The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how E.W. Scripps (NASDAQ:SSP) and the rest of the broadcasting stocks fared in Q3.

Broadcasting companies have been facing secular headwinds in the form of consumers abandoning traditional television and radio in favor of streaming services. As a result, many broadcasting companies have evolved by forming distribution agreements with major streaming platforms so they can get in on part of the action, but will these subscription revenues be as high quality and high margin as their legacy revenues? Only time will tell which of these broadcasters will survive the sea changes of technological advancement and fragmenting consumer attention.

The 7 broadcasting stocks we track reported a mixed Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.8% below.

In light of this news, share prices of the companies have held steady as they are up 2.7% on average since the latest earnings results.

E.W. Scripps (NASDAQ:SSP)

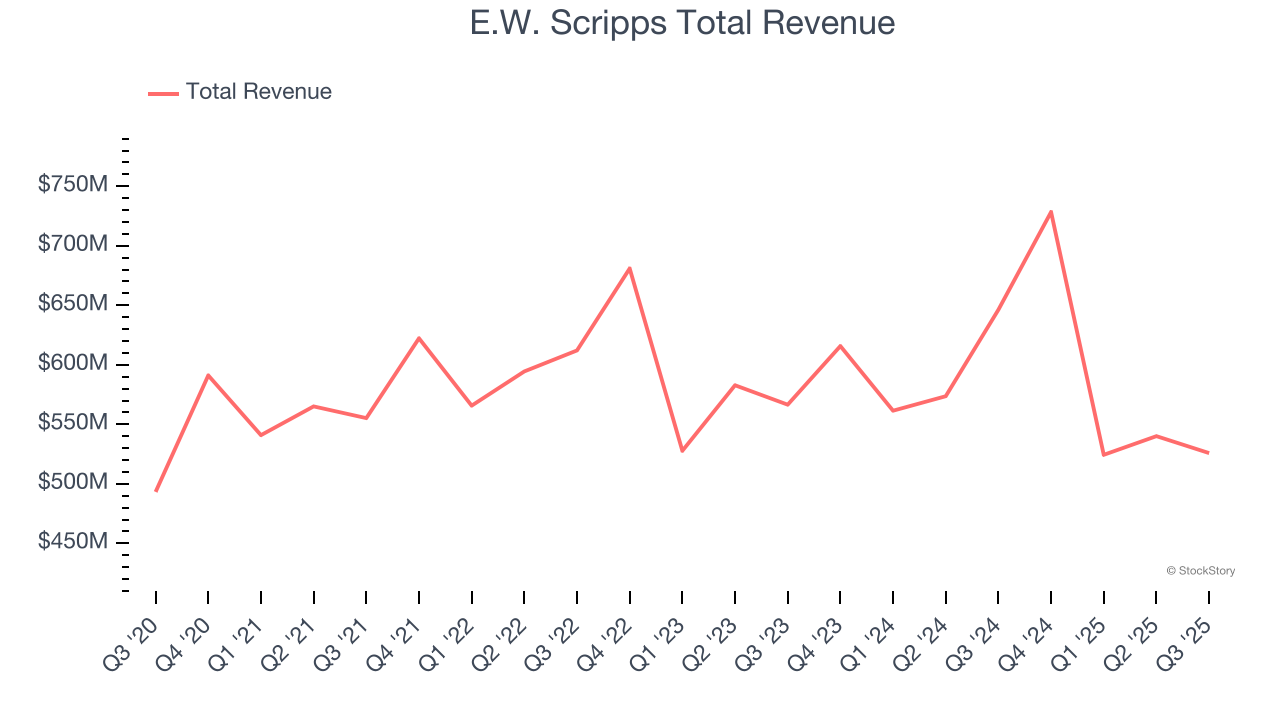

Founded as a chain of daily newspapers, E.W. Scripps (NASDAQ:SSP) is a diversified media enterprise operating a range of local television stations, national networks, and digital media platforms.

E.W. Scripps reported revenues of $525.9 million, down 18.6% year on year. This print was in line with analysts’ expectations, and overall, it was a satisfactory quarter for the company with a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 63.7% since reporting and currently trades at $3.36.

Is now the time to buy E.W. Scripps? Access our full analysis of the earnings results here, it’s free.

