Banc of California has been on fire lately. In the past six months alone, the company’s stock price has rocketed 42.9%, reaching $19.72 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now the time to buy Banc of California, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Do We Think Banc of California Will Underperform?

We’re happy investors have made money, but we're swiping left on Banc of California for now. Here are three reasons why BANC doesn't excite us and a stock we'd rather own.

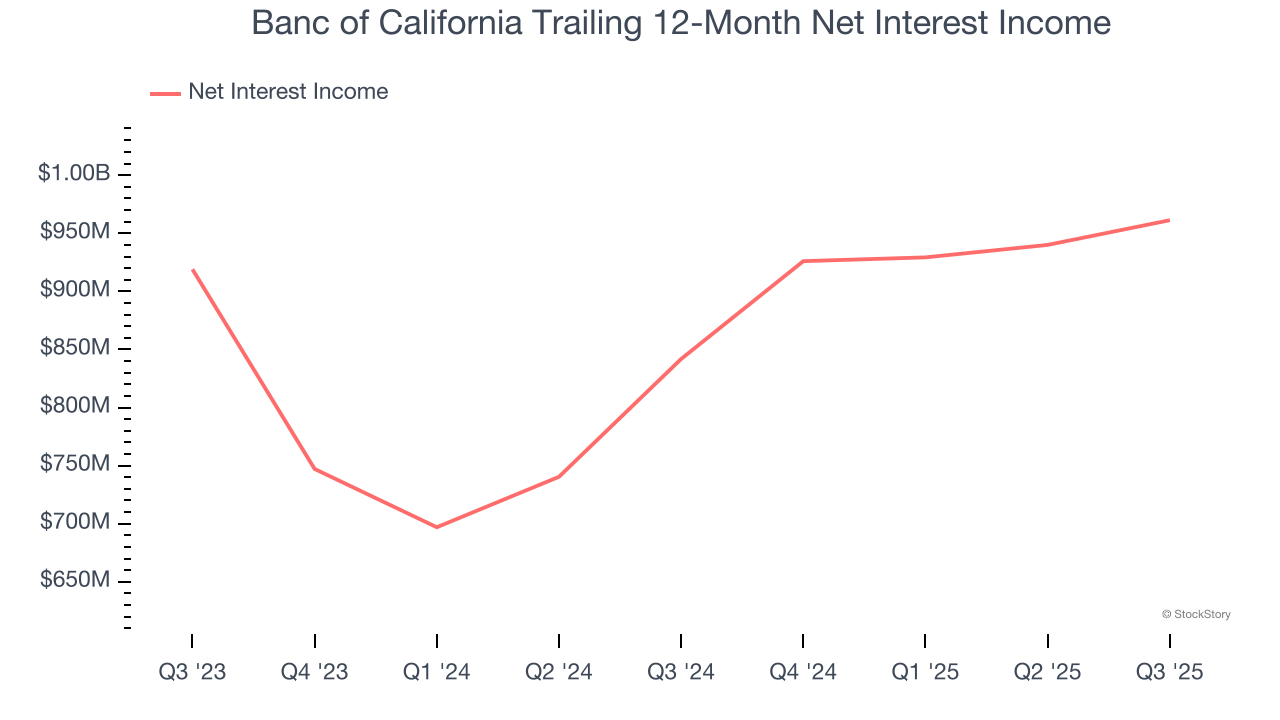

1. Net Interest Income Hits a Plateau

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

Banc of California’s net interest income was flat over the last five years, much worse than the broader banking industry and in line with its total revenue.

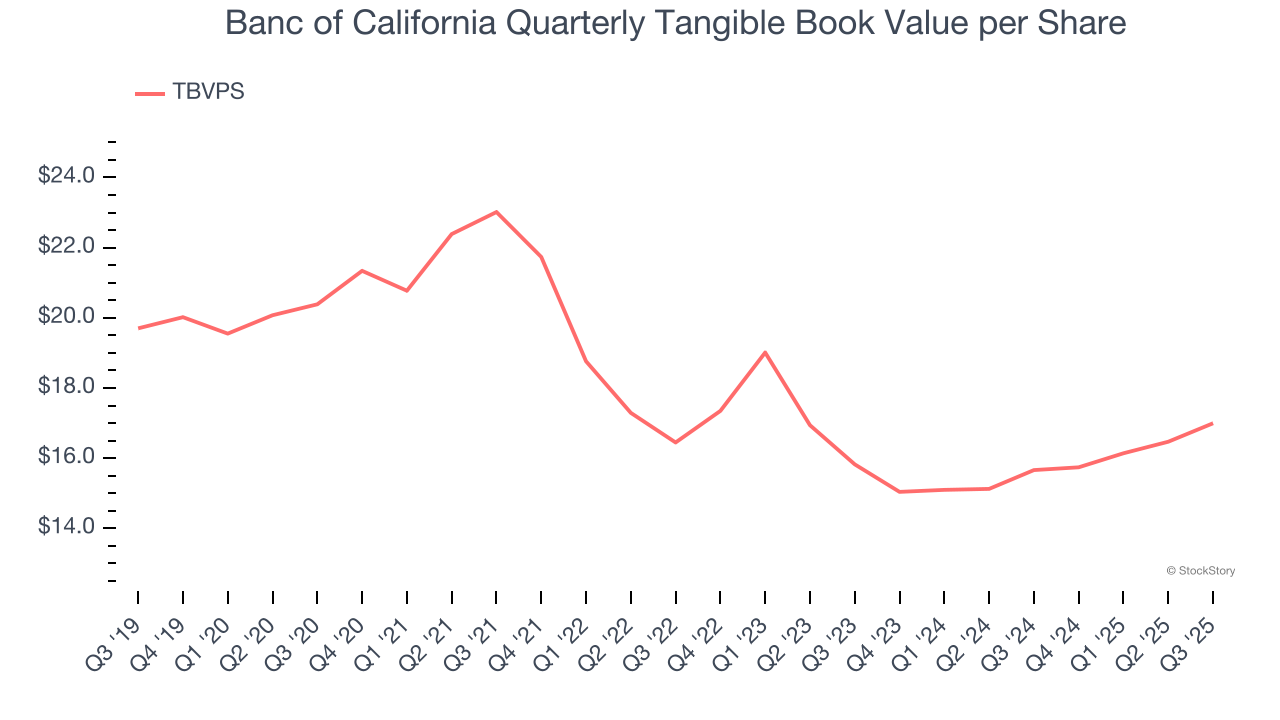

3. Substandard TBVPS Growth Indicates Limited Asset Expansion

We consider tangible book value per share (TBVPS) the most important metric to track for banks. TBVPS represents the real, liquid net worth per share of a bank, excluding intangible assets that have debatable value upon liquidation.

Disappointingly for investors, Banc of California’s TBVPS grew at a sluggish 3.6% annual clip over the last two years.

Final Judgment

Banc of California doesn’t pass our quality test. After the recent rally, the stock trades at 1× forward P/B (or $19.72 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are more exciting stocks to buy at the moment. We’d suggest looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Banc of California

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.