Let’s dig into the relative performance of Ball (NYSE:BALL) and its peers as we unravel the now-completed Q3 industrial packaging earnings season.

Industrial packaging companies have built competitive advantages from economies of scale that lead to advantaged purchasing and capital investments that are difficult and expensive to replicate. Recently, eco-friendly packaging and conservation are driving customers preferences and innovation. For example, plastic is not as desirable a material as it once was. Despite being integral to consumer goods ranging from beer to toothpaste to laundry detergent, these companies are still at the whim of the macro, especially consumer health and consumer willingness to spend.

The 8 industrial packaging stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.8%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

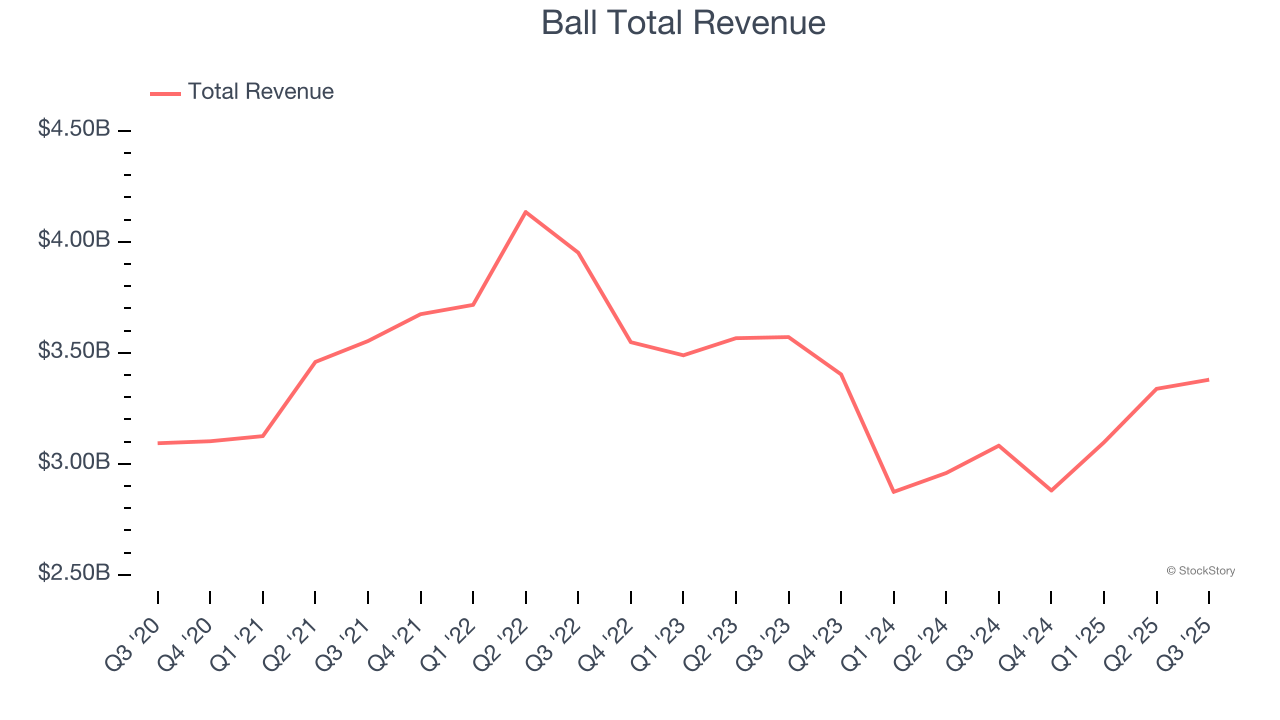

Ball (NYSE:BALL)

Started with a $200 loan in 1880, Ball (NYSE:BLL) manufactures aluminum packaging for beverages, personal care, and household products as well as aerospace systems and other technologies.

Ball reported revenues of $3.38 billion, up 9.6% year on year. This print exceeded analysts’ expectations by 1.3%. Overall, it was a strong quarter for the company with a narrow beat of analysts’ organic revenue estimates.

"Ball delivered strong third-quarter results, returning over $1 billion to shareholders in the first nine months of 2025. Our solid financial position, streamlined operating model, and disciplined growth strategy drove higher volumes and operating earnings. As we look to close out the year, we remain vigilant given ongoing geopolitical and macroeconomic volatility, but our team is well-positioned to execute and achieve our 2025 objectives. Continued focus on operational excellence is enhancing manufacturing efficiencies, while investments in innovation and sustainability enable our customers to meet evolving consumer needs. These actions, combined with rigorous cost management, provide resilience in the near term and reinforce our ability to deliver long-term value for our shareholders," said Daniel W. Fisher, chairman and chief executive officer.

Interestingly, the stock is up 1.4% since reporting and currently trades at $47.79.

Is now the time to buy Ball? Access our full analysis of the earnings results here, it’s free for active Edge members.

