Chubb trades at $306.81 and has moved in lockstep with the market. Its shares have returned 9.5% over the last six months while the S&P 500 has gained 10.4%.

Is now the time to buy CB? Find out in our full research report, it’s free.

Why Do Investors Watch CB Stock?

Dating back to when a Civil War veteran created a frost-proof water meter, Chubb Limited (NYSE:CB) provides commercial and personal property and casualty insurance, reinsurance, and life insurance products to a diverse client base across 54 countries.

Three Things to Like:

1. Net Premiums Earned Drive Additional Growth Opportunities

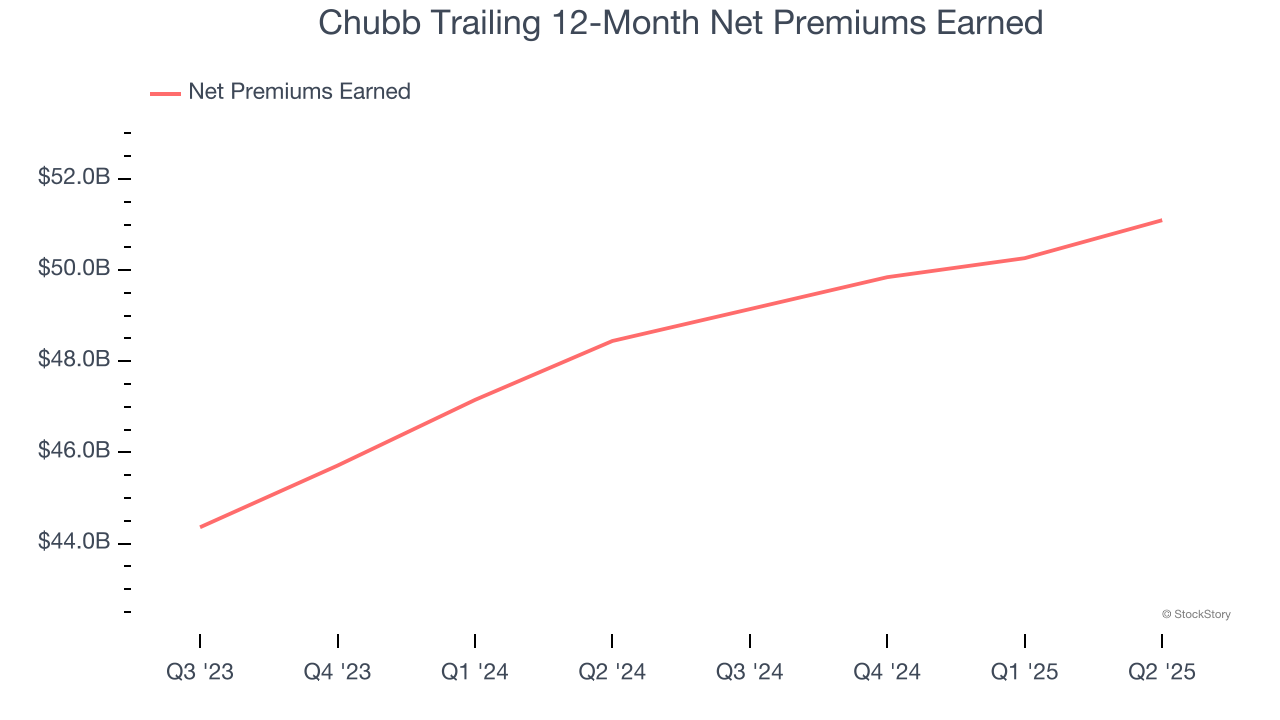

Insurers sell policies then use reinsurance (insurance for insurance companies) to protect themselves from large losses. Net premiums earned are therefore what's collected from selling policies less what’s paid to reinsurers as a risk mitigation tool.

Chubb’s net premiums earned has grown at a 9.1% annualized rate over the last two years, a step above the broader insurance industry and in line with its total revenue.

3. Outstanding Long-Term EPS Growth

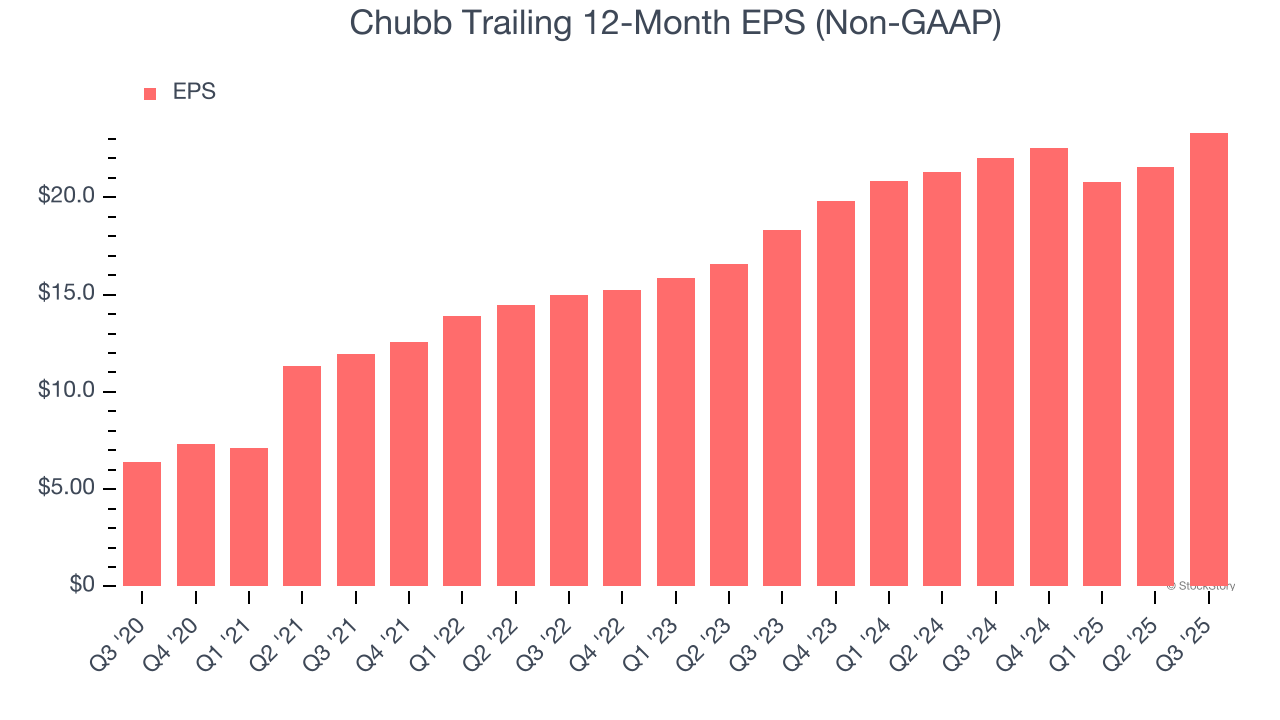

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Chubb’s EPS grew at an astounding 29.5% compounded annual growth rate over the last five years, higher than its 10.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

Chubb possesses several positive attributes, but at $306.81 per share (or 1.6× forward P/B), is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.