The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how household products stocks fared in Q3, starting with Church & Dwight (NYSE:CHD).

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

The 10 household products stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was 1% above.

While some household products stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2% since the latest earnings results.

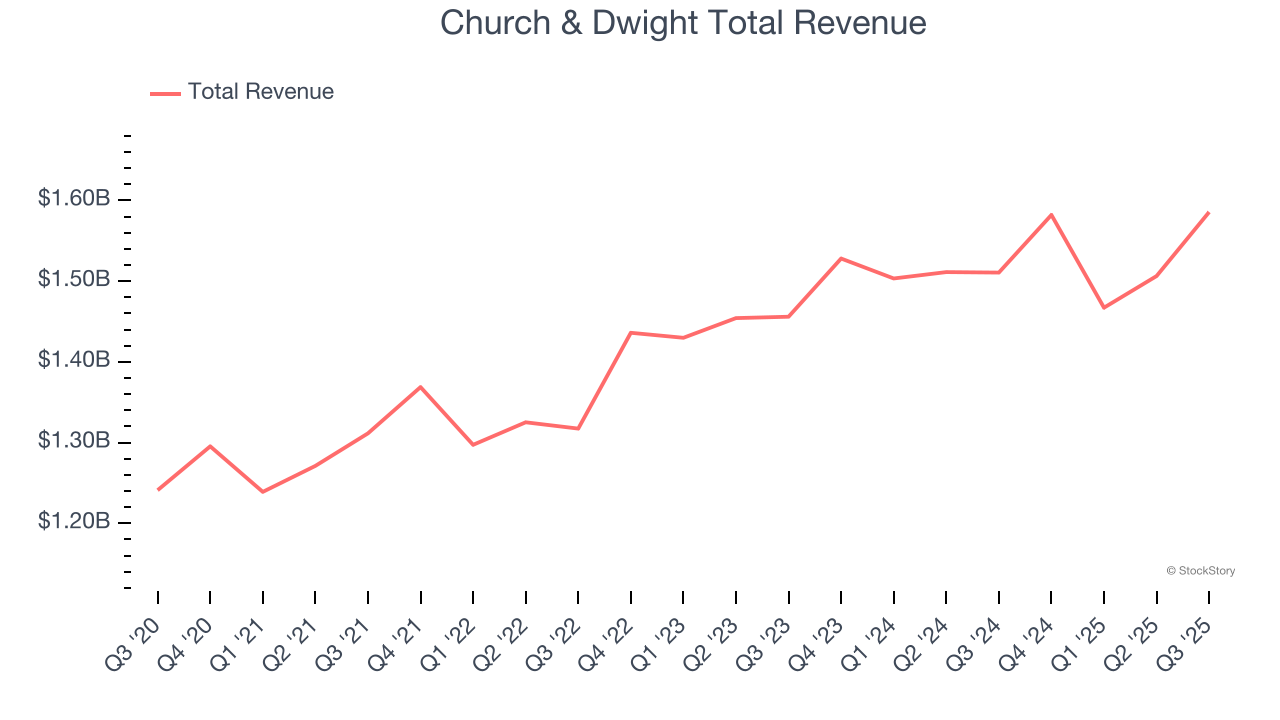

Church & Dwight (NYSE:CHD)

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Church & Dwight reported revenues of $1.59 billion, up 5% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

Rick Dierker, Chief Executive Officer, commented, “In a challenging environment, we are pleased to deliver another quarter of strong results. We continue to drive both dollar and volume share gains across most of our brands. Our balanced portfolio of value and premium products and our relentless focus on innovation continue to position us well for the future. We also were encouraged with our first quarter of ownership of TOUCHLAND, as our results exceeded our initial expectations.

Church & Dwight scored the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 4.3% since reporting and currently trades at $85.36.

Is now the time to buy Church & Dwight? Access our full analysis of the earnings results here, it’s free for active Edge members.

