Since February 2021, the S&P 500 has delivered a total return of 76.3%. But one standout stock has more than doubled the market - over the past five years, American Express has surged 173% to $354.25 per share. Its momentum hasn’t stopped as it’s also gained 16.8% in the last six months, beating the S&P by 9.1%.

Is it too late to buy AXP? Find out in our full research report, it’s free.

Why Are We Positive On American Express?

Recognizable by its iconic green logo and the slogan "Don't leave home without it," American Express (NYSE:AXP) is a global payments company that issues credit and charge cards, processes merchant transactions, and offers travel and lifestyle benefits to consumers and businesses.

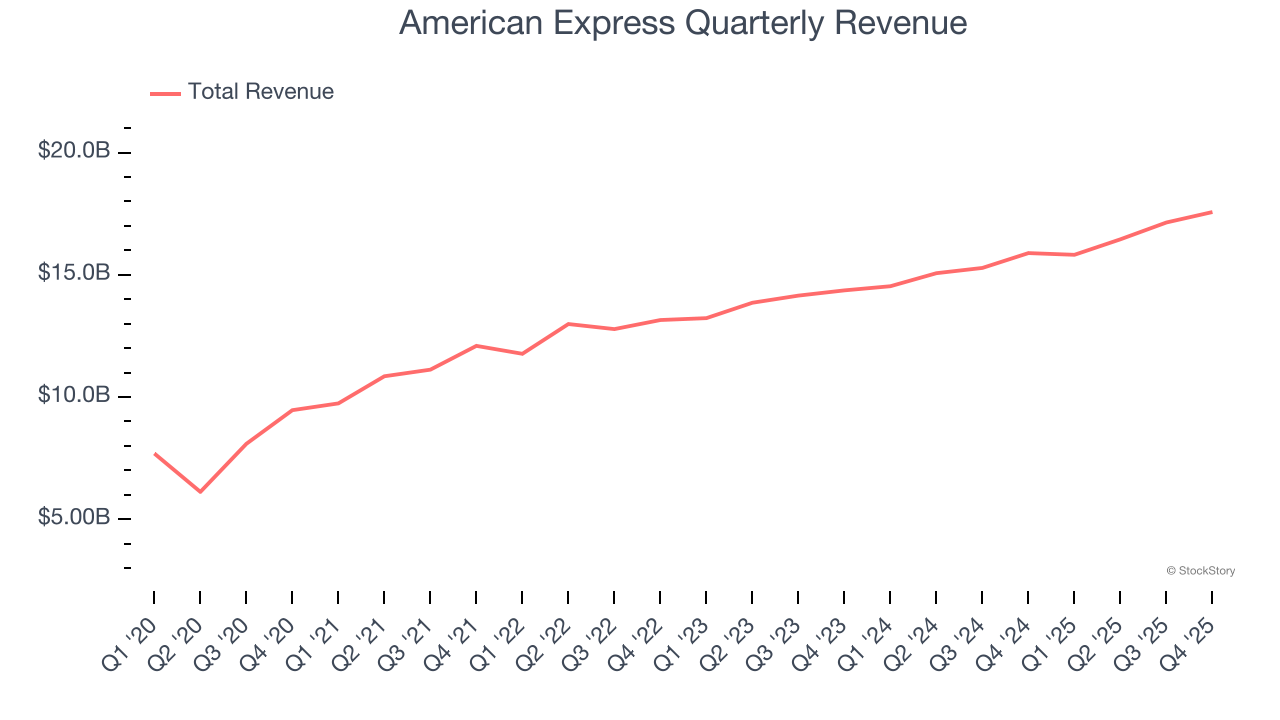

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

Thankfully, American Express’s 16.4% annualized revenue growth over the last five years was impressive. Its growth beat the average financials company and shows its offerings resonate with customers.

