Let’s dig into the relative performance of Sprout Social (NASDAQ:SPT) and its peers as we unravel the now-completed Q3 sales and marketing software earnings season.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 20 sales and marketing software stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.9% on average since the latest earnings results.

Sprout Social (NASDAQ:SPT)

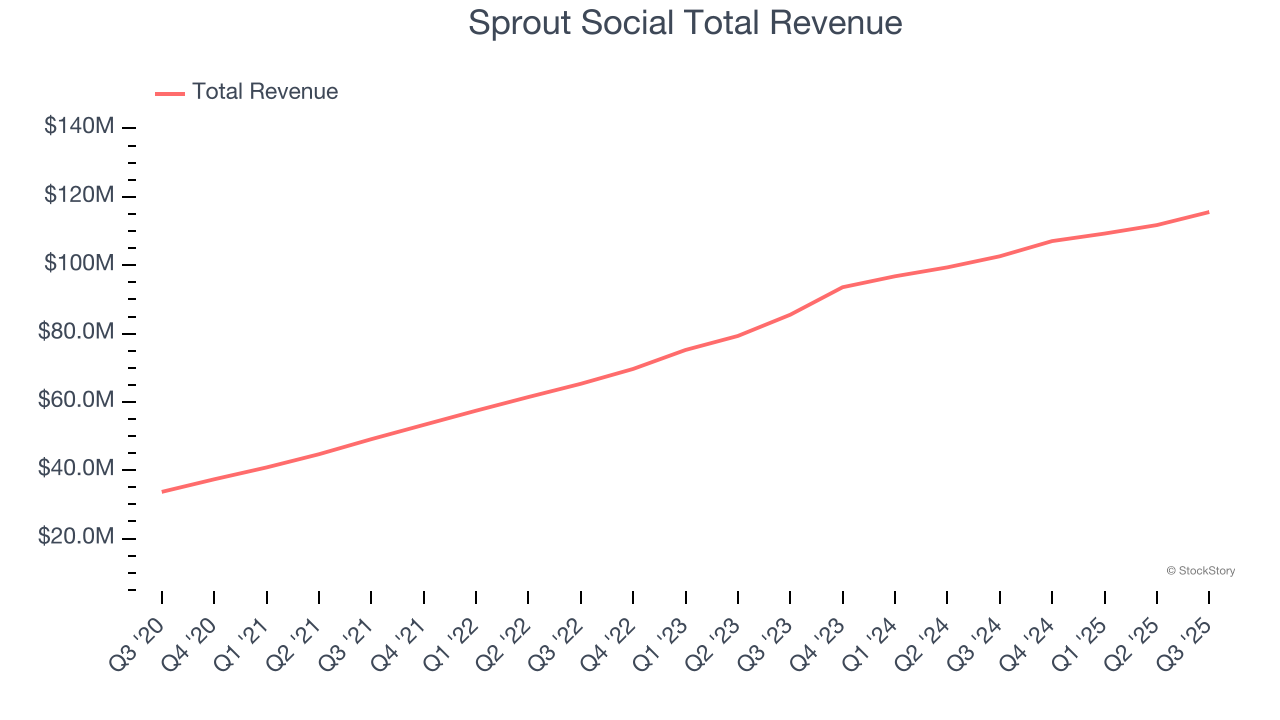

Born from the recognition that businesses needed a centralized way to handle their growing social media presence, Sprout Social (NASDAQ:SPT) provides a comprehensive software platform that helps businesses manage, analyze, and optimize their presence across various social media networks.

Sprout Social reported revenues of $115.6 million, up 12.6% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

“Our team delivered strong results in the third quarter, highlighted by 17% cRPO growth and strong profitability,” said Ryan Barretto, CEO of Sprout Social.

Unsurprisingly, the stock is down 1.4% since reporting and currently trades at $10.11.

Is now the time to buy Sprout Social? Access our full analysis of the earnings results here, it’s free.