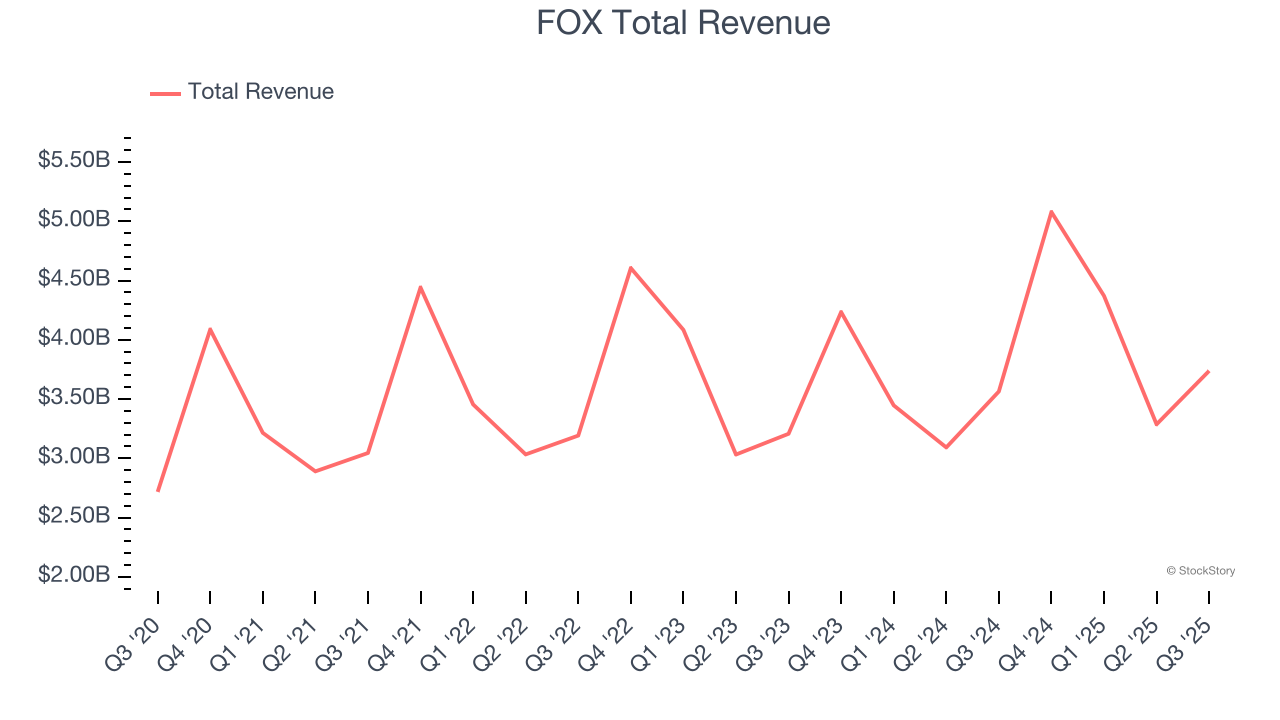

Best Q3: FOX (NASDAQ:FOXA)

Founded in 1915, Fox (NASDAQ:FOXA) is a diversified media company, operating prominent cable news, television broadcasting, and digital media platforms.

FOX reported revenues of $3.74 billion, up 4.9% year on year, outperforming analysts’ expectations by 4.6%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

FOX scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 13.5% since reporting. It currently trades at $69.

Is now the time to buy FOX? Access our full analysis of the earnings results here, it’s free.

Paramount (NASDAQ:PSKY)

Owner of Spongebob Squarepants and formerly known as ViacomCBS, Paramount Global (NASDAQ:PARA) is a major media conglomerate offering television, film production, and digital content across various global platforms.

Paramount reported revenues of $6.70 billion, down 3.4% year on year, falling short of analysts’ expectations by 5.6%. It was a softer quarter as it posted a miss of analysts’ Filmed Entertainment revenue estimates and a miss of analysts’ TV Media revenue estimates.

Paramount delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 25.4% since the results and currently trades at $11.38.

Read our full analysis of Paramount’s results here.

Gray Television (NYSE:GTN)

Specializing in local media coverage, Gray Television (NYSE:GTN) is a broadcast company supplying digital media to various markets in the United States.

Gray Television reported revenues of $749 million, down 21.2% year on year. This result met analysts’ expectations. Taking a step back, it was a satisfactory quarter as it also logged a beat of analysts’ EPS estimates but revenue guidance for next quarter missing analysts’ expectations.

Gray Television had the slowest revenue growth among its peers. The stock is down 8.6% since reporting and currently trades at $4.21.

Read our full, actionable report on Gray Television here, it’s free.

iHeartMedia (NASDAQ:IHRT)

Occasionally featuring celebrity hosts like Ryan Seacrest on its shows, iHeartMedia (NASDAQ:IHRT) is a leading multimedia company renowned for its extensive network of radio stations, digital platforms, and live events across the globe.

iHeartMedia reported revenues of $997 million, down 1.1% year on year. This print surpassed analysts’ expectations by 1.9%. Taking a step back, it was a softer quarter as it logged a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

The stock is down 30.2% since reporting and currently trades at $3.19.

Read our full, actionable report on iHeartMedia here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.