Trustmark has followed the market’s trajectory closely, rising in tandem with the S&P 500 over the past six months. The stock has climbed by 14% to $40.29 per share while the index has gained 13.3%.

Is there a buying opportunity in Trustmark, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Trustmark Not Exciting?

We're cautious about Trustmark. Here are three reasons we avoid TRMK and a stock we'd rather own.

1. Net Interest Income Points to Soft Demand

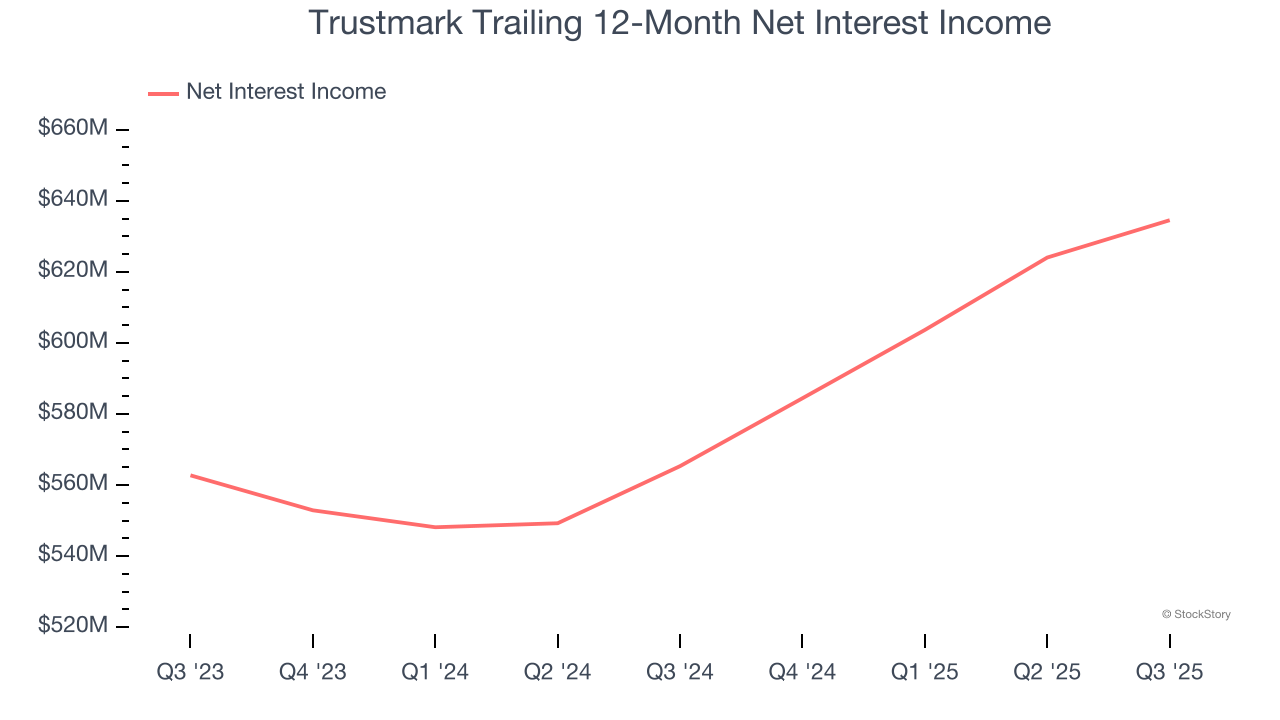

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Trustmark’s net interest income has grown at a 8.6% annualized rate over the last five years, slightly worse than the broader banking industry. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Efficiency Ratio Expected to Falter

Topline growth alone doesn't tell the complete story - the profitability of that growth shapes actual earnings impact. Banks track this dynamic through efficiency ratios, which compare non-interest expenses such as personnel, rent, IT, and marketing costs to total revenue streams.

Investors focus on efficiency ratio changes rather than absolute levels, understanding that expense structures vary by revenue mix. Counterintuitively, lower efficiency ratios indicate better performance since they represent lower costs relative to revenue.

For the next 12 months, Wall Street expects Trustmark to become less profitable as it anticipates an efficiency ratio of 63.4% compared to 61.7% over the past year.

3. Previous Growth Initiatives Haven’t Impressed

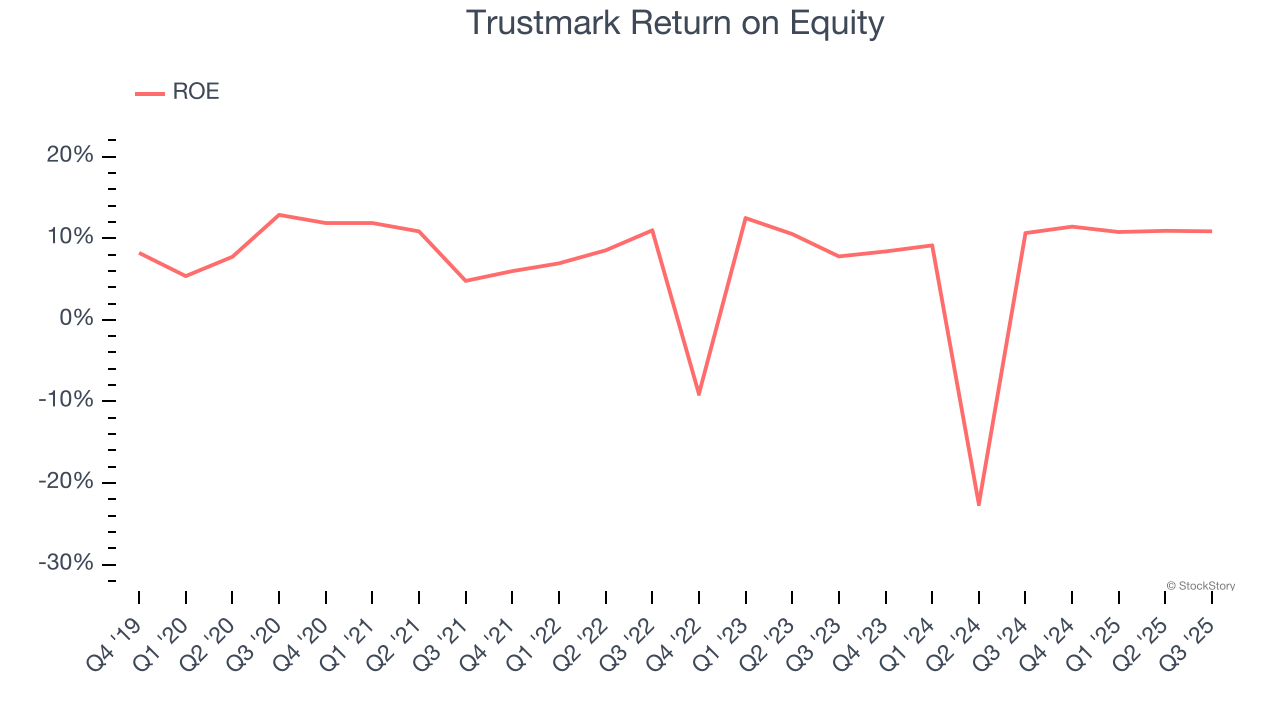

Return on equity, or ROE, tells us how much profit a company generates for each dollar of shareholder equity, a key funding source for banks. Over a long period, banks with high ROE tend to compound shareholder wealth faster through retained earnings, buybacks, and dividends.

Over the last five years, Trustmark has averaged an ROE of 7.2%, uninspiring for a company operating in a sector where the average shakes out around 7.5%.

Final Judgment

Trustmark’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1.1× forward P/B (or $40.29 per share). While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.