The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how asset management stocks fared in Q4, starting with Ares (NYSE:ARES).

Asset management firms oversee investment portfolios for institutions and individuals. The industry benefits from the growing global wealth pool, retirement savings needs, and expansion into alternative investments (private equity, real estate, etc.). However, firms face significant pressure from the shift to lower-cost passive investment products, regulatory requirements for fee transparency, and increasing technology costs to stay competitive in portfolio management and client service.

The 5 asset management stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 3.8%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 5.4% since the latest earnings results.

Weakest Q4: Ares (NYSE:ARES)

With roots in the leveraged finance group of Apollo Management, Ares Management (NYSE:ARES) is an alternative investment firm that manages private equity, credit, real estate, and infrastructure assets for institutional and high-net-worth clients.

Ares reported revenues of $1.52 billion, up 23.4% year on year. This print fell short of analysts’ expectations by 7%. Overall, it was a softer quarter for the company with a significant miss of analysts’ revenue and EPS estimates.

Ares delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 1.1% since reporting and currently trades at $135.75.

Is now the time to buy Ares? Access our full analysis of the earnings results here, it’s free.

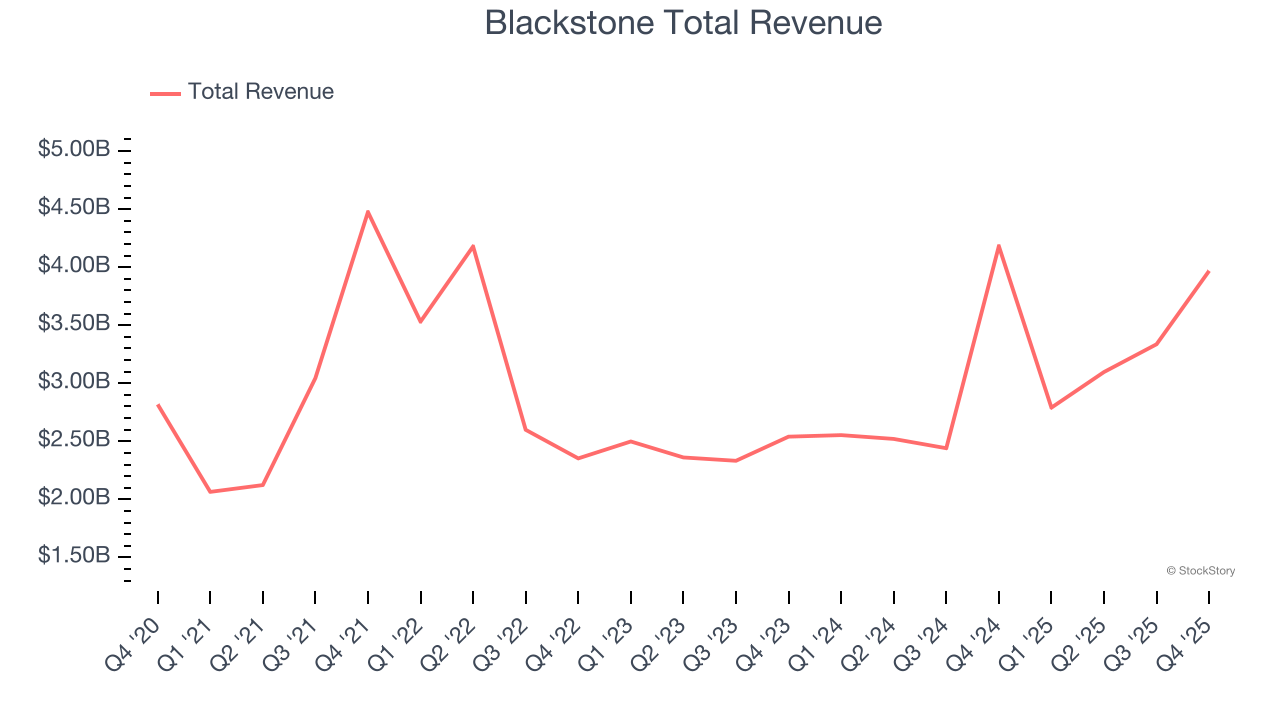

Best Q4: Blackstone (NYSE:BX)

With over $1 trillion in assets under management and investments spanning real estate, private equity, credit, and hedge funds, Blackstone (NYSE:BX) is a global alternative asset manager that invests capital on behalf of pension funds, sovereign wealth funds, and other institutional investors.

Blackstone reported revenues of $3.97 billion, down 5.1% year on year, outperforming analysts’ expectations by 6.7%. The business had an exceptional quarter with an impressive beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 10.8% since reporting. It currently trades at $130.88.

Is now the time to buy Blackstone? Access our full analysis of the earnings results here, it’s free.

Carlyle (NASDAQ:CG)

Founded in 1987 with just $5 million in capital and named after the iconic New York hotel where the founders first met, The Carlyle Group (NASDAQ:CG) is a global investment firm that raises, manages, and deploys capital across private equity, credit, and investment solutions.

Carlyle reported revenues of $1.09 billion, up 15.1% year on year, exceeding analysts’ expectations by 3.7%. Still, it was a mixed quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 1.5% since the results and currently trades at $54.59.

Read our full analysis of Carlyle’s results here.

Artisan Partners (NYSE:APAM)

Founded in 1994 with a focus on autonomous investment teams and a "high-value-added" approach, Artisan Partners (NYSE:APAM) is an investment management firm that offers actively managed equity and fixed income strategies to institutional and individual investors.

Artisan Partners reported revenues of $335.5 million, up 13% year on year. This number topped analysts’ expectations by 3.7%. Overall, it was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ revenue estimates.

The stock is flat since reporting and currently trades at $44.23.

Read our full, actionable report on Artisan Partners here, it’s free.

TPG (NASDAQ:TPG)

Founded in 1992 and managing over 300 active portfolio companies across more than 30 countries, TPG (NASDAQ:TPG) is a global alternative asset management firm that invests across private equity, credit, real estate, and public market strategies.

TPG reported revenues of $614.8 million, up 33.8% year on year. This result beat analysts’ expectations by 12%. It was a stunning quarter as it also logged an impressive beat of analysts’ fee-related earnings estimates and a solid beat of analysts’ revenue estimates.

TPG delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is down 13% since reporting and currently trades at $48.81.

Read our full, actionable report on TPG here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.