Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Atkore (NYSE:ATKR) and its peers.

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 15 electrical systems stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.3% while next quarter’s revenue guidance was 1.2% below.

In light of this news, share prices of the companies have held steady as they are up 4% on average since the latest earnings results.

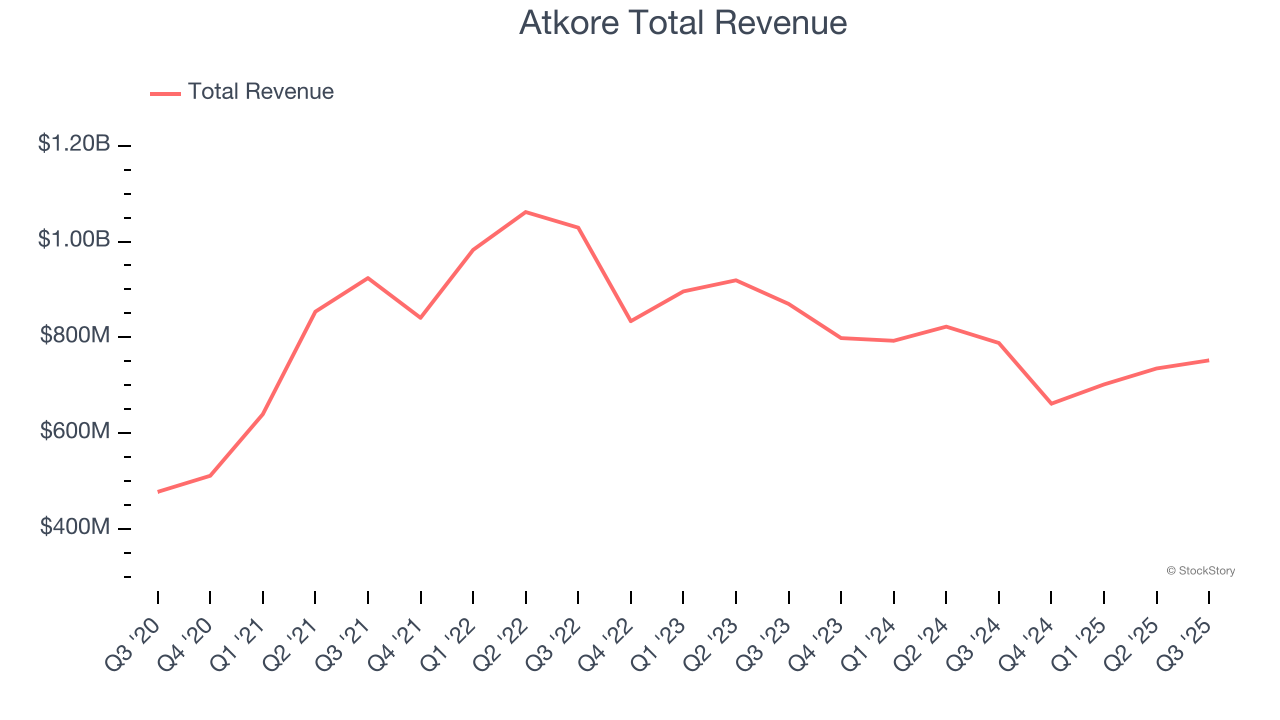

Weakest Q3: Atkore (NYSE:ATKR)

Protecting the things that power our world, Atkore (NYSE:ATKR) designs and manufactures electrical safety products.

Atkore reported revenues of $752 million, down 4.6% year on year. This print exceeded analysts’ expectations by 2.5%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ adjusted operating income estimates.

“Atkore achieved Net Sales of $2.9 billion in fiscal 2025 and grew organic volume for the third consecutive year,” said Bill Waltz, Atkore President and Chief Executive Officer.

Interestingly, the stock is up 1.3% since reporting and currently trades at $67.41.

Read our full report on Atkore here, it’s free.

