Stocks that outperform the market usually share key traits such as rising sales, expanding margins, and increasing returns on capital. The select few that can do all three for many years are often the ones that make you life-changing money.

Long story short, there is a near-perfect correlation between consistent earnings growth and huge winners. Keeping that in mind, here are three market-beating stocks that could turbocharge your returns.

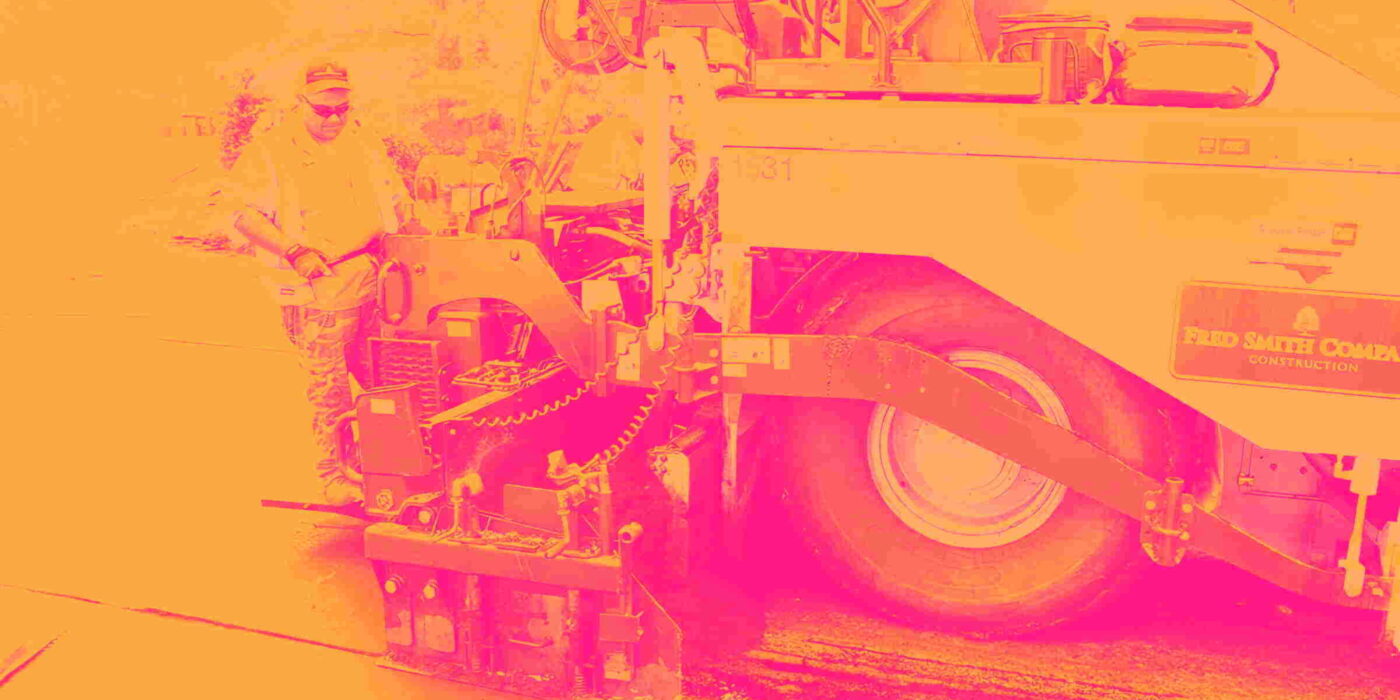

Construction Partners (ROAD)

Five-Year Return: +228%

Founded in 2001, Construction Partners (NASDAQ:ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Why Should You Buy ROAD?

- Notable projected revenue growth of 22.3% for the next 12 months hints at market share gains

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 53.7% over the last two years outstripped its revenue performance

- Free cash flow margin grew by 6.5 percentage points over the last five years, giving the company more chips to play with

Construction Partners is trading at $112.33 per share, or 39x forward P/E. Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Republic Services (RSG)

Five-Year Return: +121%

Processing several million tons of recyclables annually, Republic (NYSE:RSG) provides waste management services for residences, companies, and municipalities.

Why Are We Fans of RSG?

- Annual revenue growth of 10.2% over the last five years beat the sector average and underscores the unique value of its offerings

- Disciplined cost controls and effective management resulted in a strong long-term operating margin of 18.9%, and its profits increased over the last five years as it scaled

- Impressive free cash flow profitability enables the company to fund new investments or reward investors with share buybacks/dividends, and its rising cash conversion increases its margin of safety

At $211.84 per share, Republic Services trades at 29.3x forward P/E. Is now the right time to buy? Find out in our full research report, it’s free.

Carlyle (CG)

Five-Year Return: +97.8%

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ:CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

Why Is CG a Top Pick?

- Annual revenue growth of 10.9% over the last five years was above the sector average and underscores its products and services value to customers

- 23.6% annual growth in fee-related earnings over the last two years shows the firm optimized its expenses

- Performance over the past two years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 23.9% outpaced its revenue gains

Carlyle’s stock price of $64.52 implies a valuation ratio of 14.1x forward P/E. Is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.