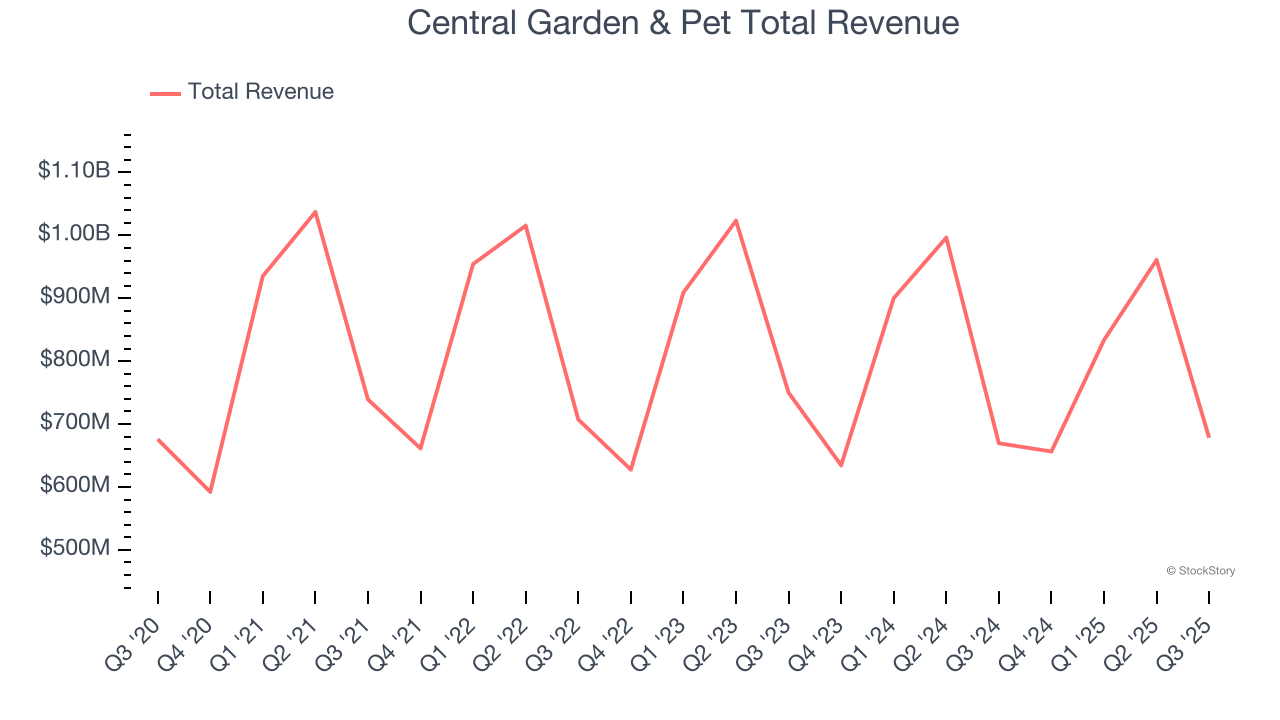

Best Q3: Central Garden & Pet (NASDAQ:CENT)

Enhancing the lives of both pets and homeowners, Central Garden & Pet (NASDAQ:CENT) is a leading producer and distributor of essential products for pet care, lawn and garden maintenance, and pest control.

Central Garden & Pet reported revenues of $678.2 million, up 1.3% year on year, outperforming analysts’ expectations by 3.9%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The market seems content with the results as the stock is up 4% since reporting. It currently trades at $32.68.

Is now the time to buy Central Garden & Pet? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Energizer (NYSE:ENR)

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

Energizer reported revenues of $832.8 million, up 3.4% year on year, exceeding analysts’ expectations by 0.8%. Still, it was a softer quarter as it posted EPS guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ gross margin estimates.

As expected, the stock is down 16.5% since the results and currently trades at $19.92.

Read our full analysis of Energizer’s results here.

Clorox (NYSE:CLX)

Founded in 1913 with bleach as the sole product offering, Clorox (NYSE:CLX) today is a consumer products giant whose product portfolio spans everything from bleach to skincare to salad dressing to kitty litter.

Clorox reported revenues of $1.43 billion, down 18.9% year on year. This number topped analysts’ expectations by 2%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ revenue estimates.

Clorox had the slowest revenue growth among its peers. The stock is down 9.8% since reporting and currently trades at $98.47.

Read our full, actionable report on Clorox here, it’s free for active Edge members.

Reynolds (NASDAQ:REYN)

Best known for its aluminum foil, Reynolds (NASDAQ:REYN) is a household products company whose products focus on food storage, cooking, and waste.

Reynolds reported revenues of $931 million, up 2.3% year on year. This result beat analysts’ expectations by 3.4%. It was a strong quarter as it also logged revenue guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ organic revenue estimates.

The stock is down 1.7% since reporting and currently trades at $23.29.

Read our full, actionable report on Reynolds here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.