E-commerce pet food and supplies retailer Chewy (NYSE:CHWY) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 8.3% year on year to $3.12 billion. Its non-GAAP profit of $0.32 per share was 5.4% above analysts’ consensus estimates.

Is now the time to buy Chewy? Find out by accessing our full research report, it’s free for active Edge members.

Chewy (CHWY) Q3 CY2025 Highlights:

- Revenue: $3.12 billion vs analyst estimates of $3.1 billion (8.3% year-on-year growth, 0.5% beat)

- Adjusted EPS: $0.32 vs analyst estimates of $0.30 (5.4% beat)

- Adjusted EBITDA: $180.9 million vs analyst estimates of $170 million (5.8% margin, 6.4% beat)

- Operating Margin: 2.1%, up from 0.9% in the same quarter last year

- Free Cash Flow Margin: 5.6%, up from 3.4% in the previous quarter

- Market Capitalization: $14.45 billion

Company Overview

Founded by Ryan Cohen, who later became known for his involvement in GameStop, Chewy (NYSE:CHWY) is an online retailer specializing in pet food, supplies, and healthcare services.

Revenue Growth

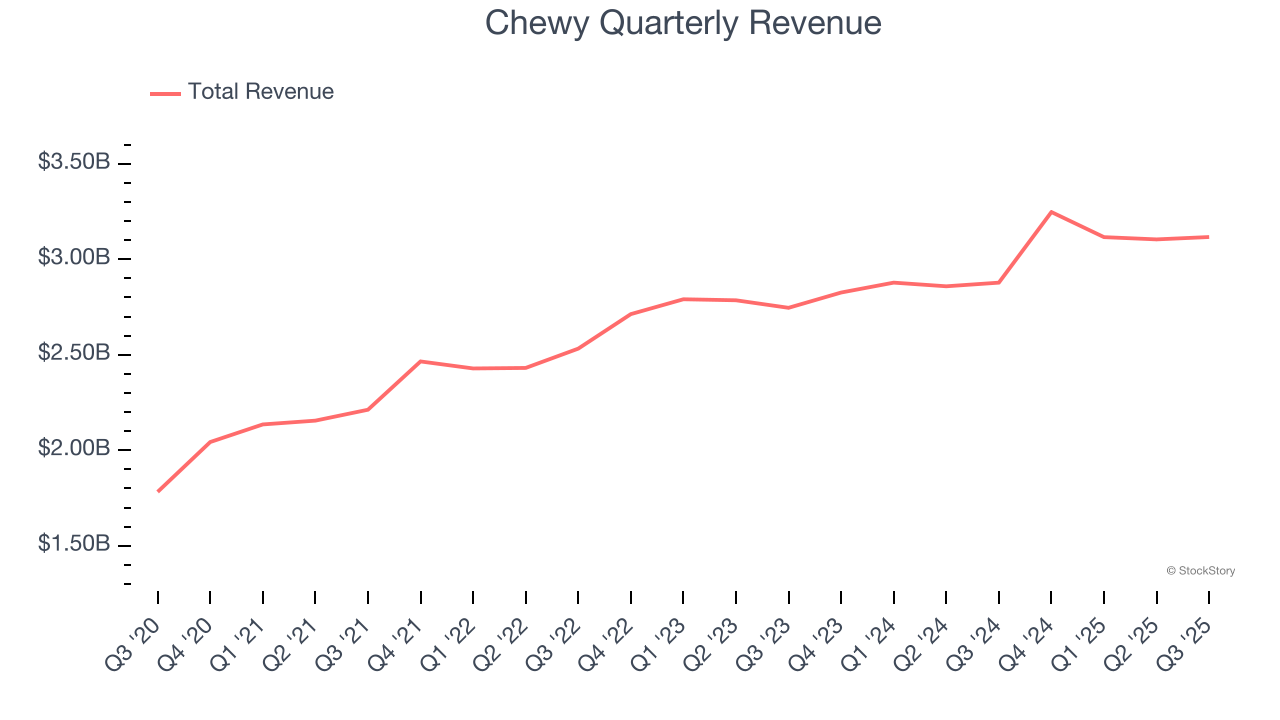

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Chewy’s 8.5% annualized revenue growth over the last three years was mediocre. This was below our standard for the consumer internet sector and is a poor baseline for our analysis.

