AXIS Capital trades at $102.99 per share and has stayed right on track with the overall market, gaining 7.2% over the last six months. At the same time, the S&P 500 has returned 8.6%.

Is now the time to buy AXIS Capital, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is AXIS Capital Not Exciting?

We don't have much confidence in AXIS Capital. Here are three reasons you should be careful with AXS and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

Big picture, insurers generate revenue from three key sources. The first is the core business of underwriting policies. The second source is income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

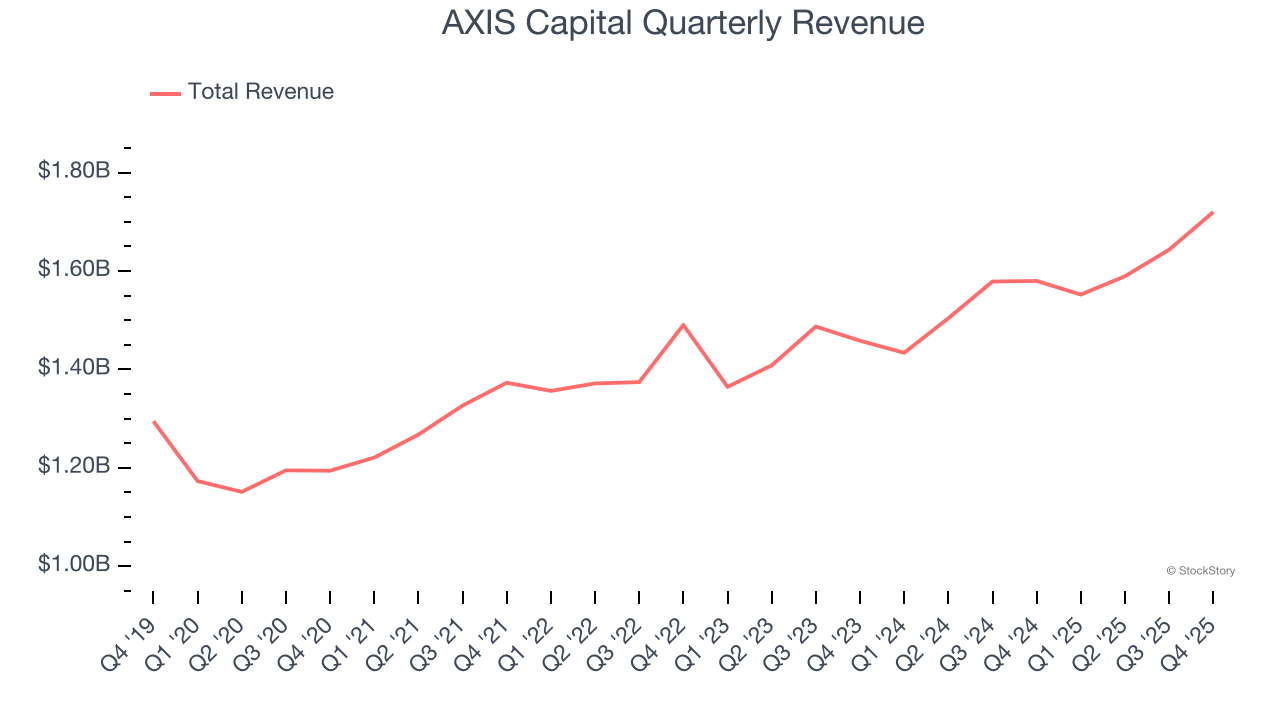

Over the last five years, AXIS Capital grew its revenue at a mediocre 6.7% compounded annual growth rate. This fell short of our benchmark for the insurance sector.

