Conagra currently trades at $19.15 per share and has shown little upside over the past six months, posting a small loss of 0.6%. The stock also fell short of the S&P 500’s 8.6% gain during that period.

Is now the time to buy Conagra, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Conagra Will Underperform?

We're sitting this one out for now. Here are three reasons we avoid CAG and a stock we'd rather own.

1. Demand Slipping as Sales Volumes Decline

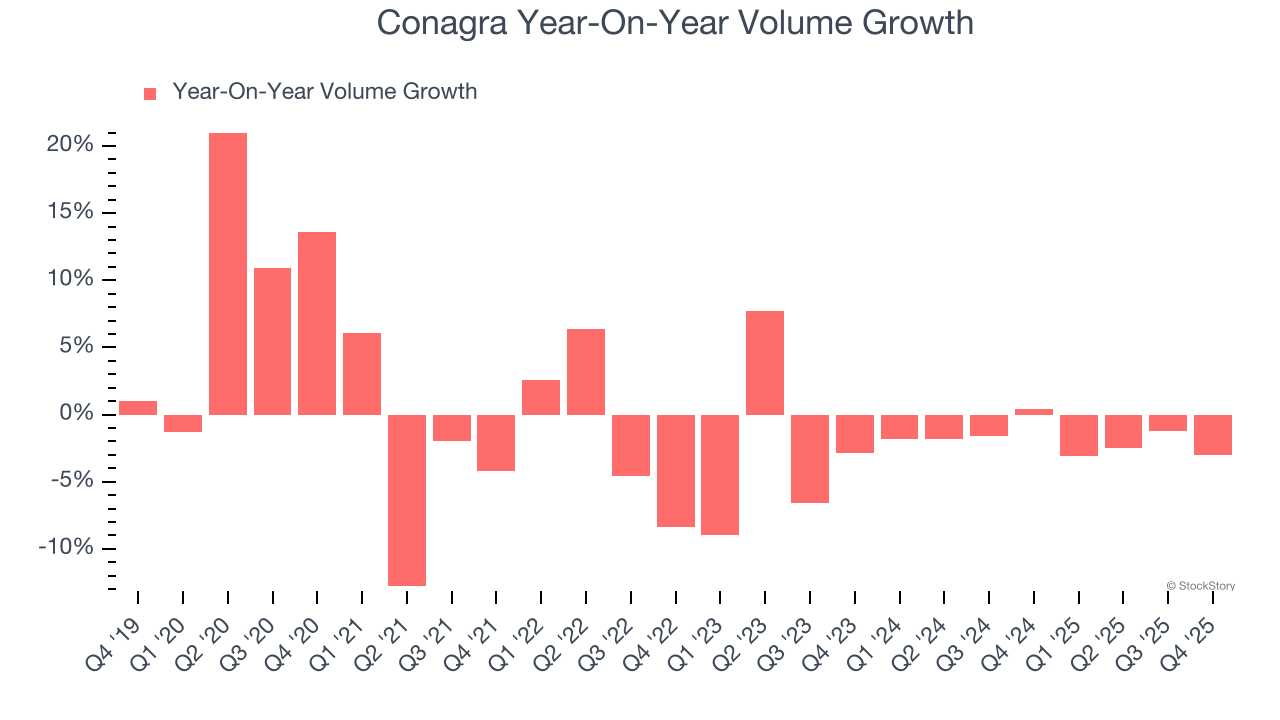

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Conagra’s average quarterly sales volumes have shrunk by 1.8% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Conagra’s revenue to stall. While this projection implies its newer products will fuel better top-line performance, it is still below average for the sector.

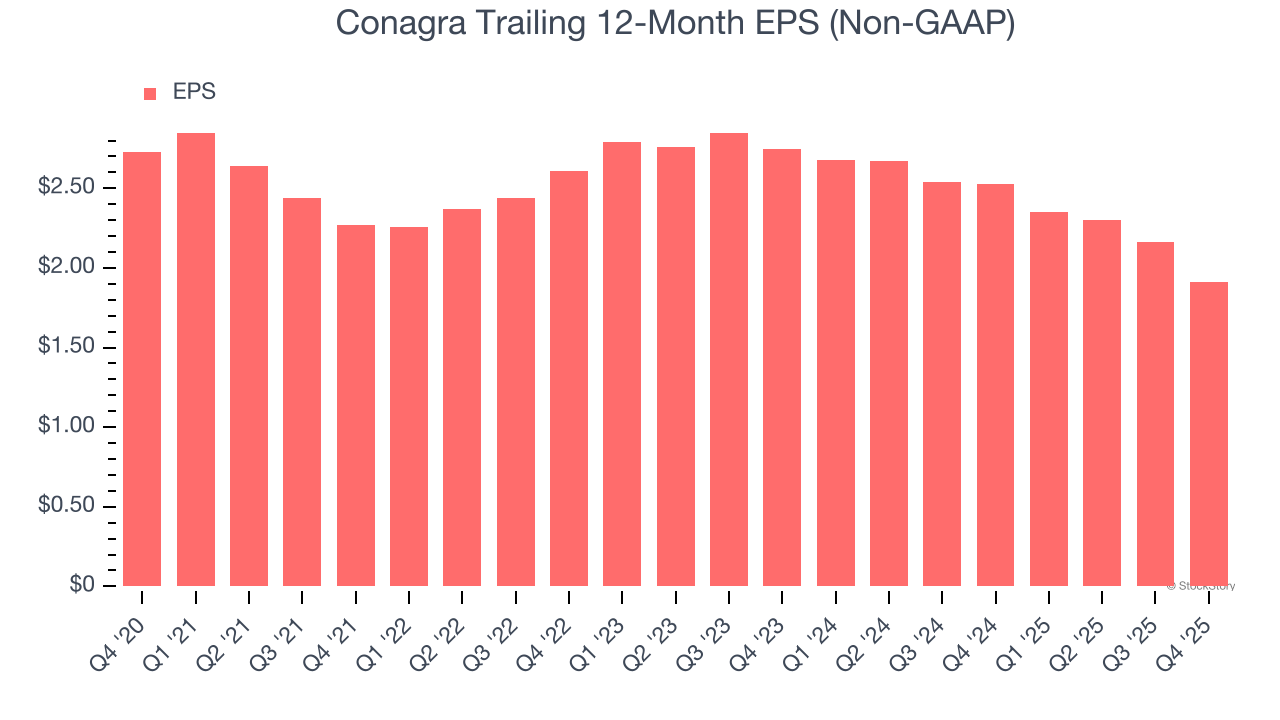

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Conagra, its EPS declined by 9.9% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Conagra doesn’t pass our quality test. With its shares lagging the market recently, the stock trades at 10.9× forward P/E (or $19.15 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Conagra

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.