This quarter, Chewy reported year-on-year revenue growth of 8.3%, and its $3.12 billion of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.9% over the next 12 months, a slight deceleration versus the last three years. This projection is underwhelming and implies its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

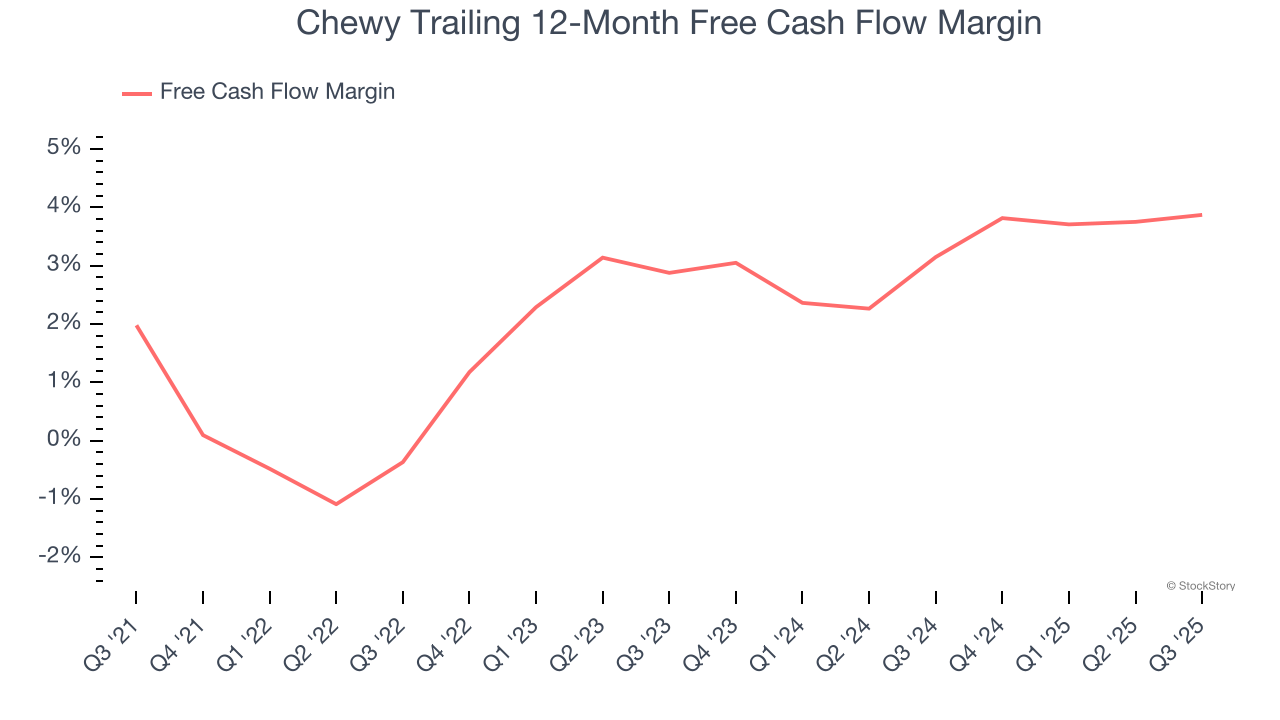

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Chewy has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.5%, subpar for a consumer internet business.

Taking a step back, an encouraging sign is that Chewy’s margin expanded by 4.2 percentage points over the last few years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

Chewy’s free cash flow clocked in at $175.8 million in Q3, equivalent to a 5.6% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

Key Takeaways from Chewy’s Q3 Results

We enjoyed seeing Chewy beat analysts’ EBITDA expectations this quarter. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 2.8% to $35.82 immediately following the results.

Chewy may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.