Global satellite communications provider Viasat (NASDAQ:VSAT) missed Wall Street’s revenue expectations in Q3 CY2025 as sales only rose 1.7% year on year to $1.14 billion. Its non-GAAP profit of $0.09 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Viasat? Find out by accessing our full research report, it’s free for active Edge members.

Viasat (VSAT) Q3 CY2025 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.15 billion (1.7% year-on-year growth, 0.6% miss)

- Adjusted EPS: $0.09 vs analyst estimates of -$0.06 (significant beat)

- Adjusted EBITDA: $384.7 million vs analyst estimates of $375 million (33.7% margin, 2.6% beat)

- Operating Margin: 3.1%, up from -2.2% in the same quarter last year

- Free Cash Flow Margin: 6%, up from 0.9% in the same quarter last year

- Market Capitalization: $5.09 billion

Company Overview

Operating a fleet of 23 satellites that orbit the Earth and beam connectivity from space, Viasat (NASDAQ:VSAT) provides satellite-based communications networks and services for airlines, maritime vessels, governments, businesses, and residential customers worldwide.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.58 billion in revenue over the past 12 months, Viasat is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

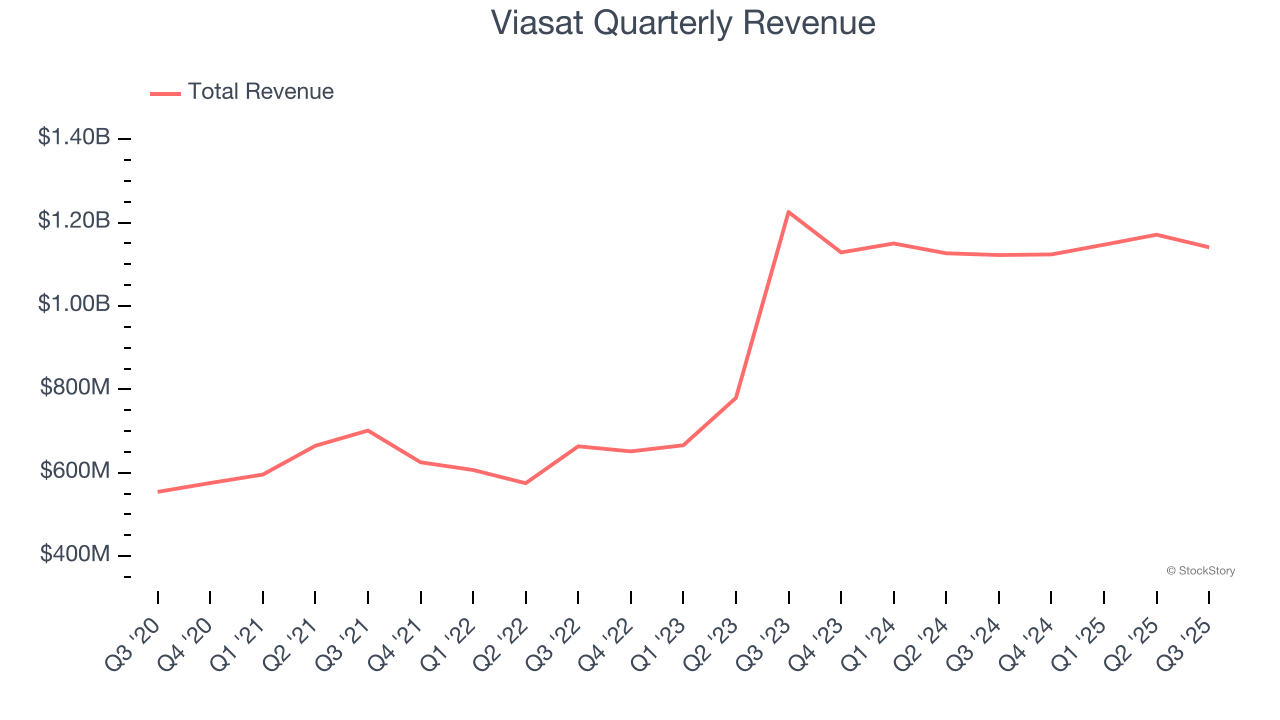

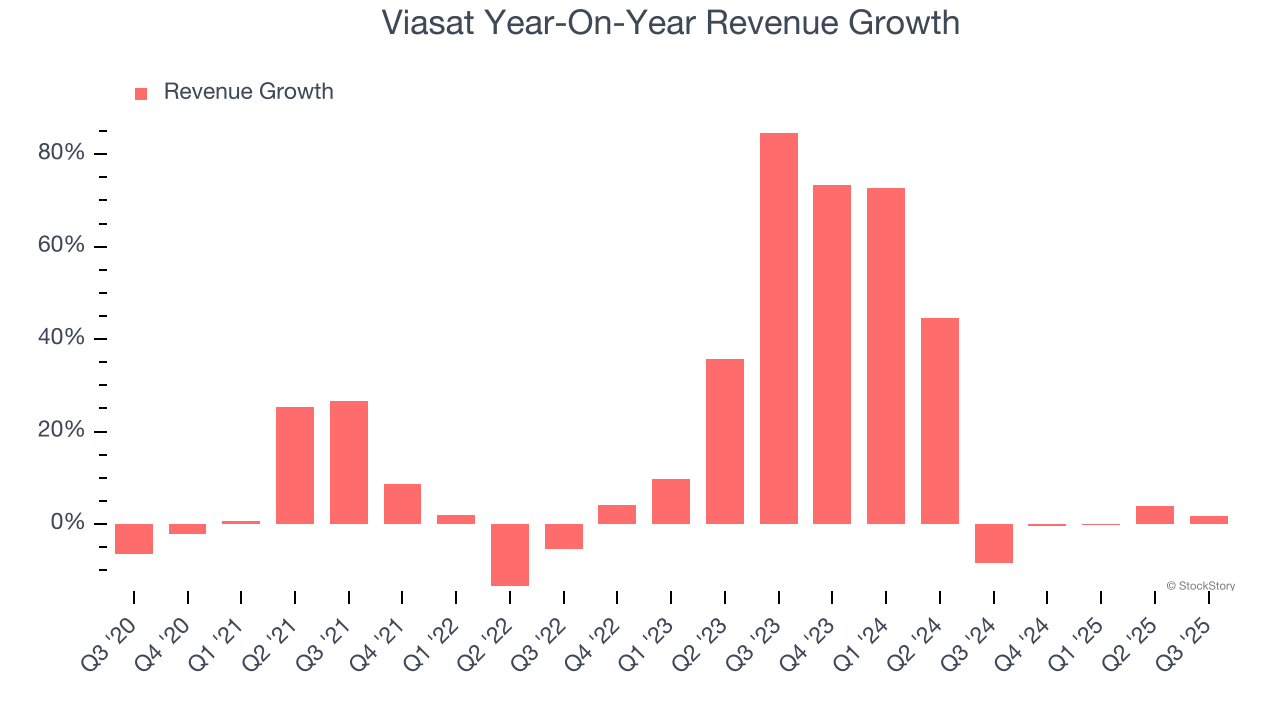

As you can see below, Viasat’s 15.1% annualized revenue growth over the last five years was incredible. This is an encouraging starting point for our analysis because it shows Viasat’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Viasat’s annualized revenue growth of 17.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Viasat’s revenue grew by 1.7% year on year to $1.14 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

