What a time it’s been for Zumiez. In the past six months alone, the company’s stock price has increased by a massive 86.4%, reaching $26.44 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Zumiez, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Do We Think Zumiez Will Underperform?

Despite the momentum, we're swiping left on Zumiez for now. Here are three reasons we avoid ZUMZ and a stock we'd rather own.

1. Stores Are Closing, a Headwind for Revenue

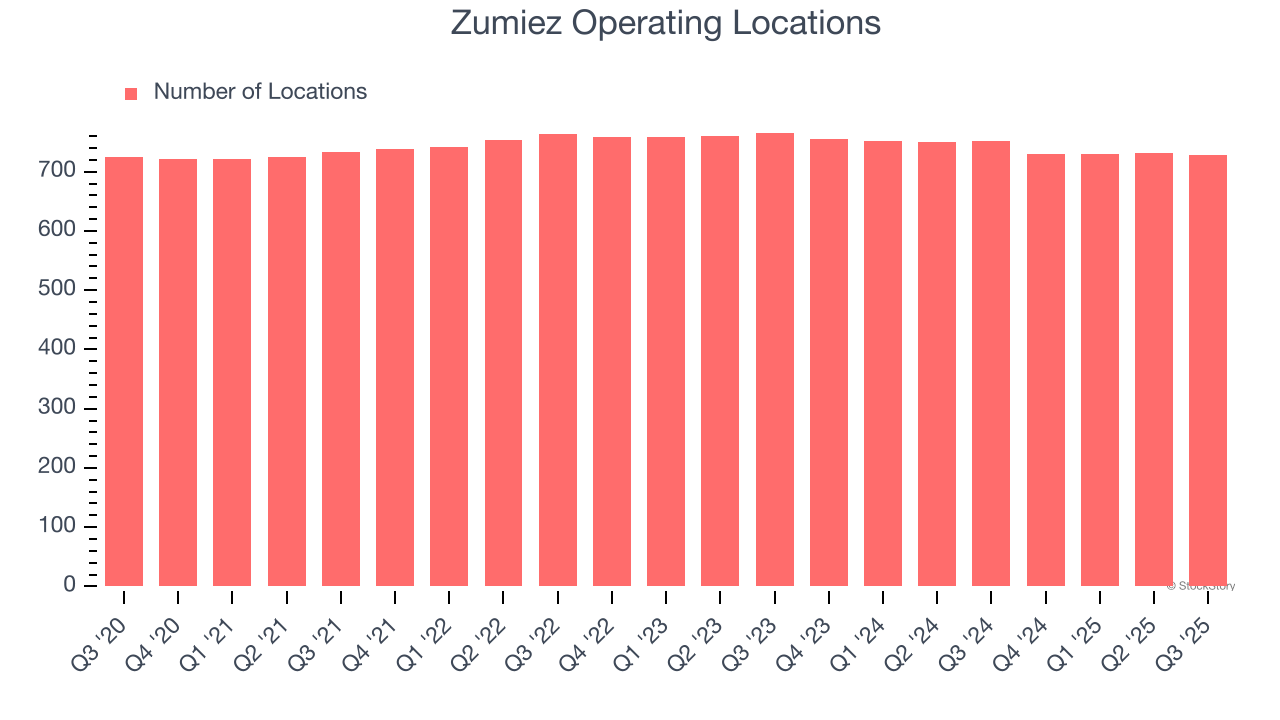

A retailer’s store count often determines how much revenue it can generate.

Zumiez operated 728 locations in the latest quarter. Over the last two years, the company has generally closed its stores, averaging 2.1% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

