What a fantastic six months it’s been for Caterpillar. Shares of the company have skyrocketed 59.4%, hitting $624.00. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Caterpillar, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free for active Edge members.

Why Is Caterpillar Not Exciting?

We’re glad investors have benefited from the price increase, but we don't have much confidence in Caterpillar. Here are three reasons why CAT doesn't excite us and a stock we'd rather own.

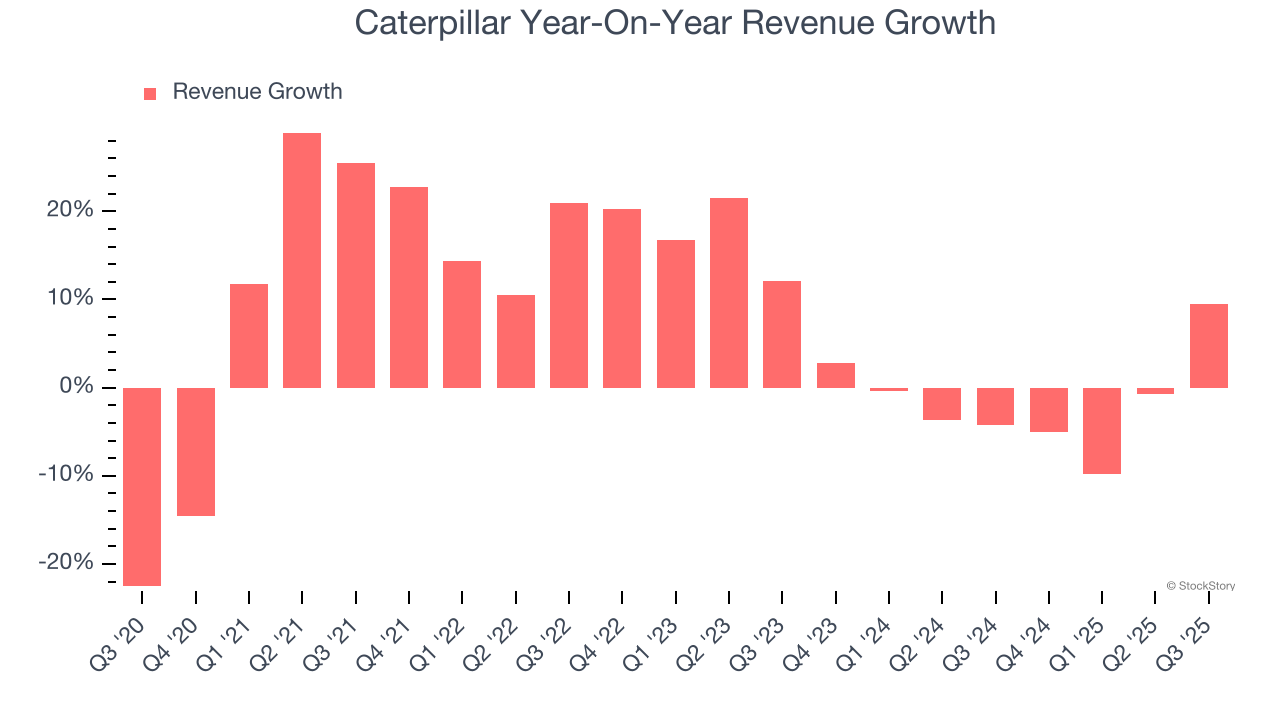

1. Revenue Tumbling Downwards

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Caterpillar’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 1.4% over the last two years. Caterpillar isn’t alone in its struggles as the Construction Machinery industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

