Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Caterpillar (NYSE:CAT) and its peers.

Automation that increases efficiencies and connected equipment that collects analyzable data have been trending, creating new demand for heavy machinery and equipment companies. The gradual transition to clean energy also allows companies to innovate around emissions, potentially spurring replacement cycles that can accelerate revenue growth. On the other hand, heavy machinery companies are at the whim of economic cycles. Interest rates, for example, can greatly impact the commercial and residential construction that drives demand for these companies’ offerings.

The 22 heavy machinery stocks we track reported a mixed Q3. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 1.1% on average since the latest earnings results.

Best Q3: Caterpillar (NYSE:CAT)

With its iconic yellow machinery working on construction sites, Caterpillar (NYSE:CAT) manufactures construction equipment like bulldozers, excavators, and parts and maintenance services.

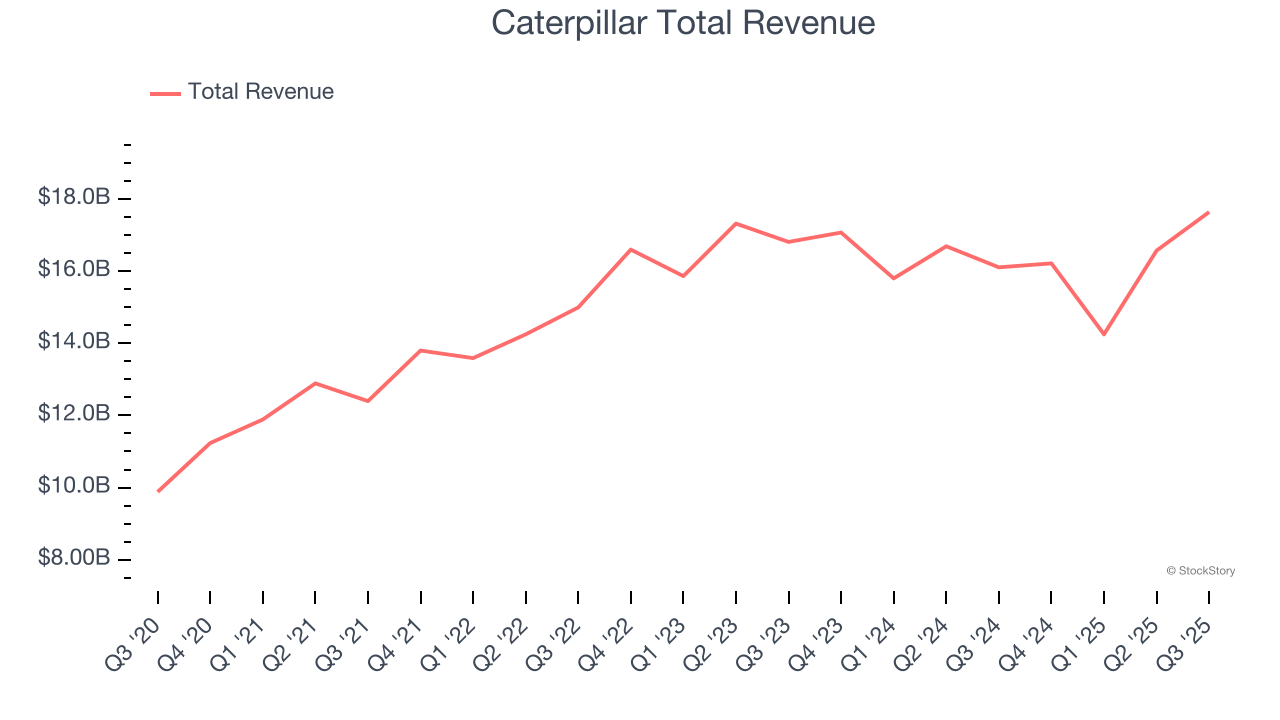

Caterpillar reported revenues of $17.64 billion, up 9.5% year on year. This print exceeded analysts’ expectations by 6.1%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EBITDA estimates.

"Solid performance from our team generated strong results this quarter, driven by resilient demand and focused execution across our three primary segments," said Caterpillar CEO Joe Creed.

Interestingly, the stock is up 9.4% since reporting and currently trades at $573.95.

Is now the time to buy Caterpillar? Access our full analysis of the earnings results here, it’s free for active Edge members.

REV Group (NYSE:REVG)

Offering the first full-electric North American fire truck, REV (NYSE:REVG) manufactures and sells specialty vehicles.

REV Group reported revenues of $664.4 million, up 11.1% year on year, outperforming analysts’ expectations by 4.5%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 9.3% since reporting. It currently trades at $60.80.

Is now the time to buy REV Group? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Wabash (NYSE:WNC)

With its first trailer reportedly built on two sawhorses, Wabash (NYSE:WNC) offers semi trailers, liquid transportation containers, truck bodies, and equipment for moving goods.

Wabash reported revenues of $381.6 million, down 17.8% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and full-year EPS guidance missing analysts’ expectations significantly.

Wabash delivered the weakest full-year guidance update in the group. Interestingly, the stock is up 3.5% since the results and currently trades at $8.60.

Read our full analysis of Wabash’s results here.

Blue Bird (NASDAQ:BLBD)

With around a century of experience, Blue Bird (NASDAQ:BLBD) is a manufacturer of school buses and complementary parts.

Blue Bird reported revenues of $409.4 million, up 16.9% year on year. This number beat analysts’ expectations by 7.7%. It was a very strong quarter as it also produced a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Blue Bird achieved the biggest analyst estimates beat among its peers. The stock is down 15.1% since reporting and currently trades at $46.60.

Read our full, actionable report on Blue Bird here, it’s free for active Edge members.

Douglas Dynamics (NYSE:PLOW)

Once manufacturing snowplows designed for the iconic jeep vehicle precursor, Douglas Dynamics (NYSE:PLOW) offers snow and ice equipment for the roads and sidewalks.

Douglas Dynamics reported revenues of $162.1 million, up 25.3% year on year. This print lagged analysts' expectations by 0.7%. Zooming out, it was actually a strong quarter as it put up an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance slightly topping analysts’ expectations.

Douglas Dynamics delivered the fastest revenue growth among its peers. The stock is up 10% since reporting and currently trades at $32.66.

Read our full, actionable report on Douglas Dynamics here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.