Bally's has been on fire lately. In the past six months alone, the company’s stock price has rocketed 43.6%, reaching $14.52 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Bally's, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Bally's Will Underperform?

We’re happy investors have made money, but we don't have much confidence in Bally's. Here are three reasons you should be careful with BALY and a stock we'd rather own.

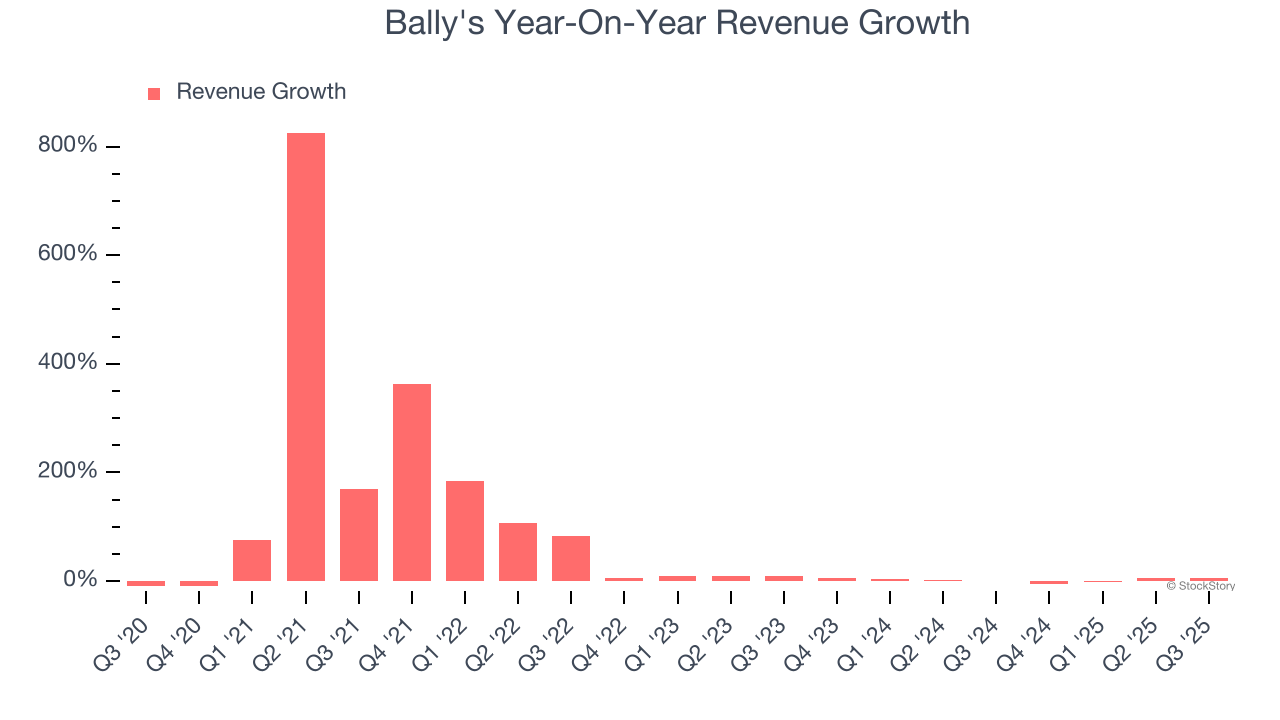

1. Lackluster Revenue Growth

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Bally’s recent performance shows its demand has slowed as its annualized revenue growth of 2% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs. Note that COVID hurt Bally’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

2. New Investments Fail to Bear Fruit as ROIC Declines

We like to invest in businesses with high returns, but the trend in a company’s ROIC can also be an early indicator of future business quality.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Bally’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

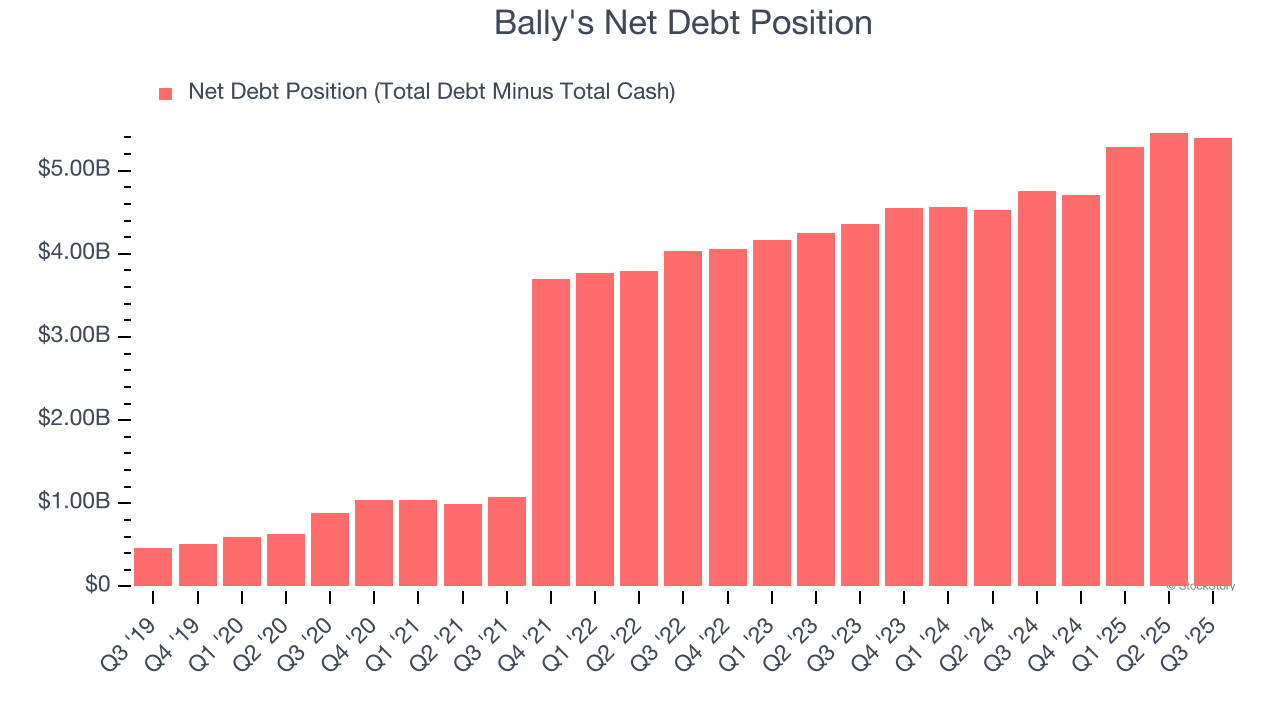

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Bally's burned through $269.9 million of cash over the last year, and its $5.63 billion of debt exceeds the $239.9 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Bally’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Bally's until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Bally's, we’ll be cheering from the sidelines. Following the recent rally, the stock trades at 10.9× forward EV-to-EBITDA (or $14.52 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.