Since June 2025, Vertex Pharmaceuticals has been in a holding pattern, posting a small return of 0.5% while floating around $450.68. The stock also fell short of the S&P 500’s 13.6% gain during that period.

Given the weaker price action, is now a good time to buy VRTX? Or should investors expect a bumpy road ahead? Find out in our full research report, it’s free for active Edge members.

Why Does VRTX Stock Spark Debate?

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ:VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

Two Things to Like:

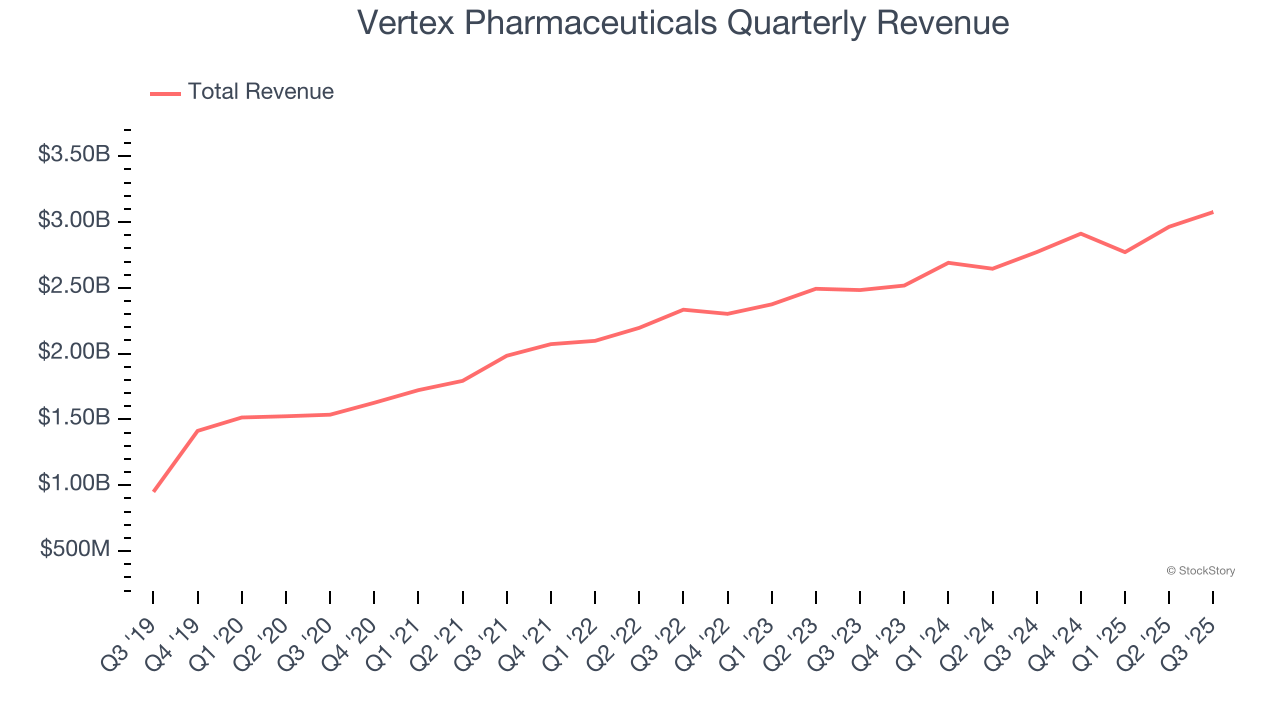

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Vertex Pharmaceuticals’s 14.4% annualized revenue growth over the last five years was solid. Its growth beat the average healthcare company and shows its offerings resonate with customers.

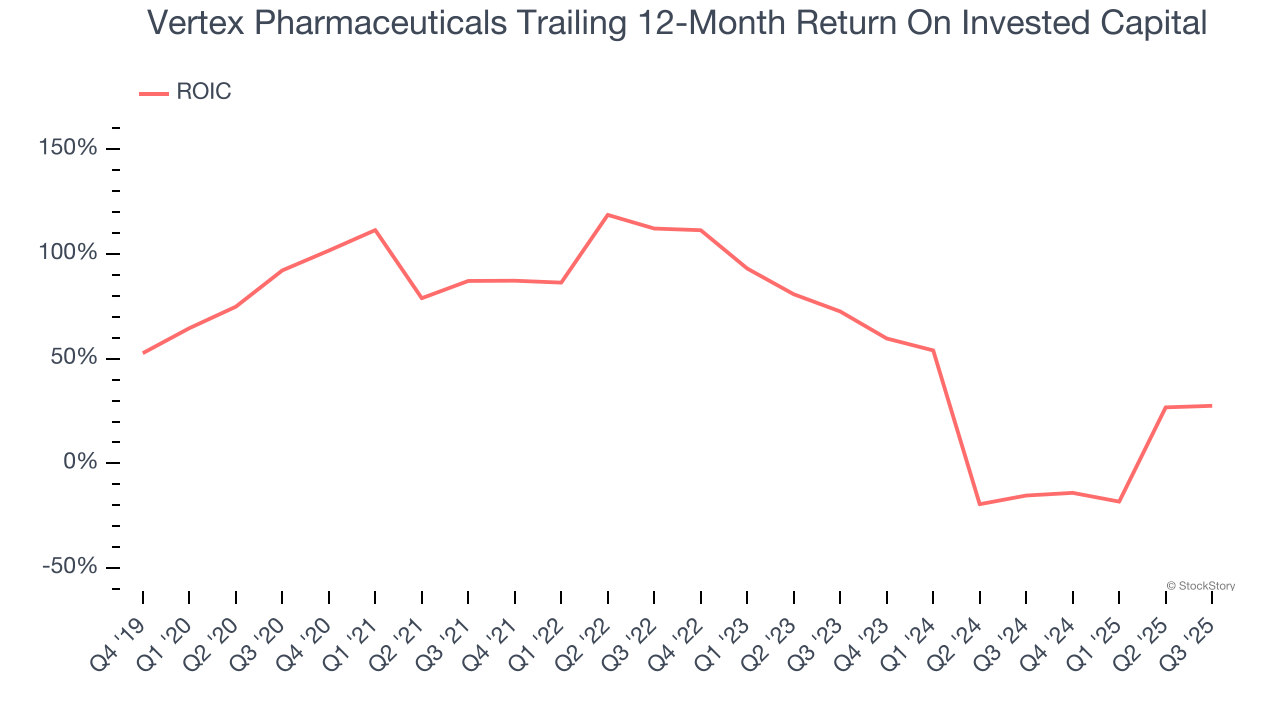

2. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Vertex Pharmaceuticals’s five-year average ROIC was 43%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

One Reason to be Careful:

New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Vertex Pharmaceuticals’s ROIC has unfortunately decreased significantly. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

Vertex Pharmaceuticals’s merits more than compensate for its flaws. With its shares lagging the market recently, the stock trades at 22.7× forward P/E (or $450.68 per share). Is now the right time to buy? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Vertex Pharmaceuticals

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.