What a brutal six months it’s been for Bowhead Specialty. The stock has dropped 25.7% and now trades at $25.87, rattling many shareholders. This might have investors contemplating their next move.

Following the drawdown, is now the time to buy BOW? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Bowhead Specialty?

Named after the Arctic bowhead whale known for navigating challenging waters, Bowhead Specialty Holdings (NYSE:BOW) is a specialty insurance company that provides customized coverage for complex and high-risk commercial sectors.

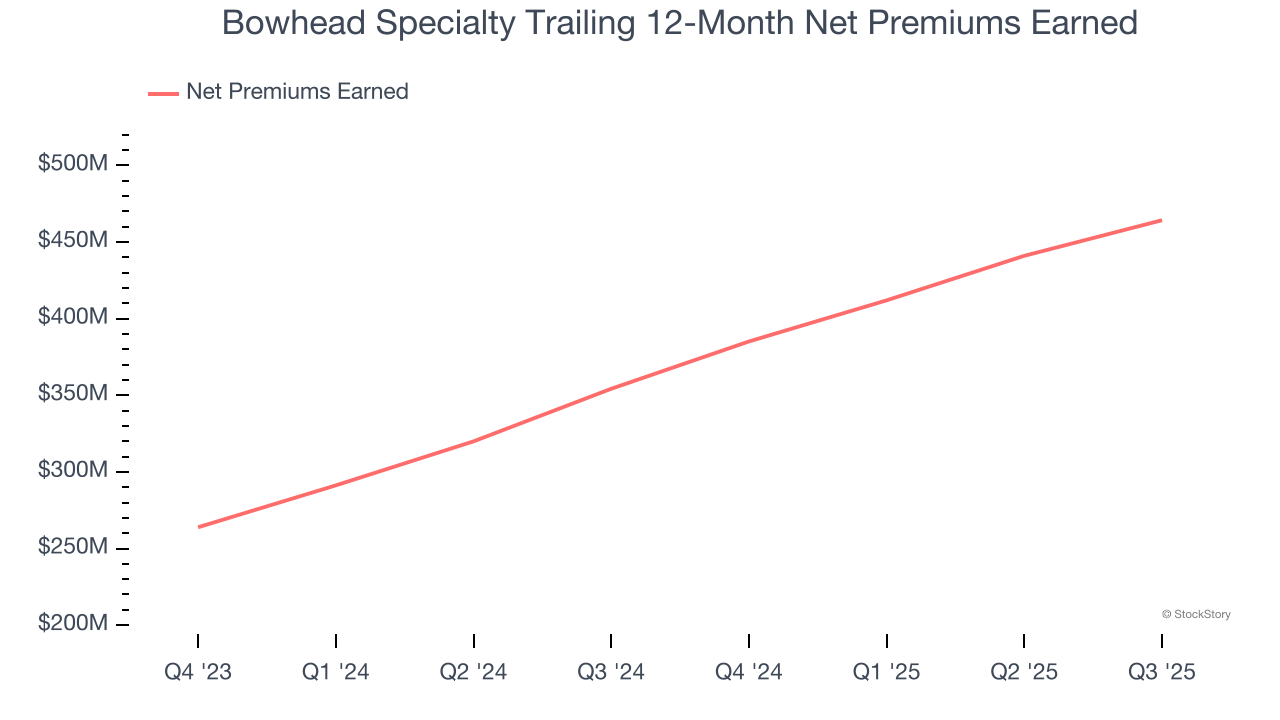

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

Net premiums earned are net of what’s paid to reinsurers (insurance for insurance companies), which are used by insurers to protect themselves from large losses.

Bowhead Specialty’s net premiums earned has grown at a 37.9% annualized rate over the last two years, much better than the broader insurance industry.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Bowhead Specialty’s revenue to rise by 20.5%. While this projection is below its 42.1% annualized growth rate for the past two years, it is eye-popping and suggests the market is baking in success for its products and services.

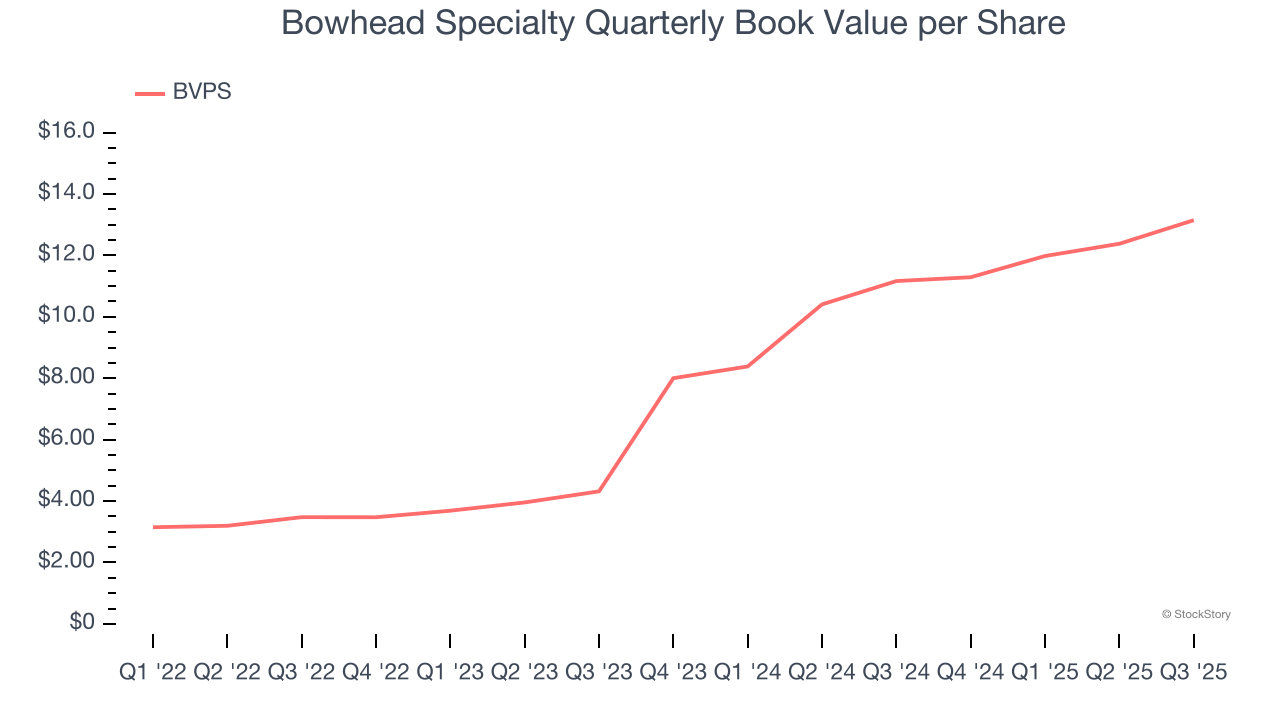

3. Growing BVPS Reflects Strong Asset Base

Book value per share (BVPS) serves as a key indicator of an insurer’s financial stability, reflecting a company’s ability to maintain adequate capital levels and meet its long-term obligations to policyholders.

Fortunately for investors, Bowhead Specialty’s BVPS grew at an incredible 74.5% annual clip over the last two years.

Final Judgment

These are just a few reasons why we're bullish on Bowhead Specialty. After the recent drawdown, the stock trades at 2.1× forward P/B (or $25.87 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Bowhead Specialty

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.