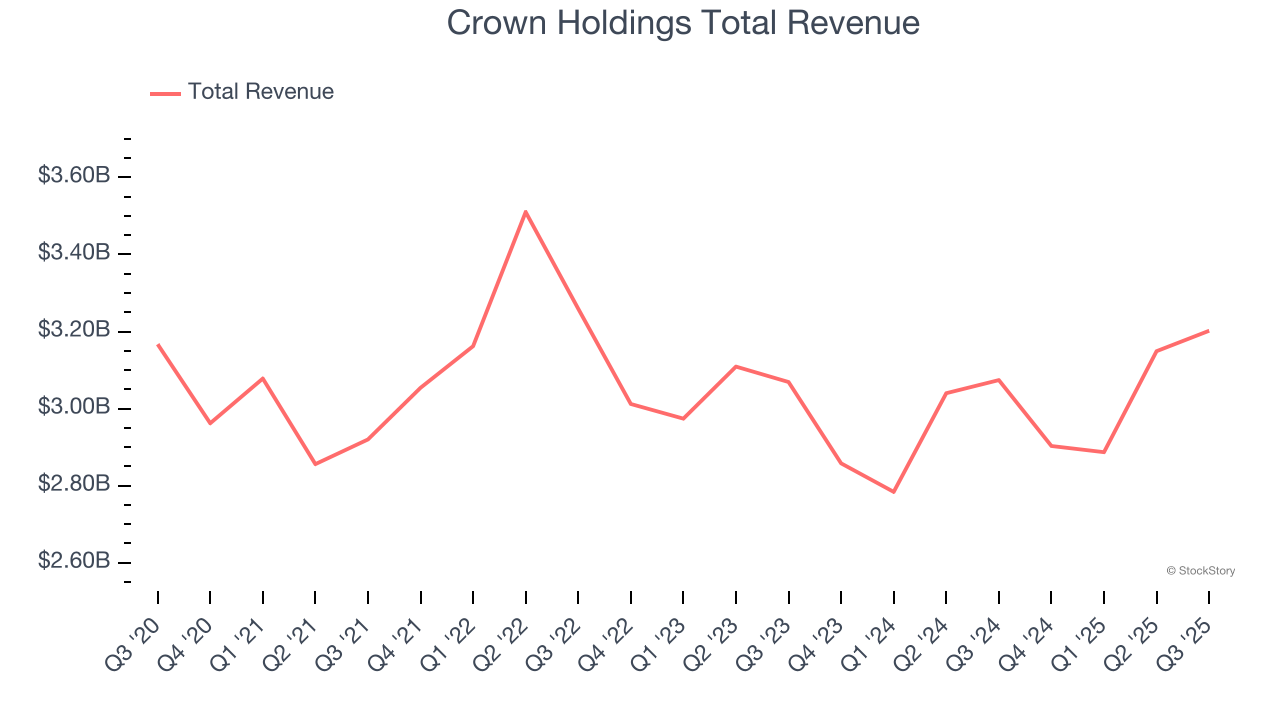

Best Q3: Crown Holdings (NYSE:CCK)

Formerly Crown Cork & Seal, Crown Holdings (NYSE:CCK) produces packaging products for consumer marketing companies, including food, beverage, household, and industrial products.

Crown Holdings reported revenues of $3.20 billion, up 4.2% year on year, outperforming analysts’ expectations by 1.5%. The business had an exceptional quarter with EPS guidance for next quarter exceeding analysts’ expectations and full-year EPS guidance exceeding analysts’ expectations.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $95.08.

Is now the time to buy Crown Holdings? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: International Paper (NYSE:IP)

Established in 1898, International Paper (NYSE:IP) produces containerboard, pulp, paper, and materials used in packaging and printing applications.

International Paper reported revenues of $6.22 billion, up 32.8% year on year, falling short of analysts’ expectations by 3.6%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

International Paper delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 11.1% since the results and currently trades at $39.33.

Read our full analysis of International Paper’s results here.

Packaging Corporation of America (NYSE:PKG)

Founded in 1959, Packaging Corporation of America (NYSE: PKG) produces containerboard and corrugated packaging products as well as displays and package protection.

Packaging Corporation of America reported revenues of $2.31 billion, up 6% year on year. This number was in line with analysts’ expectations. Aside from that, it was a softer quarter as it produced a significant miss of analysts’ EPS estimates and EPS guidance for next quarter missing analysts’ expectations significantly.

The stock is down 2.9% since reporting and currently trades at $202.70.

Sealed Air (NYSE:SEE)

Founded in 1960, Sealed Air Corporation (NYSE: SEE) specializes in the development and production of protective and food packaging solutions, serving a variety of industries.

Sealed Air reported revenues of $1.35 billion, flat year on year. This print topped analysts’ expectations by 2.7%. Overall, it was an exceptional quarter as it also put up an impressive beat of analysts’ sales volume estimates and an impressive beat of analysts’ adjusted operating income estimates.

Sealed Air delivered the highest full-year guidance raise among its peers. The stock is up 22.6% since reporting and currently trades at $41.65.

Read our full, actionable report on Sealed Air here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.