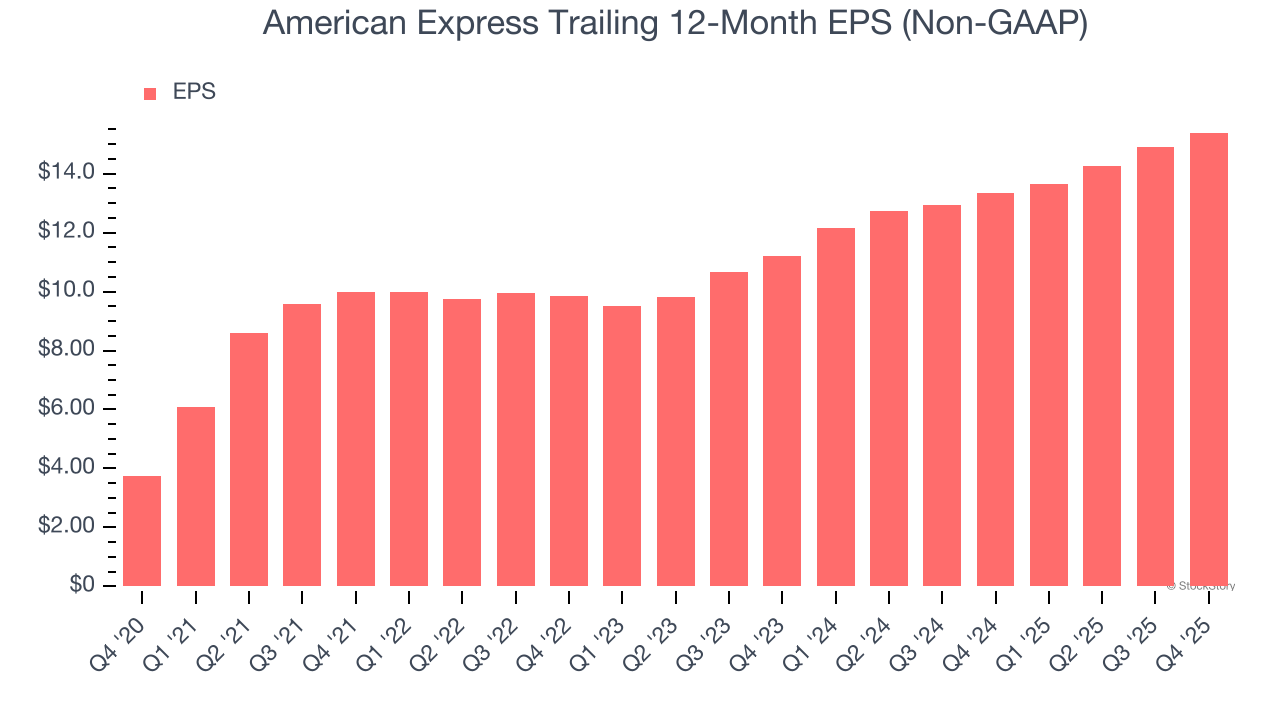

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

American Express’s EPS grew at an astounding 32.6% compounded annual growth rate over the last five years, higher than its 16.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

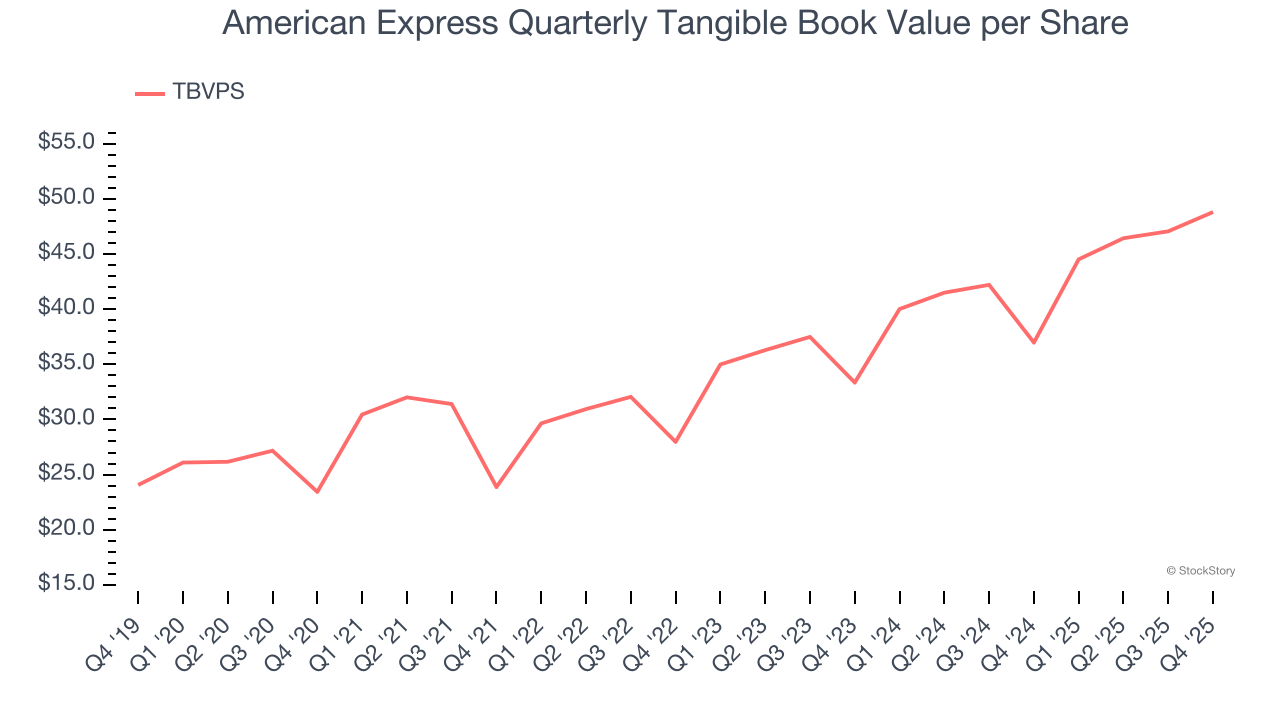

3. Growing TBVPS Reflects Strong Asset Base

Tangible book value per share (TBVPS) is a crucial metric that measures the actual value of shareholders’ equity, stripping out goodwill and other intangible assets that may not be recoverable in a worst-case scenario.

American Express’s TBVPS increased by 15.8% annually over the last five years, and growth has recently accelerated as TBVPS grew at an incredible 21% annual clip over the past two years (from $33.34 to $48.80 per share).

Final Judgment

These are just a few reasons why American Express is a cream-of-the-crop financials company, and with its shares outperforming the market lately, the stock trades at 20.7× forward P/E (or $354.25 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than American Express

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.