Cruise ship company Carnival (NYSE:CCL) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 6.6% year on year to $6.33 billion. Its non-GAAP profit of $0.34 per share was 38.6% above analysts’ consensus estimates.

Is now the time to buy Carnival? Find out by accessing our full research report, it’s free for active Edge members.

Carnival (CCL) Q4 CY2025 Highlights:

- Revenue: $6.33 billion vs analyst estimates of $6.37 billion (6.6% year-on-year growth, 0.6% miss)

- Adjusted EPS: $0.34 vs analyst estimates of $0.25 (38.6% beat)

- Adjusted EBITDA: $1.48 billion vs analyst estimates of $1.37 billion (23.3% margin, 8.1% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.48 at the midpoint, beating analyst estimates by 2.5%

- EBITDA guidance for the upcoming financial year 2026 is $7.63 billion at the midpoint, above analyst estimates of $7.53 billion

- Operating Margin: 11.6%, up from 9.4% in the same quarter last year

- Free Cash Flow Margin: 0.2%, down from 5.3% in the same quarter last year

- Passenger Cruise Days: 24.6 million, in line with the same quarter last year

- Market Capitalization: $36.96 billion

"2025 was a truly phenomenal year. We set new records across our business, achieved investment grade leverage metrics and, as announced just today, reinstated our dividend. These milestones reflect the collective strength of our cruise line portfolio and confidence in our long-term future," said Carnival Corporation & plc's Chief Executive Officer Josh Weinstein.

Company Overview

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE:CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Carnival grew its sales at a 36.6% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Carnival’s recent performance shows its demand has slowed as its annualized revenue growth of 11% over the last two years was below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of passenger cruise days, which reached 24.6 million in the latest quarter. Over the last two years, Carnival’s passenger cruise days averaged 5.8% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Carnival’s revenue grew by 6.6% year on year to $6.33 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Carnival’s operating margin has been trending up over the last 12 months and averaged 15.6% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

In Q4, Carnival generated an operating margin profit margin of 11.6%, up 2.2 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

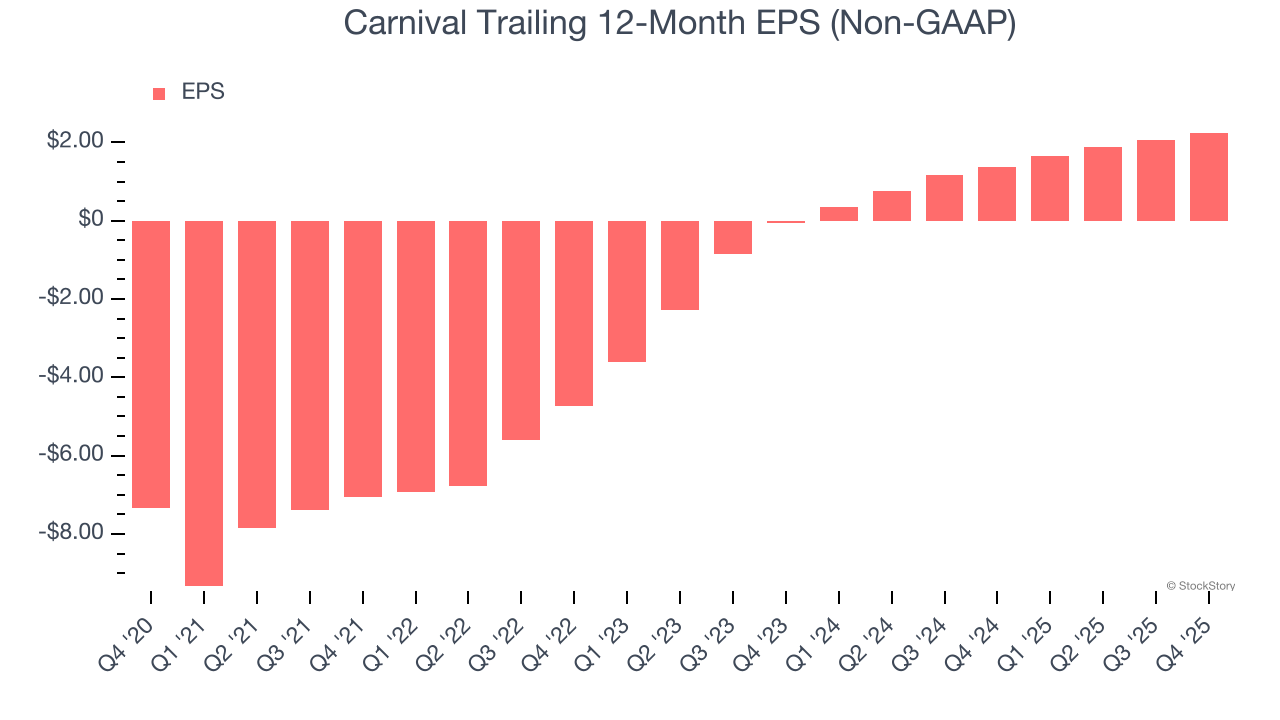

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Carnival’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Carnival reported adjusted EPS of $0.34, up from $0.14 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Carnival’s full-year EPS of $2.25 to grow 7.5%.

Key Takeaways from Carnival’s Q4 Results

It was good to see Carnival beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its number of passenger cruise days missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives.

So do we think Carnival is an attractive buy at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.