2. Operating Losses Sound the Alarms

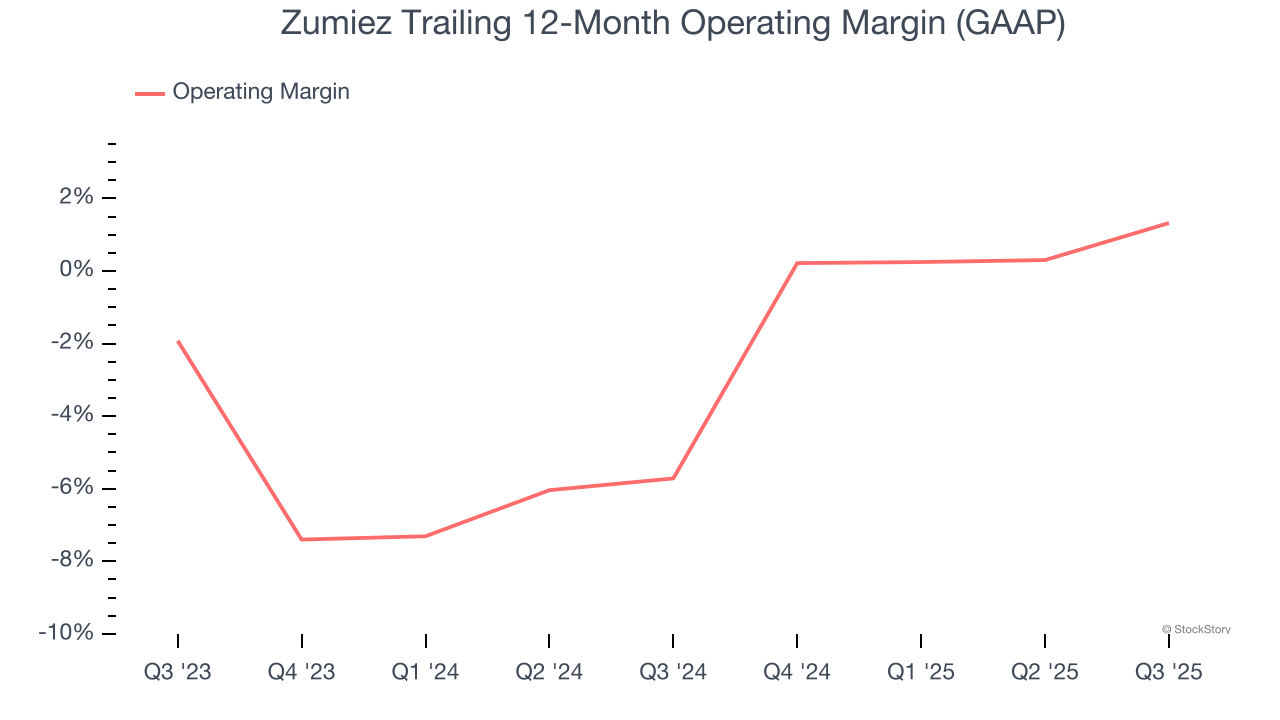

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Although Zumiez was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 2.1% over the last two years. Despite the consumer retail industry’s secular decline, unprofitable public companies are few and far between. It’s unfortunate that Zumiez was one of them.

3. EPS Trending Down

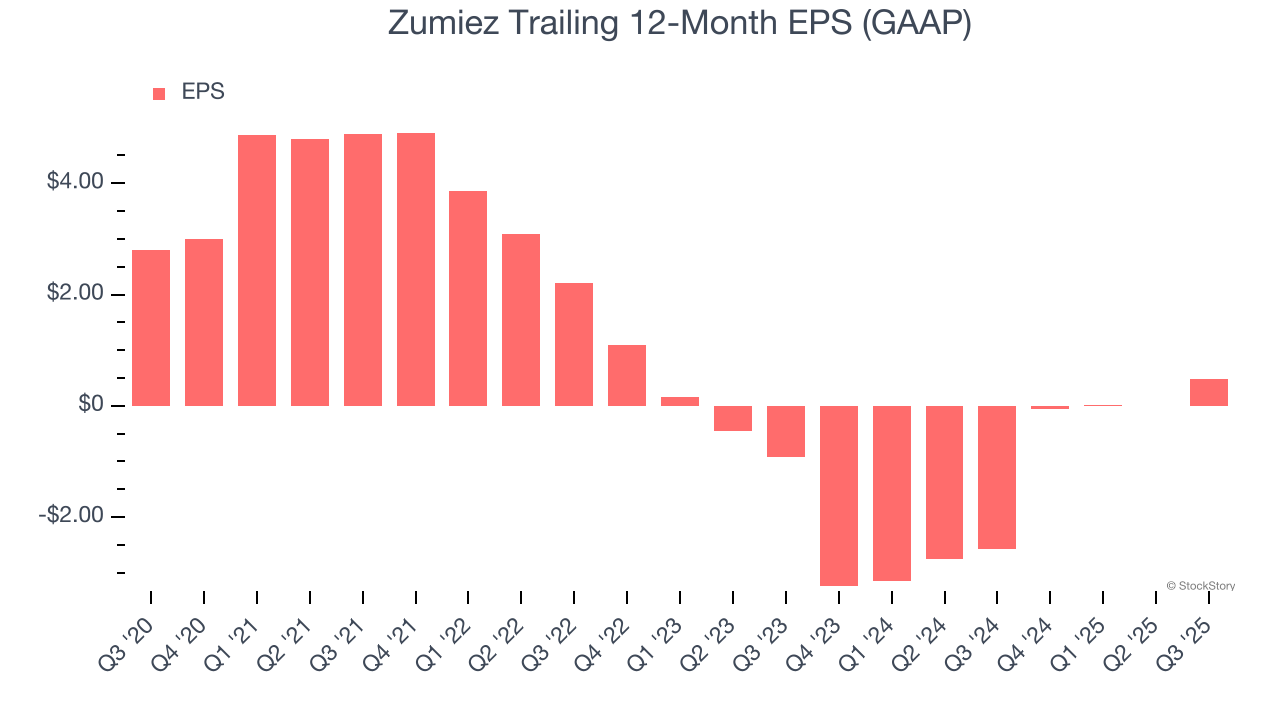

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Zumiez, its EPS declined by 39.7% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Zumiez doesn’t pass our quality test. Following the recent surge, the stock trades at 29.1× forward P/E (or $26.44 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.