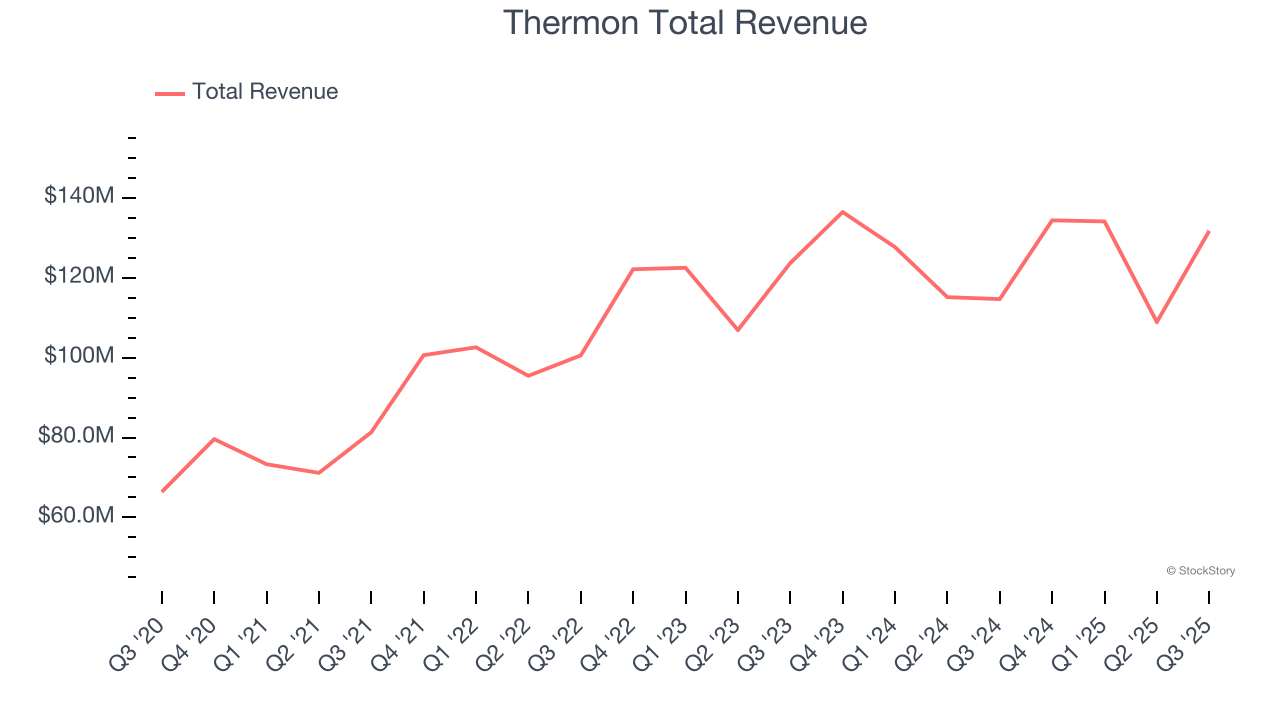

Best Q3: Thermon (NYSE:THR)

Creating the first packaged tracing systems, Thermon (NYSE:THR) is a leading provider of engineered industrial process heating solutions for process industries.

Thermon reported revenues of $131.7 million, up 14.9% year on year, outperforming analysts’ expectations by 10.3%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Thermon pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 34.4% since reporting. It currently trades at $39.53.

Is now the time to buy Thermon? Access our full analysis of the earnings results here, it’s free.

Hubbell (NYSE:HUBB)

A respected player in the electrical segment, Hubbell (NYSE:HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Hubbell reported revenues of $1.50 billion, up 4.1% year on year, falling short of analysts’ expectations by 1.6%. It was a slower quarter as it posted a miss of analysts’ revenue estimates and a miss of analysts’ organic revenue estimates.

Hubbell delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 8.4% since the results and currently trades at $470.54.

Read our full analysis of Hubbell’s results here.

Sanmina (NASDAQ:SANM)

Founded in 1980, Sanmina (NASDAQ:SANM) is an electronics manufacturing services company offering end-to-end solutions for various industries.

Sanmina reported revenues of $2.10 billion, up 3.9% year on year. This number surpassed analysts’ expectations by 2.2%. It was an exceptional quarter as it also put up EPS guidance for next quarter exceeding analysts’ expectations and revenue guidance for next quarter exceeding analysts’ expectations.

The stock is up 9.3% since reporting and currently trades at $153.46.

Read our full, actionable report on Sanmina here, it’s free.

Methode Electronics (NYSE:MEI)

Founded in 1946, Methode Electronics (NYSE:MEI) is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).

Methode Electronics reported revenues of $246.9 million, down 15.6% year on year. This print topped analysts’ expectations by 3.9%. Overall, it was a very strong quarter as it also logged a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

Methode Electronics had the slowest revenue growth among its peers. The stock is down 19.6% since reporting and currently trades at $6.99.

Read our full, actionable report on Methode Electronics here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.