AMETEK trades at $208.25 and has moved in lockstep with the market. Its shares have returned 17% over the last six months while the S&P 500 has gained 13.3%.

Is there a buying opportunity in AMETEK, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is AMETEK Not Exciting?

We're cautious about AMETEK. Here are two reasons we avoid AME and a stock we'd rather own.

1. Lackluster Revenue Growth

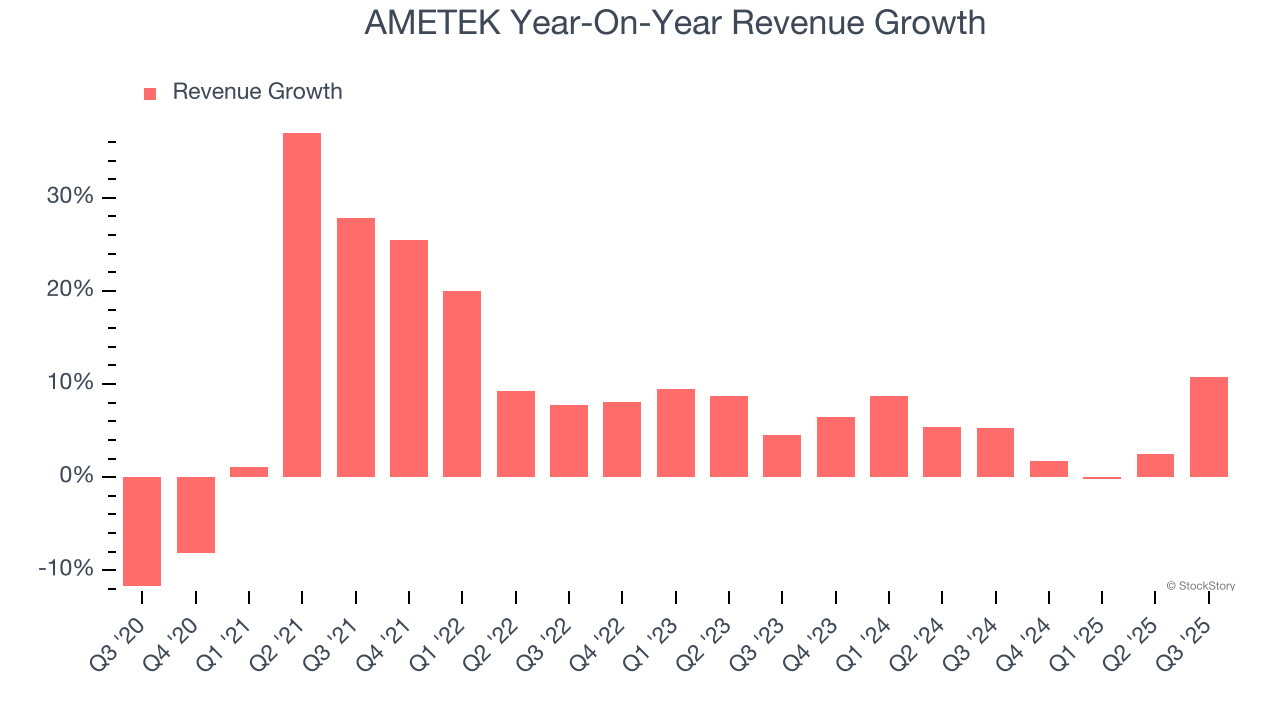

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. AMETEK’s recent performance shows its demand has slowed as its annualized revenue growth of 5.1% over the last two years was below its five-year trend.

2. Core Business Falling Behind as Demand Plateaus

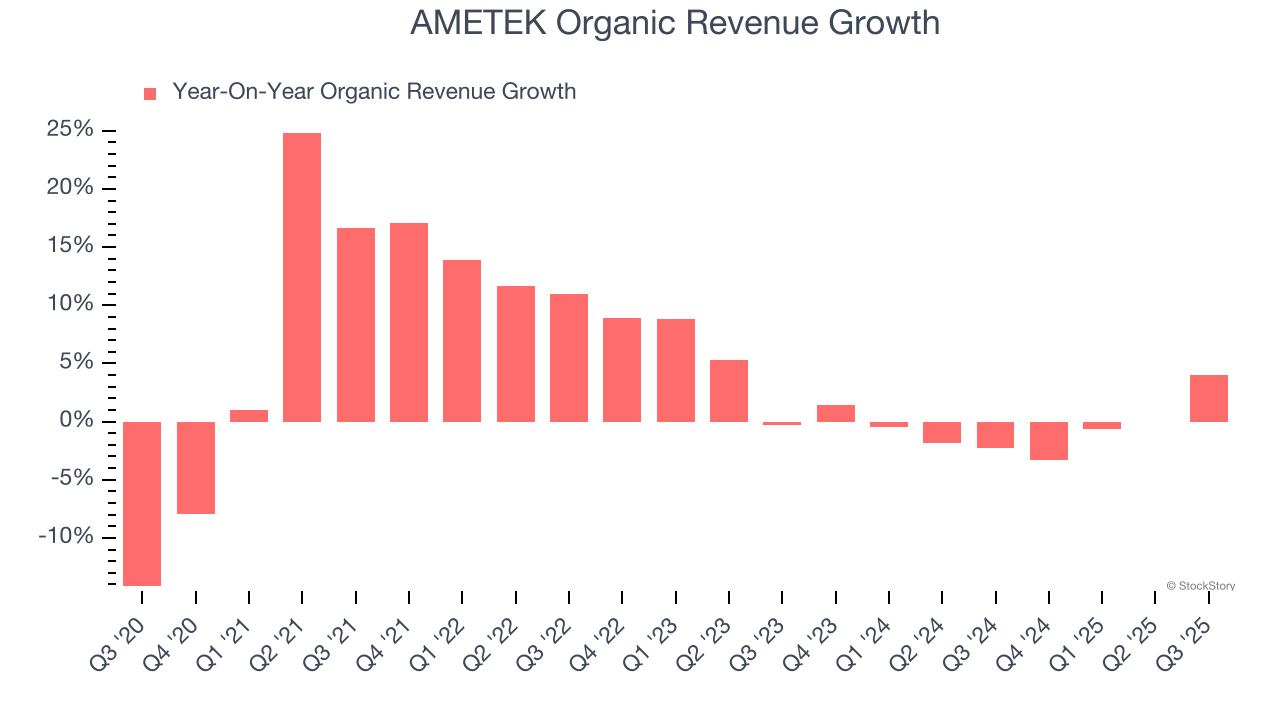

We can better understand Internet of Things companies by analyzing their organic revenue. This metric gives visibility into AMETEK’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, AMETEK failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests AMETEK might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

Final Judgment

AMETEK isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 26.7× forward P/E (or $208.25 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Would Buy Instead of AMETEK

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.