Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Wingstop (NASDAQ:WING) and its peers.

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

The 6 modern fast food stocks we track reported a slower Q3. As a group, revenues missed analysts’ consensus estimates by 1.2%.

Thankfully, share prices of the companies have been resilient as they are up 8.3% on average since the latest earnings results.

Wingstop (NASDAQ:WING)

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Wingstop reported revenues of $175.7 million, up 8.1% year on year. This print fell short of analysts’ expectations by 5%. Overall, it was a softer quarter for the company with a significant miss of analysts’ same-store sales estimates and a significant miss of analysts’ revenue estimates.

"Our third quarter results highlight the strength and resiliency of our business model delivering 18.6% Adjusted EBITDA growth — supported by best-in-class unit economics, strategic investments, disciplined execution, and enthusiasm from our brand partners to open more Wingstops," said Michael Skipworth, President & Chief Executive Officer.

Wingstop delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 23.5% since reporting and currently trades at $264.41.

Is now the time to buy Wingstop? Access our full analysis of the earnings results here, it’s free.

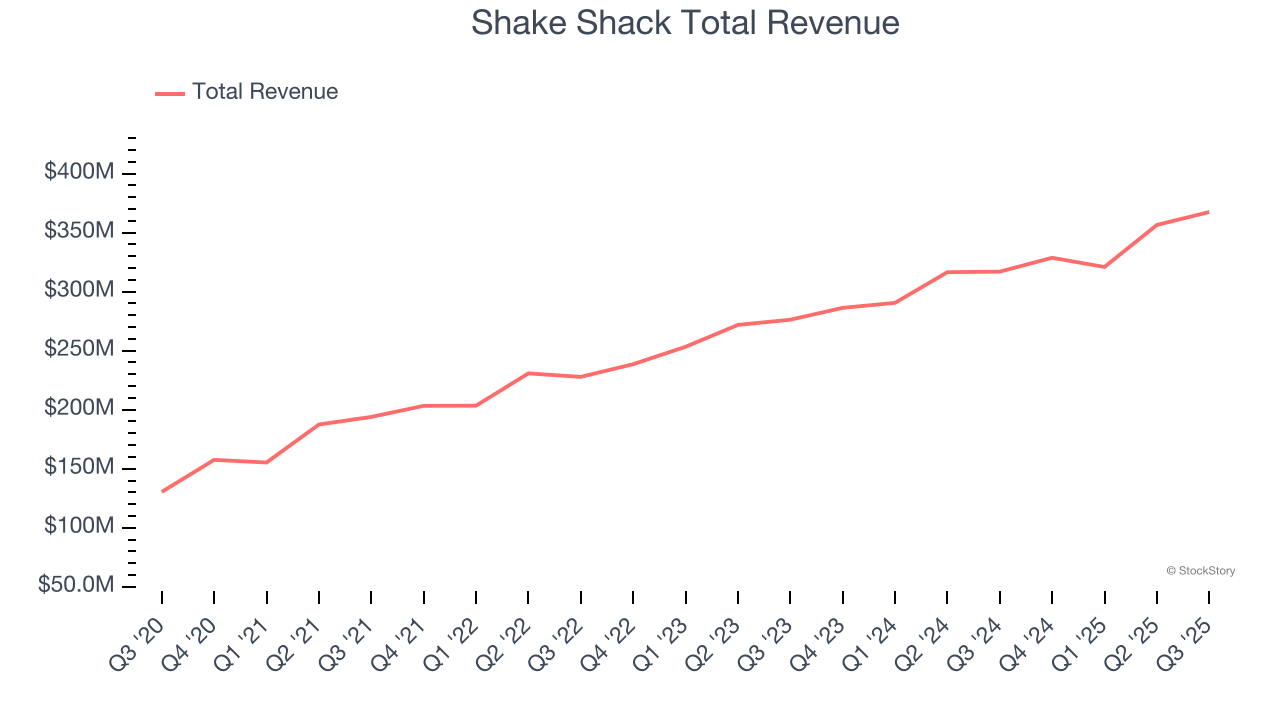

Best Q3: Shake Shack (NYSE:SHAK)

Started as a hot dog cart in New York City's Madison Square Park, Shake Shack (NYSE:SHAK) is a fast-food restaurant known for its burgers and milkshakes.

Shake Shack reported revenues of $367.4 million, up 15.9% year on year, outperforming analysts’ expectations by 1%. The business had a very strong quarter with an impressive beat of analysts’ same-store sales estimates and a solid beat of analysts’ EBITDA estimates.

Shake Shack scored the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.7% since reporting. It currently trades at $92.25.

Is now the time to buy Shake Shack? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Sweetgreen (NYSE:SG)

Founded in 2007 by three Georgetown University alum, Sweetgreen (NYSE:SG) is a casual quick service chain known for its healthy salads and bowls.

Sweetgreen reported revenues of $172.4 million, flat year on year, falling short of analysts’ expectations by 3.1%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EBITDA guidance missing analysts’ expectations significantly.

Sweetgreen delivered the slowest revenue growth in the group. As expected, the stock is down 5.9% since the results and currently trades at $5.88.

Read our full analysis of Sweetgreen’s results here.

Portillo's (NASDAQ:PTLO)

Begun as a Chicago hot dog stand in 1963, Portillo’s (NASDAQ:PTLO) is a casual restaurant chain that serves Chicago-style hot dogs and beef sandwiches as well as fries and shakes.

Portillo's reported revenues of $181.4 million, up 1.8% year on year. This number came in 0.7% below analysts' expectations. Aside from that, it was a strong quarter as it put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ same-store sales estimates.

The stock is up 9.4% since reporting and currently trades at $5.74.

Read our full, actionable report on Portillo's here, it’s free.

CAVA (NYSE:CAVA)

Starting from a single Washington, D.C. location, CAVA (NYSE:CAVA) operates a fast-casual restaurant chain offering customizable Mediterranean-inspired dishes.

CAVA reported revenues of $292.2 million, up 19.9% year on year. This result was in line with analysts’ expectations. Zooming out, it was a slower quarter as it produced full-year EBITDA guidance missing analysts’ expectations and a slight miss of analysts’ same-store sales estimates.

CAVA delivered the fastest revenue growth among its peers. The stock is up 22.5% since reporting and currently trades at $63.33.

Read our full, actionable report on CAVA here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.