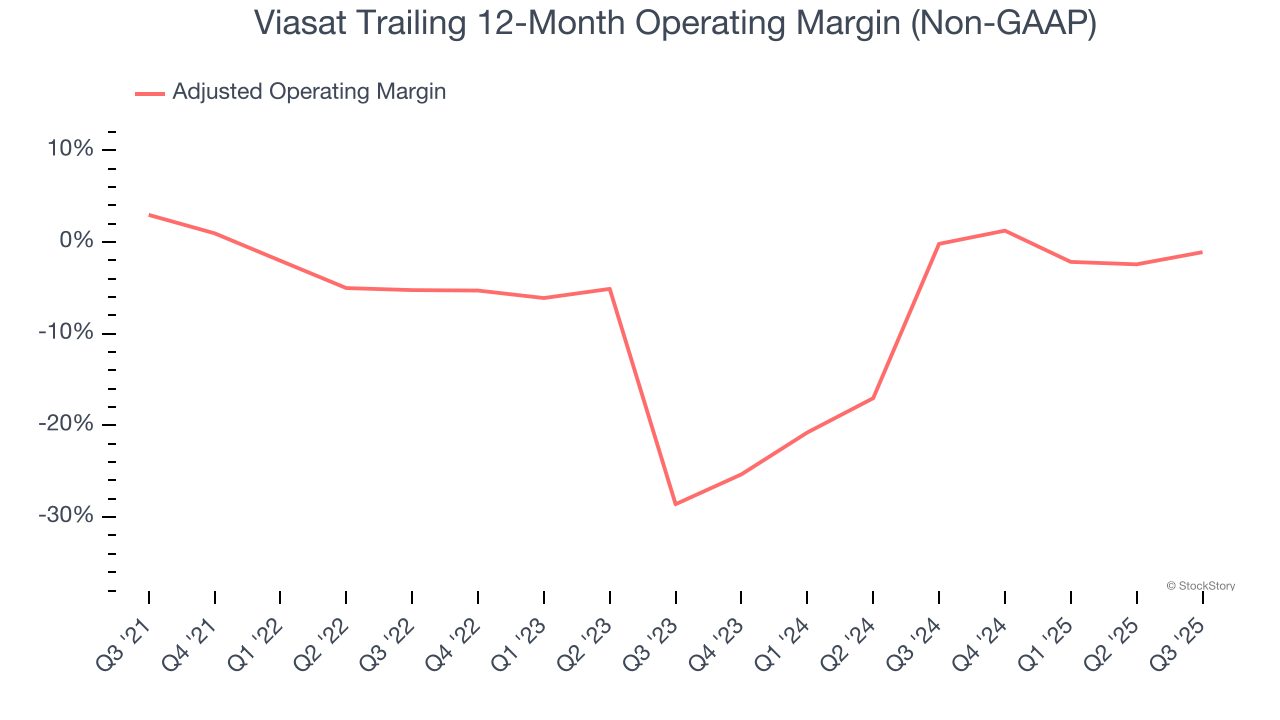

Although Viasat was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average adjusted operating margin of negative 6.1% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

Looking at the trend in its profitability, Viasat’s adjusted operating margin decreased by 4.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Viasat’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Viasat generated an adjusted operating margin profit margin of 3.1%, up 5.3 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

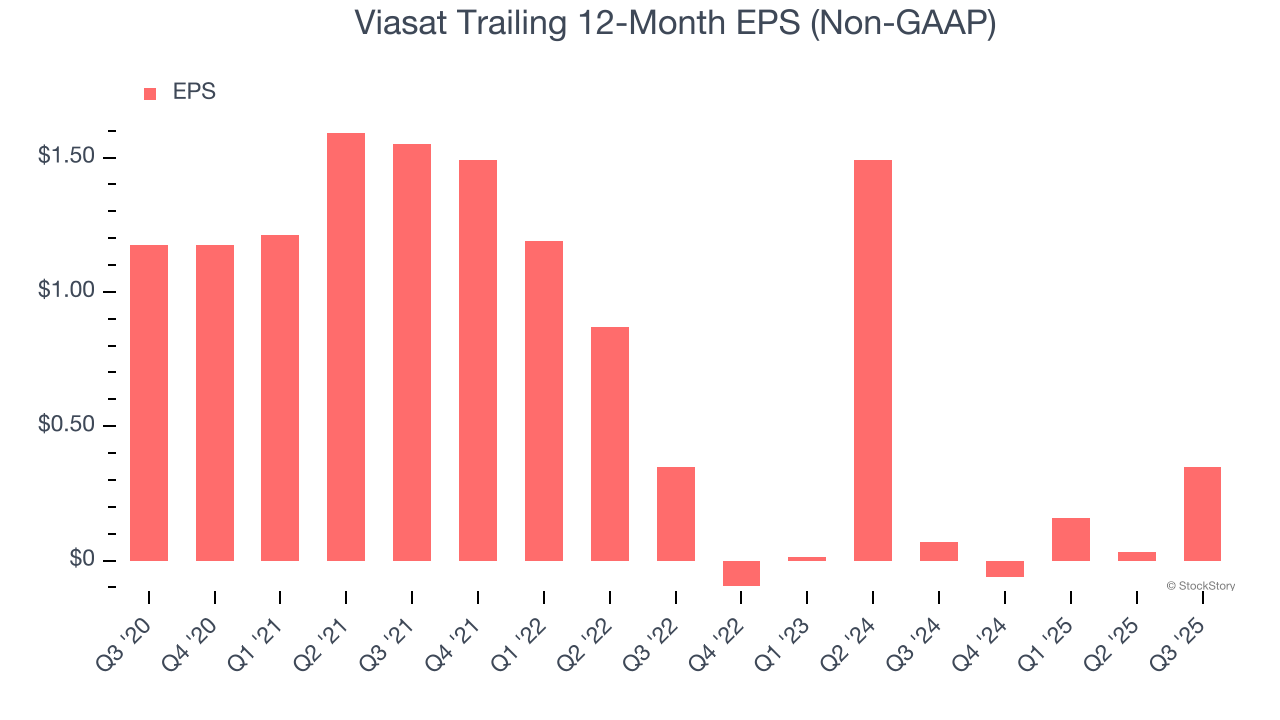

Sadly for Viasat, its EPS declined by 21.5% annually over the last five years while its revenue grew by 15.1%. This tells us the company became less profitable on a per-share basis as it expanded.