2. Net Premiums Earned Point to Soft Demand

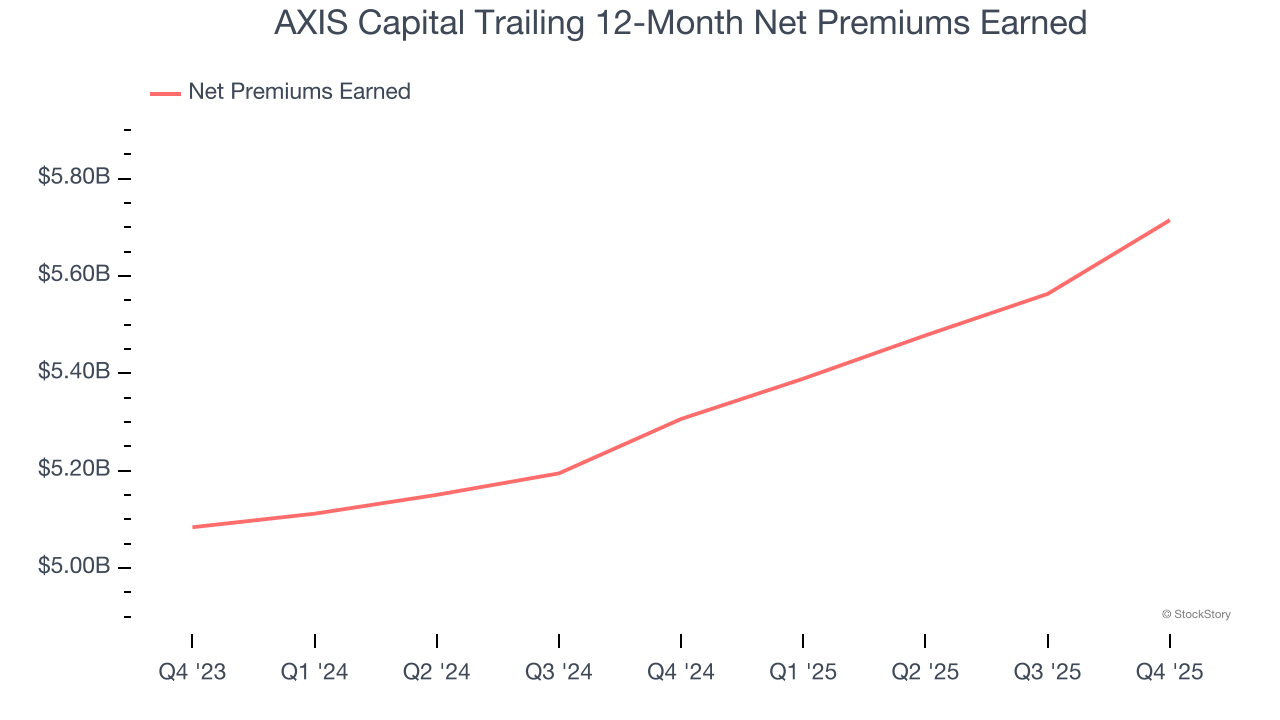

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

AXIS Capital’s net premiums earned has grown at a 5.5% annualized rate over the last five years, worse than the broader insurance industry and slower than its total revenue.

3. Recent EPS Growth Below Our Standards

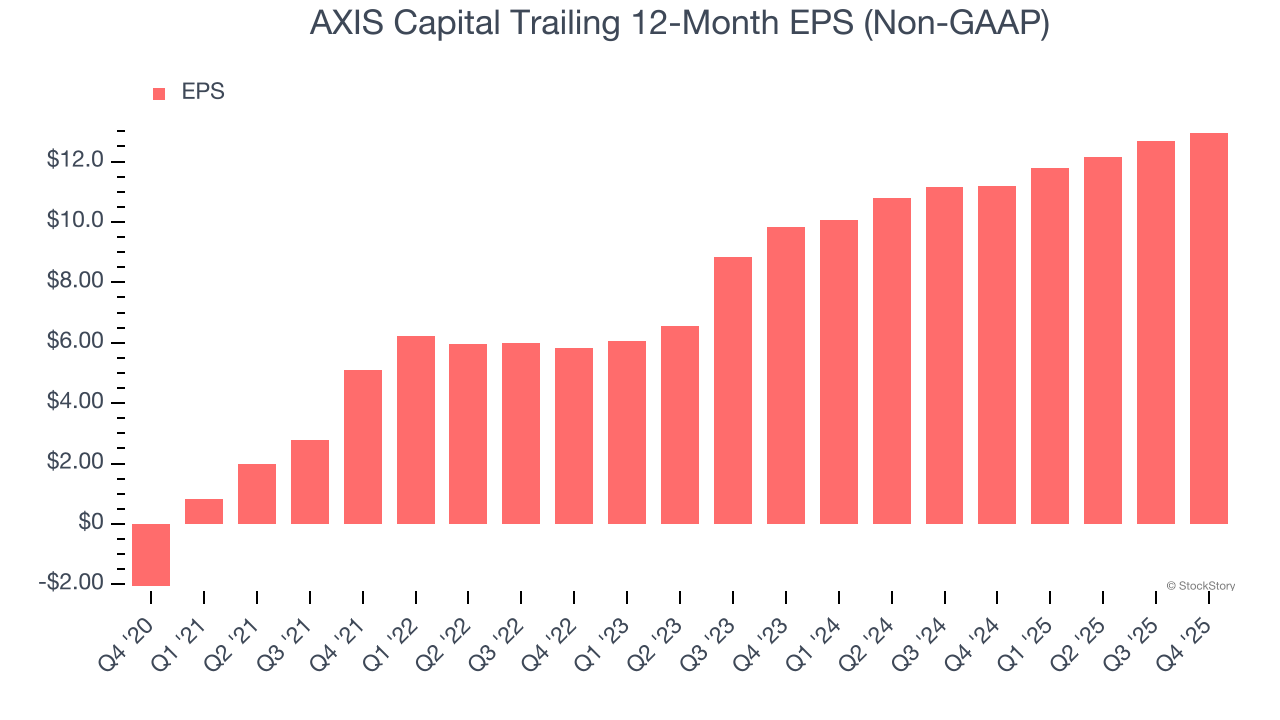

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

AXIS Capital’s EPS grew at an unimpressive 14.8% compounded annual growth rate over the last two years. On the bright side, this performance was higher than its 6.7% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

AXIS Capital’s business quality ultimately falls short of our standards. That said, the stock currently trades at 1.2× forward P/B (or $102.99 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than AXIS Capital

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.