Looking back on medical devices & supplies - diversified stocks’ Q3 earnings, we examine this quarter’s best and worst performers, including Baxter (NYSE:BAX) and its peers.

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies. However, the capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

The 6 medical devices & supplies - diversified stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

While some medical devices & supplies - diversified stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.2% since the latest earnings results.

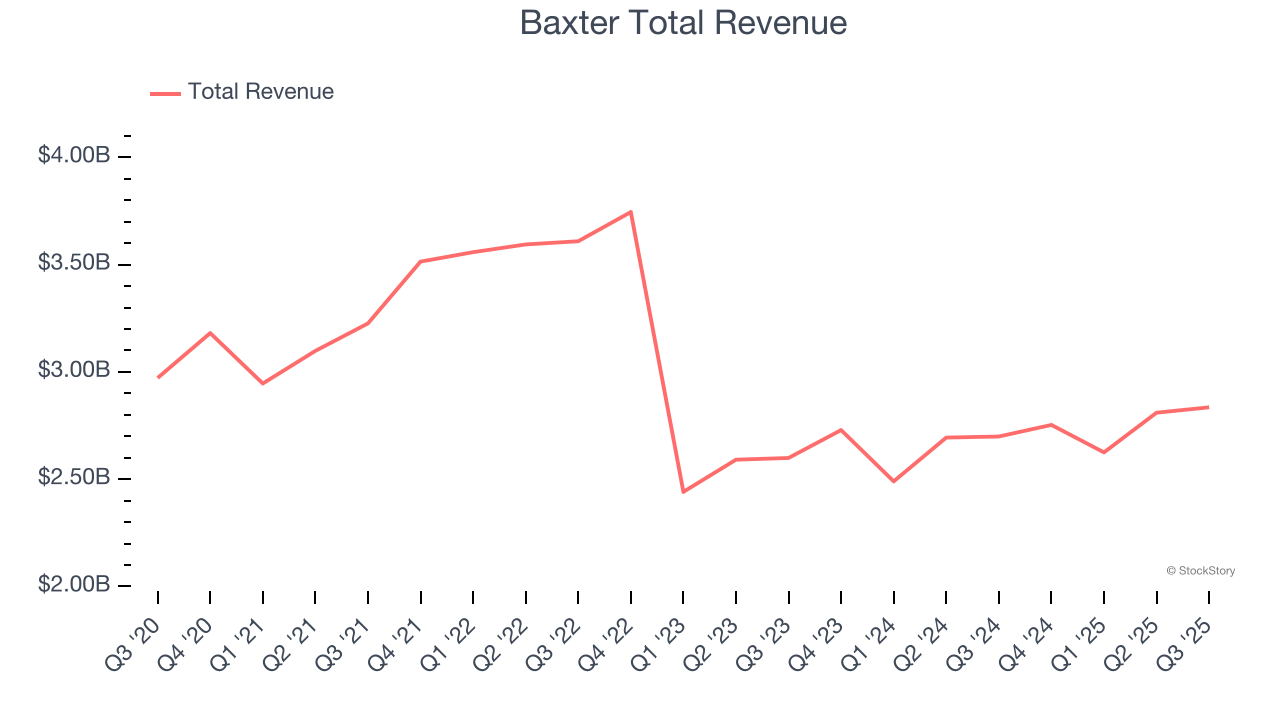

Weakest Q3: Baxter (NYSE:BAX)

With a history dating back to 1931 and products used in over 100 countries, Baxter International (NYSE:BAX) provides essential healthcare products including dialysis therapies, IV solutions, infusion systems, surgical products, and patient monitoring technologies to hospitals and clinics worldwide.

Baxter reported revenues of $2.84 billion, up 5% year on year. This print fell short of analysts’ expectations by 1.4%. Overall, it was a softer quarter for the company with a significant miss of analysts’ full-year EPS guidance estimates and revenue guidance for next quarter missing analysts’ expectations significantly.

“I joined Baxter because it’s a global healthcare leader – an iconic brand with an essential portfolio that touches more than 350 million patients every year,” said Andrew Hider, president and CEO.

Baxter delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 19% since reporting and currently trades at $18.15.

Read our full report on Baxter here, it’s free for active Edge members.