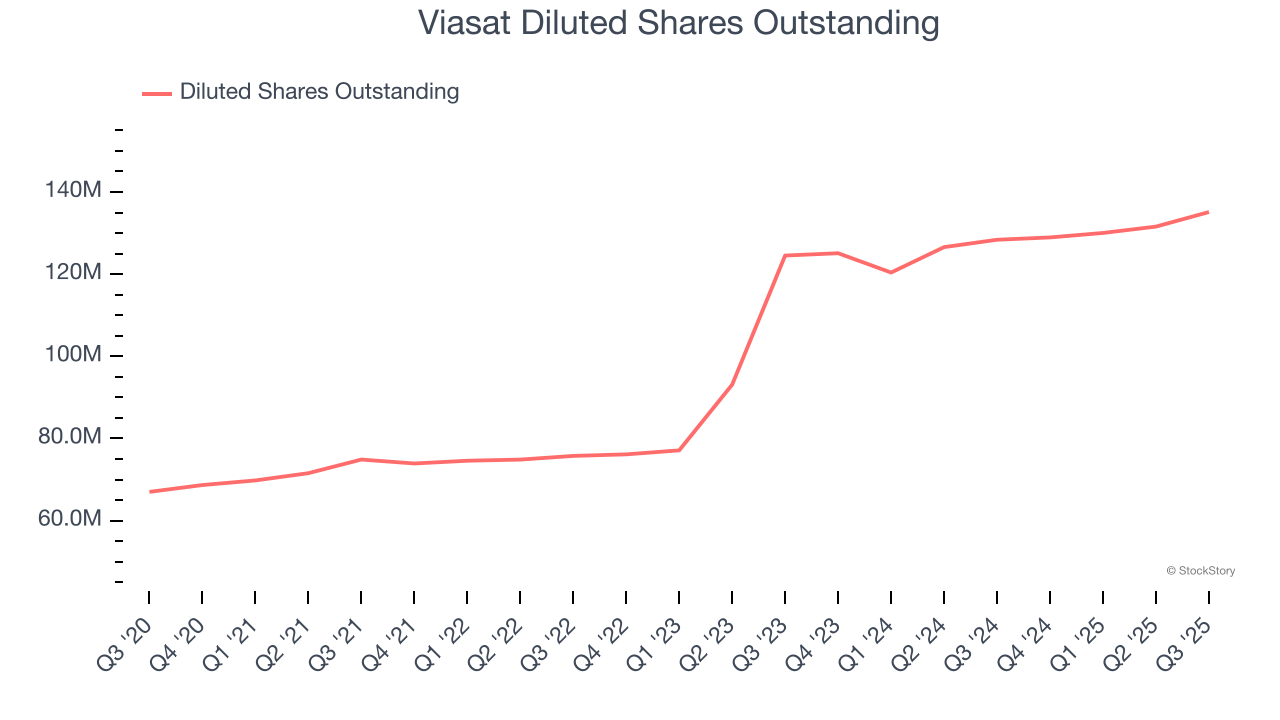

We can take a deeper look into Viasat’s earnings to better understand the drivers of its performance. As we mentioned earlier, Viasat’s adjusted operating margin expanded this quarter but declined by 4.1 percentage points over the last five years. Its share count also grew by 102%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Viasat, its two-year annual EPS declines of 62% show it’s continued to underperform. These results were bad no matter how you slice the data, but given it was successful in other measures of financial health, we’re hopeful Viasat can generate earnings growth in the future.

In Q3, Viasat reported adjusted EPS of $0.09, up from negative $0.23 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Viasat’s full-year EPS of $0.35 to grow 44.8%.

Key Takeaways from Viasat’s Q3 Results

It was good to see Viasat beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 2.7% to $38.64 immediately after reporting.

Viasat put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.