Over the last six months, Chipotle’s shares have sunk to $38.41, producing a disappointing 7.7% loss - a stark contrast to the S&P 500’s 9.1% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy CMG? Find out in our full research report, it’s free.

Why Do Investors Watch Chipotle?

Born from a desire to offer quick meals with fresh, flavorful ingredients, Chipotle (NYSE:CMG) is a fast-food chain known for its healthy, Mexican-inspired cuisine and customizable dishes.

Three Things to Like:

1. New Restaurants Opening at Breakneck Speed

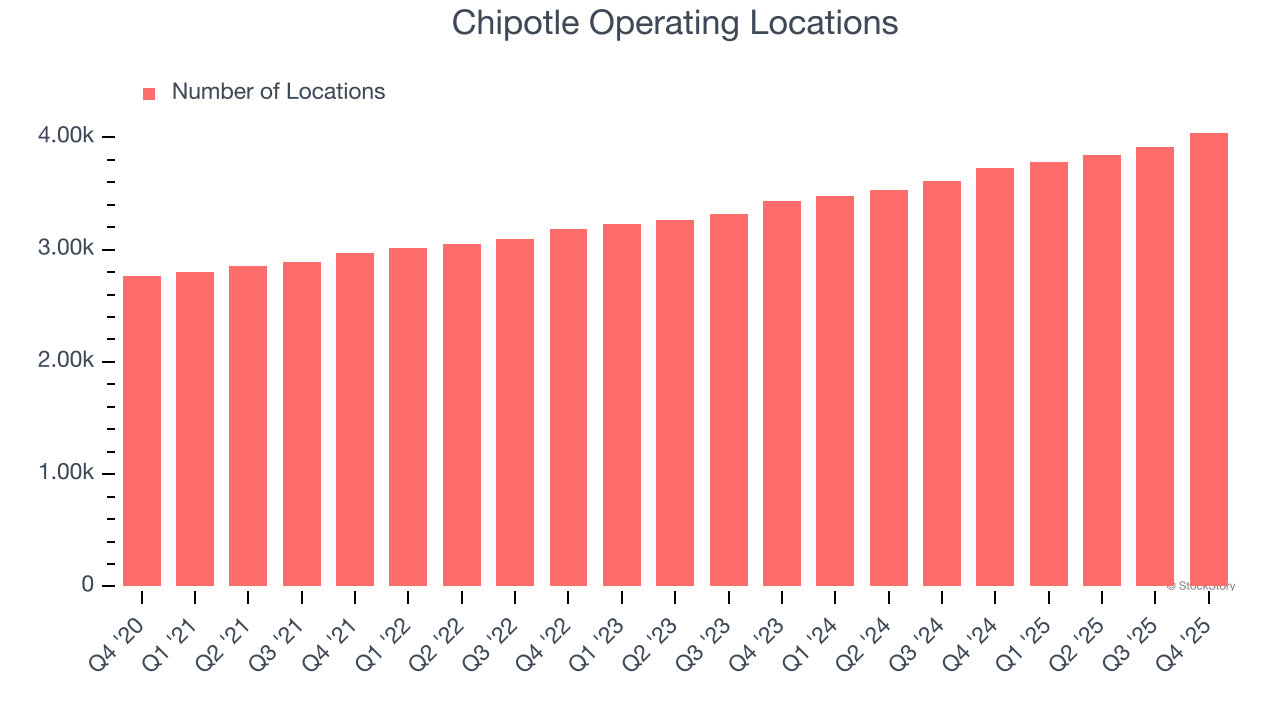

A restaurant chain’s total number of dining locations often determines how much revenue it can generate.

Chipotle sported 4,042 locations in the latest quarter. Over the last two years, it has opened new restaurants at a rapid clip by averaging 8.4% annual growth, among the fastest in the restaurant sector.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

2. Solid Same-Store Sales Suggest Increasing Demand

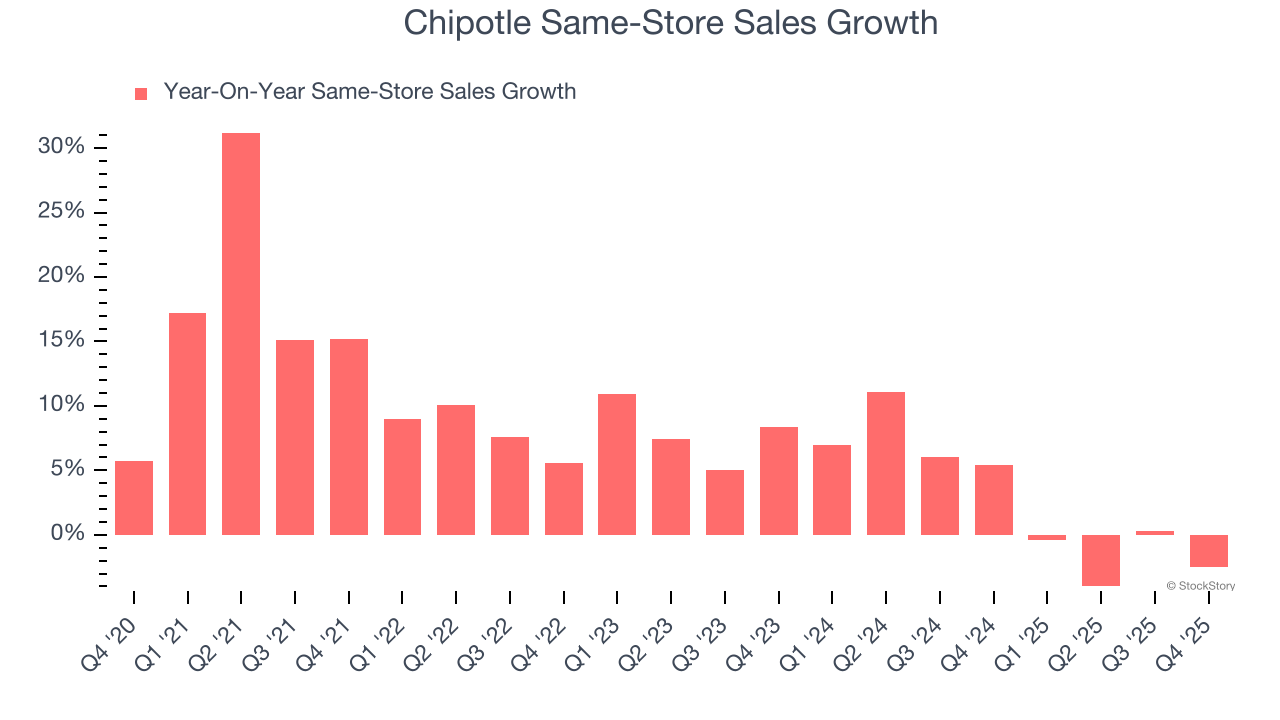

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Chipotle’s demand has been healthy for a restaurant chain over the last two years. On average, the company has grown its same-store sales by a robust 2.9% per year.

3. Economies of Scale Give It Negotiating Leverage with Suppliers

With $11.93 billion in revenue over the past 12 months, Chipotle is one of the most widely recognized restaurant chains and benefits from customer loyalty, a luxury many don’t have. Its scale also gives it negotiating leverage with suppliers, enabling it to source its ingredients at a lower cost.

Final Judgment

Chipotle possesses several positive attributes. After the recent drawdown, the stock trades at 34.8× forward P/E (or $38.41 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Chipotle

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.