its offerings resonate with customers.

2. EPS Improving Significantly

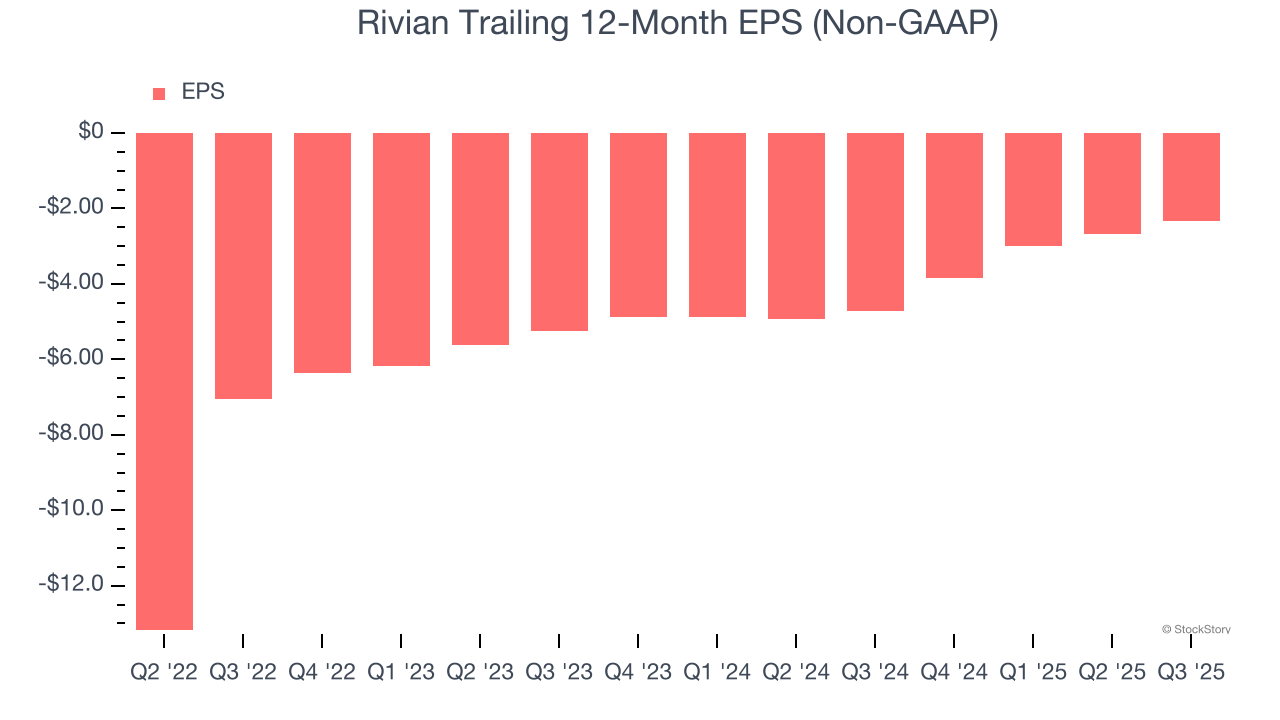

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Although Rivian’s full-year earnings are still negative, it reduced its losses and improved its EPS by 38.9% annually over the last three years. The next few quarters will be critical for assessing its long-term profitability. Given it formed a $5.8 billion joint venture with Volkswagen in November 2024, an inflection point could be coming soon.

One Reason to be Careful:

Weak Sales Volumes Indicate Waning Demand

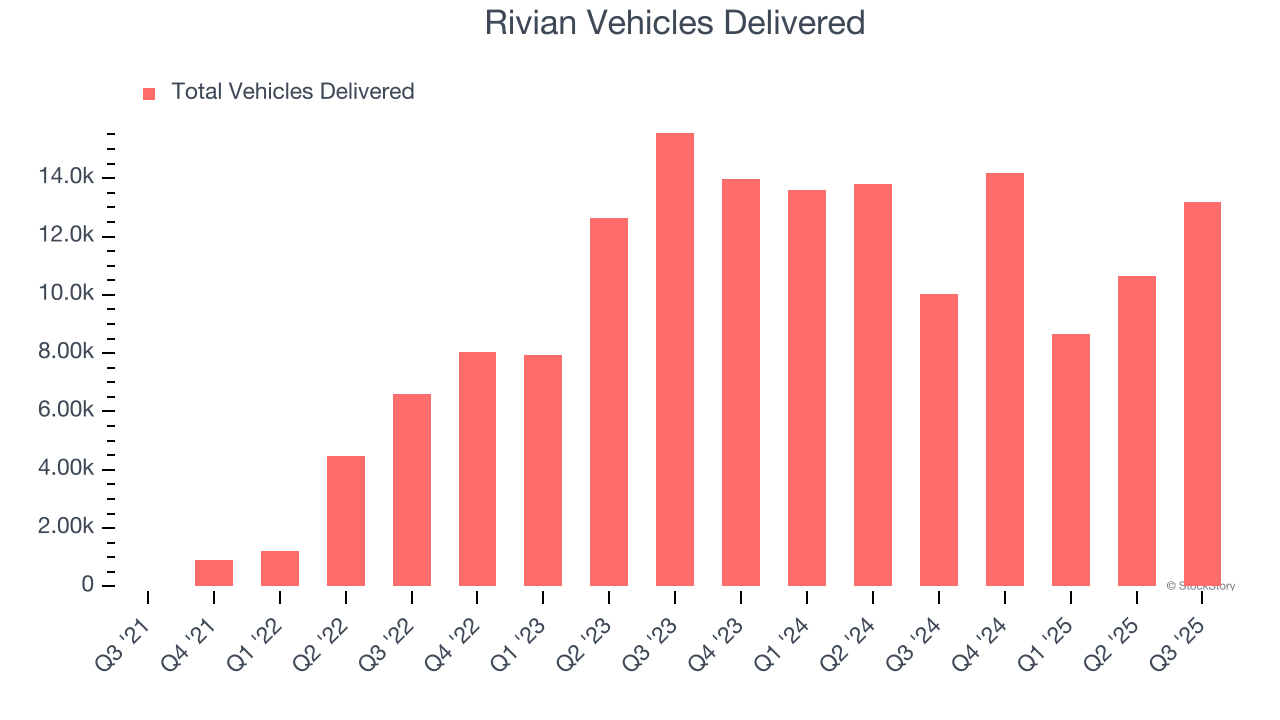

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Automobile Manufacturing company because there’s a ceiling to what customers will pay.

Rivian’s vehicles delivered came in at 13,201 in the latest quarter, and over the last two years, they grew by 2.8% annually. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Rivian’s positive characteristics outweigh the negatives, and with its shares beating the market recently, the stock trades at $15.75 per share (or a forward price-to-sales ratio of 3.3×). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.