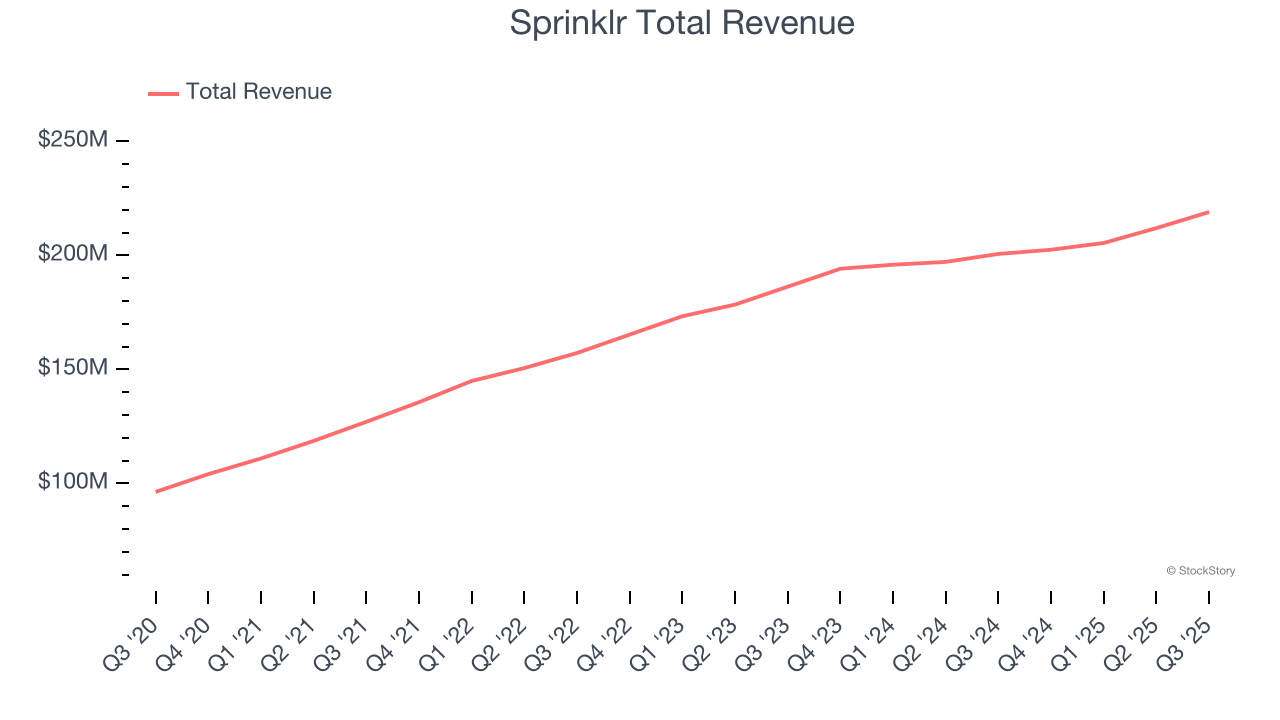

Best Q3: Sprinklr (NYSE:CXM)

With a proprietary AI engine processing 450 million data points daily across 30+ digital channels, Sprinklr (NYSE:CXM) provides cloud-based software that helps large enterprises manage customer experiences across social, messaging, chat, and voice channels.

Sprinklr reported revenues of $219.1 million, up 9.2% year on year, outperforming analysts’ expectations by 4.5%. The business had an exceptional quarter with an impressive beat of analysts’ billings estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 3.2% since reporting. It currently trades at $7.30.

Is now the time to buy Sprinklr? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Upland Software (NASDAQ:UPLD)

Operating under the mantra "land and expand," Upland Software (NASDAQ:UPLD) provides cloud-based applications that help organizations manage projects, workflows, and digital transformation across various business functions.

Upland Software reported revenues of $50.53 million, down 24.2% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a softer quarter as it posted revenue guidance for next quarter missing analysts’ expectations significantly and EBITDA guidance for next quarter missing analysts’ expectations significantly.

Upland Software delivered the slowest revenue growth in the group. As expected, the stock is down 21.1% since the results and currently trades at $1.52.

Read our full analysis of Upland Software’s results here.

ZoomInfo (NASDAQ:GTM)

Operating a platform it calls "RevOS" - short for Revenue Operating System - ZoomInfo (NASDAQ:GTM) provides sales, marketing, and recruiting teams with business intelligence and analytics to identify prospects and deliver targeted outreach.

ZoomInfo reported revenues of $318 million, up 4.7% year on year. This number beat analysts’ expectations by 4.7%. It was a strong quarter as it also logged EPS guidance for next quarter exceeding analysts’ expectations and full-year EPS guidance exceeding analysts’ expectations.

The company added 3 enterprise customers paying more than $100,000 annually to reach a total of 1,887. The stock is down 14.7% since reporting and currently trades at $10.06.

Read our full, actionable report on ZoomInfo here, it’s free.

Braze (NASDAQ:BRZE)

With its technology powering interactions with 6.2 billion monthly active users across the digital landscape, Braze (NASDAQ:BRZE) provides a platform that helps brands build and maintain direct relationships with their customers through personalized, cross-channel messaging and engagement.

Braze reported revenues of $190.8 million, up 25.5% year on year. This print surpassed analysts’ expectations by 3.6%. Overall, it was a very strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

The company added 106 customers to reach a total of 2,528. The stock is down 4.3% since reporting and currently trades at $29.32.

Read our full, actionable report on Braze here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.