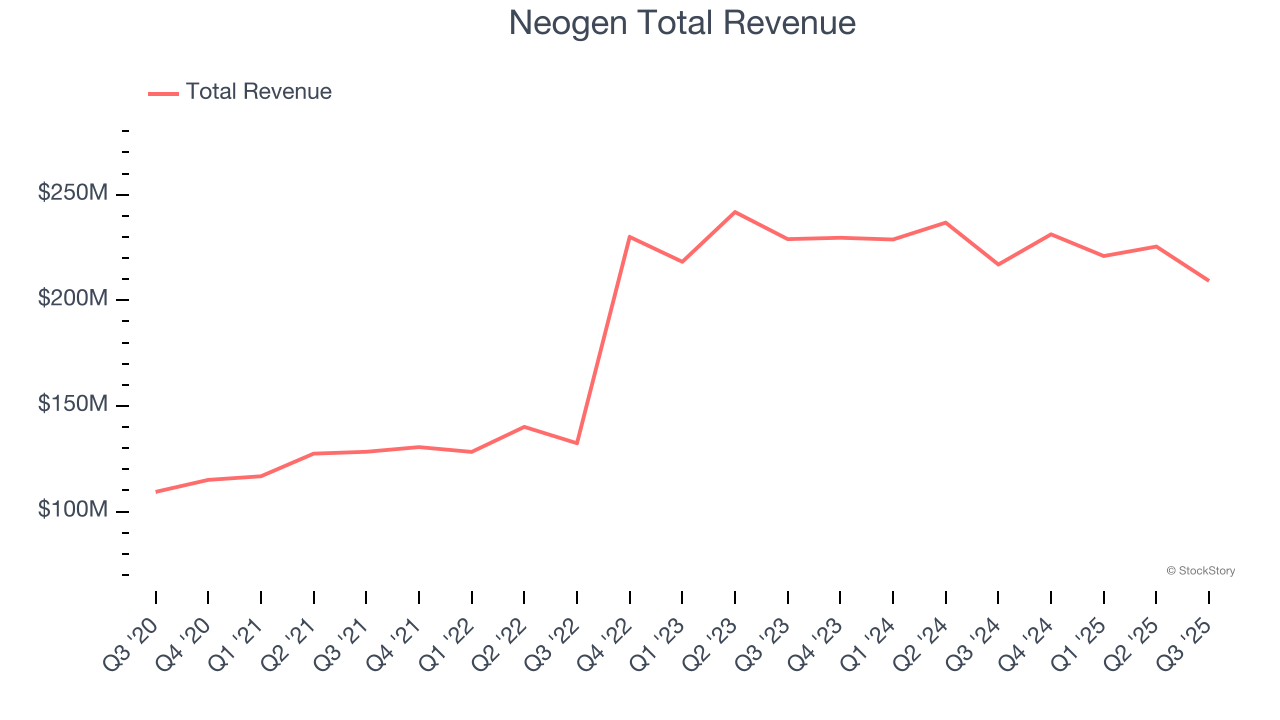

Best Q3: Neogen (NASDAQ:NEOG)

Founded in 1981 and operating at the intersection of food safety and animal health, Neogen (NASDAQ:NEOG) develops and manufactures diagnostic tests and related products to detect dangerous substances in food and pharmaceuticals for animal health.

Neogen reported revenues of $209.2 million, down 3.6% year on year, outperforming analysts’ expectations by 2.6%. The business had a very strong quarter with an impressive beat of analysts’ revenue estimates and full-year revenue guidance slightly topping analysts’ expectations.

Neogen achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 21.2% since reporting. It currently trades at $6.98.

Is now the time to buy Neogen? Access our full analysis of the earnings results here, it’s free for active Edge members.

Abbott Laboratories (NYSE:ABT)

With roots dating back to 1888 when founder Dr. Wallace Abbott began producing precise, dosage-form medications, Abbott Laboratories (NYSE:ABT) develops and sells a diverse range of healthcare products including medical devices, diagnostics, nutrition products, and branded generic pharmaceuticals.

Abbott Laboratories reported revenues of $11.37 billion, up 6.9% year on year, in line with analysts’ expectations. It was a mixed quarter as it posted organic revenue in line with analysts’ estimates but revenue in line with analysts’ estimates.

As expected, the stock is down 7.7% since the results and currently trades at $122.98.

Read our full analysis of Abbott Laboratories’s results here.

Boston Scientific (NYSE:BSX)

Founded in 1979 with a mission to advance less-invasive medicine, Boston Scientific (NYSE:BSX) develops and manufactures medical devices used in minimally invasive procedures across cardiovascular, urological, neurological, and gastrointestinal specialties.

Boston Scientific reported revenues of $5.07 billion, up 20.3% year on year. This print surpassed analysts’ expectations by 1.9%. It was a very strong quarter as it also logged an impressive beat of analysts’ organic revenue estimates and revenue guidance for next quarter topping analysts’ expectations.

Boston Scientific scored the fastest revenue growth among its peers. The stock is down 7.1% since reporting and currently trades at $92.80.

Read our full, actionable report on Boston Scientific here, it’s free for active Edge members.

CooperCompanies (NASDAQ:COO)

With a history dating back to 1958 and a portfolio spanning two distinct healthcare segments, Cooper Companies (NASDAQ:COO) develops and manufactures medical devices focused on vision care through contact lenses and women's health including fertility products and services.

CooperCompanies reported revenues of $1.07 billion, up 4.6% year on year. This result was in line with analysts’ expectations. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ full-year EPS guidance estimates and an impressive beat of analysts’ EPS guidance for next quarter estimates.

CooperCompanies had the weakest full-year guidance update among its peers. The stock is up 3.4% since reporting and currently trades at $79.68.

Read our full, actionable report on CooperCompanies here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.