2. Core Business Falling Behind as Demand Declines

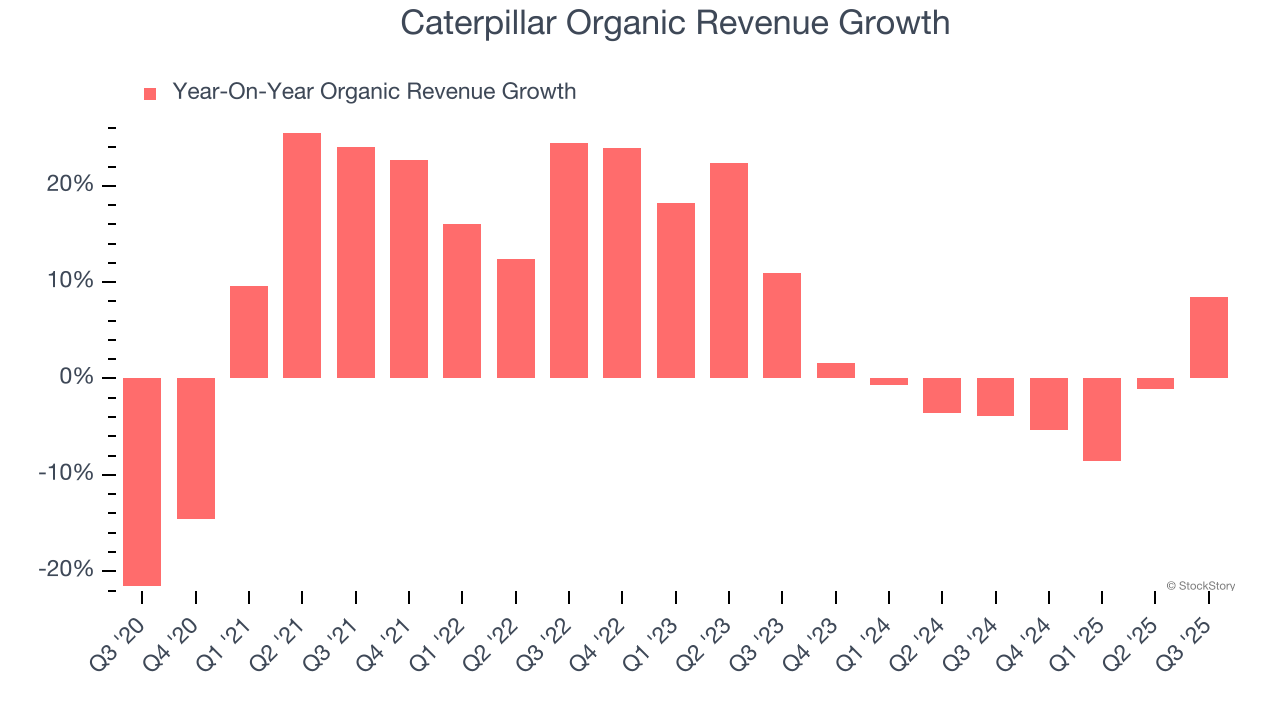

Investors interested in Construction Machinery companies should track organic revenue in addition to reported revenue. This metric gives visibility into Caterpillar’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Caterpillar’s organic revenue averaged 1.6% year-on-year declines. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Caterpillar might have to lean into acquisitions to grow, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

3. EPS Took a Dip Over the Last Two Years

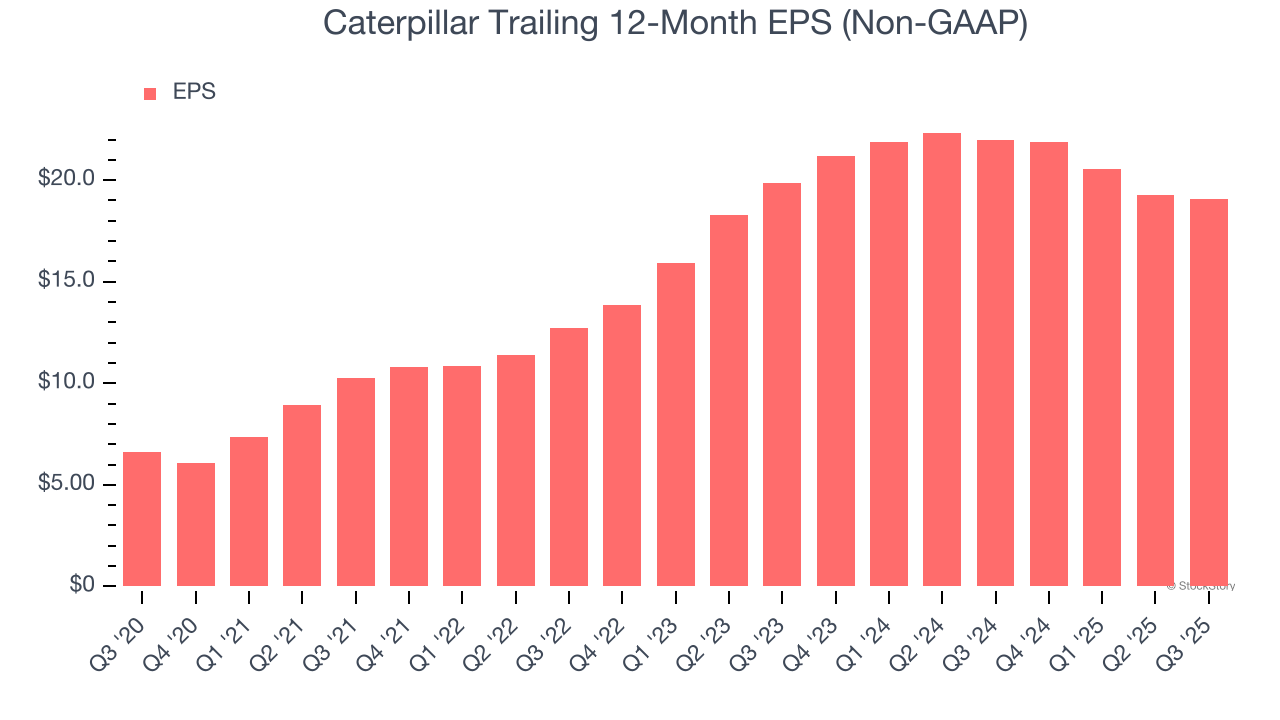

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Caterpillar, its EPS and revenue declined by 2% and 1.4% annually over the last two years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Caterpillar’s low margin of safety could leave its stock price susceptible to large downswings.

Final Judgment

Caterpillar isn’t a terrible business, but it doesn’t pass our quality test. After the recent rally, the stock trades at 29.7× forward P/E (or $624.00 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Caterpillar

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.