Ameris Bancorp’s 20.8% return over the past six months has outpaced the S&P 500 by 7.9%, and its stock price has climbed to $76.43 per share. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Ameris Bancorp, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Ameris Bancorp Not Exciting?

We’re happy investors have made money, but we're cautious about Ameris Bancorp. Here are three reasons we avoid ABCB and a stock we'd rather own.

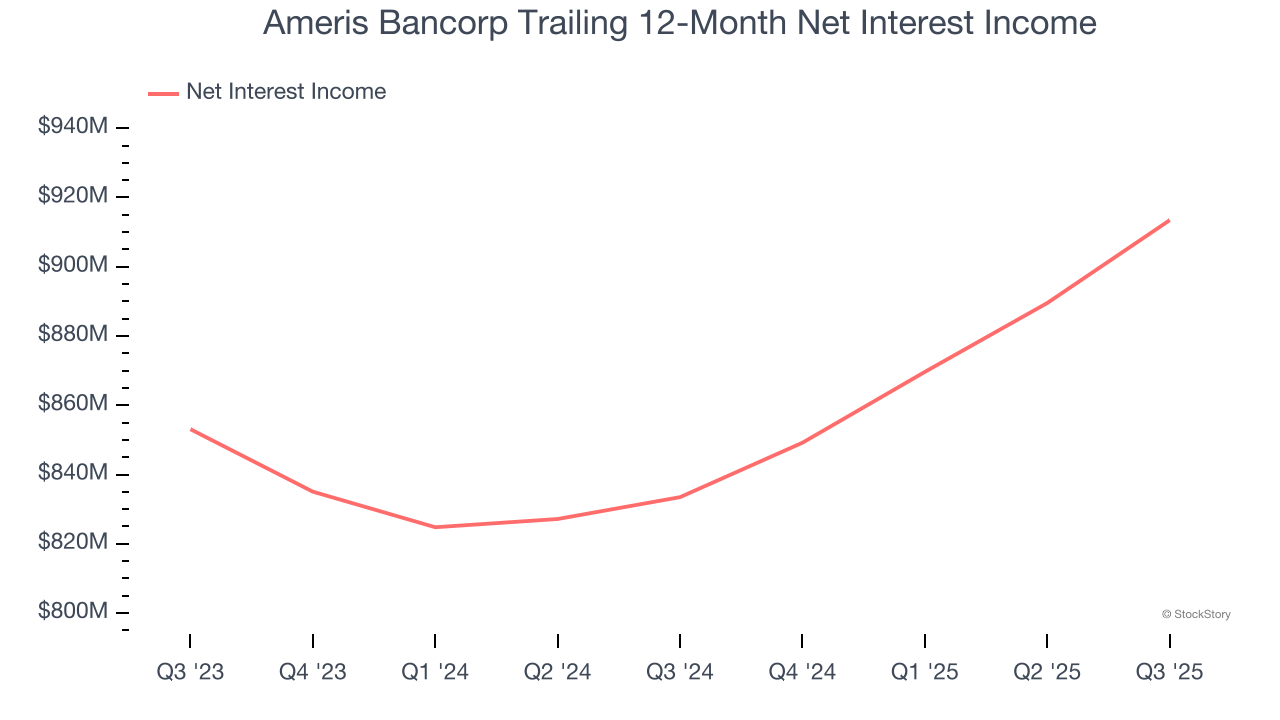

1. Net Interest Income Points to Soft Demand

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Ameris Bancorp’s net interest income has grown at a 7.7% annualized rate over the last five years, worse than the broader banking industry.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Ameris Bancorp’s net interest income to rise by 5.5%.

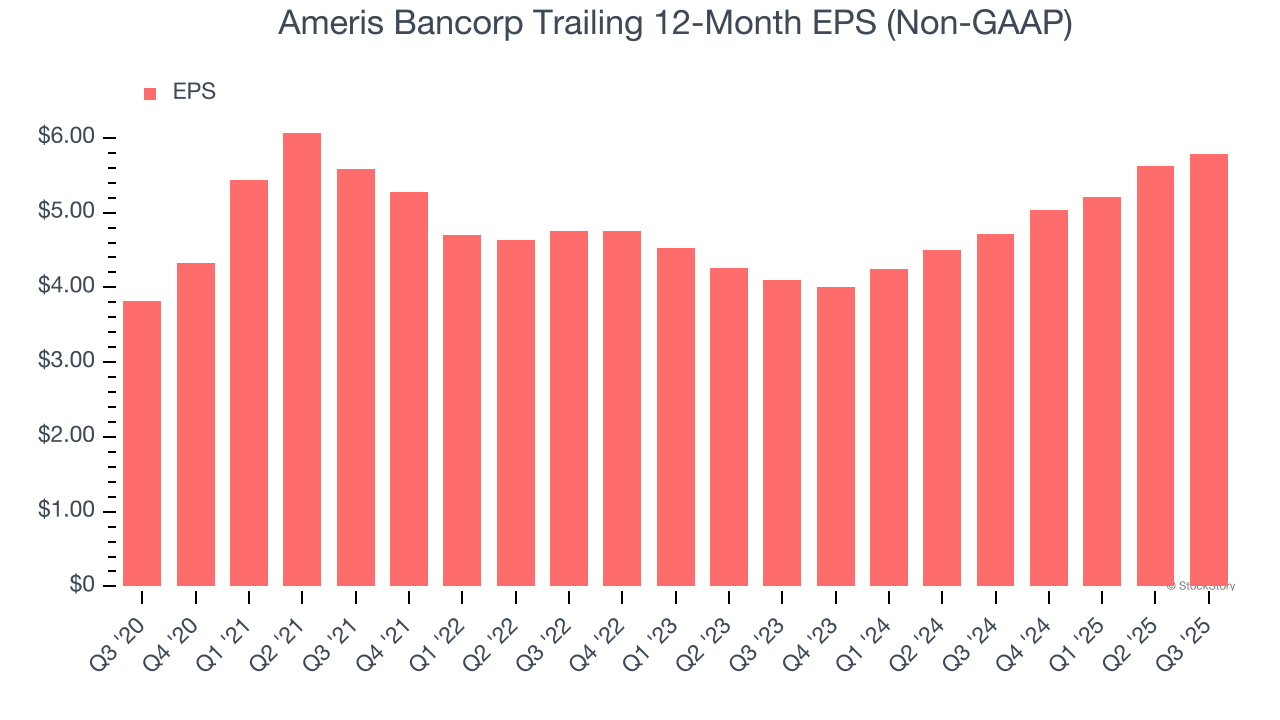

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Ameris Bancorp’s EPS grew at an unimpressive 8.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.7% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Ameris Bancorp isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 1.3× forward P/B (or $76.43 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.